Visit crypto-currencies were first introduced around ten years ago, and since then they've grown in popularity. While they have their advantages, such as decentralization, confidentiality and security, some fear they could be abused for illegal activities. In this article, we take a look at advantages and disadvantages crypto-currencies and their impact on the economy.

Crypto-currencies: between opportunities and risks

Crypto-currencies are becoming increasingly popular with investors around the world. Some of them, like Bitcoin, have even reached historic highs in value in recent years. But despite their potential benefits, crypto-currencies also carry significant risks for investors. Fluctuations in their value can be extremely volatile, and there's always the risk of fraud or piracy.

Crypto-currency opportunities lies in their potential to offer an alternative to traditional financial systems. They can be used to transfer money instantly across the globe without the need for intermediaries such as banks. And with the rise of blockchain technology, crypto-currency transactions can be transparent and secure.

However, it's important to recognize the risks inherent in investing in crypto-currencies. The volatility of their value can cause significant losses for investors who haven't taken the time to understand what they're buying. What's more, there's always the risk of fraud and hacking, which can devastate crypto-currency wallets.

The bottom line is that crypto-currencies can offer great opportunities for those prepared to take risks. However, it's essential that investors do their homework before investing in these digital assets. It's important to understand the risks and exercise caution when investing in crypto-currencies.

RICH PEOPLE DON'T WANT ME TO TELL YOU THAT!

[arve url="https://www.youtube.com/embed/7BaFbf7kImY "/]

My top 3 cryptos to buy in 2023 (and likely to explode...)

[arve url="https://www.youtube.com/embed/SkvPQYb6TY4″/]

What are the disadvantages of crypto-currencies?

The disadvantages of crypto-currencies are numerous and should be considered before using them as a means of payment or investment.

Firstly, they are highly volatile in terms of value. Rapid, unpredictable fluctuations can lead to substantial losses for investors unwilling to take on high risks.

What's more, the safety crypto-currencies can be difficult to guarantee. Digital wallets can be hacked and transactions can be fraudulent, which can result in the total loss of the investment.

In addition, cryptocurrencies can be used for illegal activitiesSuch as money laundering or buying drugs on online black markets.

Finally, crypto-currency is still relatively new and unregulated. There's no guarantee of government support should something go wrong, nor is there protection against fraudulent or deceptive business practices.

In short, while crypto-currencies offer interesting benefits, it's essential to consider the associated risks before deciding to use or invest in them.

What are the benefits of cryptocurrency?

Visit cryptocurrencyalso known as virtual currency, is becoming increasingly popular and has significant potential benefits. First and foremost, it enables fast, secure transactions thanks to blockchain technology. Transactions are verified and validated by a large number of users, rather than being controlled by a single central entity.

What's more, cryptocurrencies are decentralized, meaning they are not regulated by a government or central bank, offering a financial alternative for those who don't trust traditional institutions. Users can also achieve privacy in their transactions, as personal information is not necessarily linked to transactions.

Finally, cryptocurrencies can offer the potential for high returns due to their volatile nature. This means that it's possible to make money by buying a cryptocurrency at a low price and selling it when its value rises.

However, it's worth noting that cryptocurrencies are still relatively new and not widely accepted as a means of payment. There are also risks, such as the security of digital wallets and the possibility of increased regulation in the future. Potential investors should therefore be aware of these risks and do their own research before deciding to invest in cryptocurrencies.

What are the limits of cryptocurrency?

The limits of cryptocurrency are many and varied. First and foremost, it is highly volatile and can see its price change radically in the space of a few hours, making it risky for investors. In addition, it is often associated with illegal activitiessuch as money laundering or buying drugs on online black markets.

Cryptocurrency is also vulnerable to hackingAs demonstrated by the famous hack of the Mt.Gox platform in 2014, which saw thousands of Bitcoins stolen. In addition, cryptocurrency not yet accepted everywhere as a means of payment, which limits its scope as a truly alternative currency.

Finally, cryptocurrency is still relatively difficult to understand and useThis makes it relatively inaccessible to the general public. Despite these limitations, cryptocurrencies continue to attract the attention of investors and spark debate about their role in the global economy.

What are the dangers of investing in bitcoin?

Investing in bitcoin presents several potential dangers for investors. Firstly, the volatility of the cryptocurrency market is very high and can lead to massive price fluctuations in a very short space of time. What's more, there's no guarantee that the value of bitcoin will continually rise, meaning investors could lose money if they don't sell at the right time.

Another danger relates to the security of portfolios. bitcoins. Hackers can target crypto-currency wallets and steal the bitcoins they contain. Investors should therefore be extra vigilant and take steps to protect their crypto-currency wallets.

Finally, the regulation of cryptocurrencies is still very uncertain and could change at any time. Governments could decide to regulate the cryptocurrency market more strictly, which could result in significant losses for investors.

It is therefore important that investors understand the risks associated with investing in bitcoin before making an investment decision.

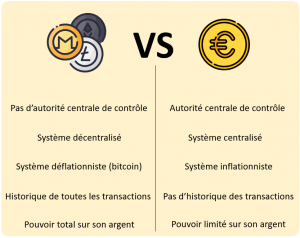

What are the advantages and disadvantages of crypto currencies compared to traditional currencies?

The advantages of crypto-currencies

Crypto currencies offer many advantages over traditional currencies. Firstly, they offer a high level of security thanks to their blockchain technology, which guarantees the reliability and integrity of transactions. What's more, crypto currencies are decentralized, which means they are not controlled by any central authority and are therefore less likely to be subject to corruption, manipulation or fraud.

The disadvantages of crypto-currencies

However, crypto currencies also have certain drawbacks. Firstly, they can be unstable, with significant fluctuations in value along the way. This can make it difficult to use crypto currencies for day-to-day purchases and long-term investments. What's more, although some crypto currencies are accepted as a means of payment in some businesses, their overall adoption is still relatively low.

Conclusion

Ultimately, crypto currencies certainly offer advantages over traditional currencies in terms of security and decentralization, but they also carry risks associated with their volatility and limited adoption. It's important to fully understand the implications of these pros and cons before deciding whether crypto currencies are a viable option for you.

How can crypto currencies be used legally and securely?

Crypto currencies can be used legally and securely in a number of ways. First of all, it's important to use exchange platforms that are recognized and regulated by the relevant authorities to buy and sell crypto currencies. In addition, it is advisable to store crypto currencies on a secure electronic wallet such as Ledger or Trezor.

In addition, crypto currencies can be used to make legal payments in certain countries, such as Switzerland or Japan, which have recognized Bitcoin as a means of payment. There are also companies that accept crypto currencies as a means of payment, provided that transactions comply with current laws and regulations.

It's also possible to invest in legitimate crypto-currency projects, by thoroughly researching the issuing company and ensuring that it complies with applicable laws and regulations.

Finally, it's important to be wary of crypto-currency-related scams, such as unregulated investment offers or phishing scams. You should remain vigilant and never divulge your private keys or wallet information to untrustworthy third parties.

What are the risks of using crypto currencies, such as theft and fraud, and how can they be avoided?

The use of crypto-currencies can entail various risks, including theft and fraud. Indeed, as crypto currencies are detached from traditional banking systems, they can be more vulnerable to attack and human error. What's more, crypto-currency transactions are often irreversible, meaning that if someone with malicious intent manages to get hold of your funds, it can be difficult, if not impossible, to get them back.

However, there are ways to minimize these risks and protect your crypto currency investments. First of all, it's advisable to choose a reliable, secure exchange platform to buy and sell crypto currencies. It is also important to store your funds in a digital wallet and preferably offline, like a physical wallet. This way, you can avoid cyber-attacks and hacking.

It is also important to not to divulge your private information and not to share your passwords with anyone. Crooks can use this information to access your accounts and steal your funds. To strengthen your account security, we also recommend that you choose a strong, complex passwordand to use it only for your crypto-currency accounts.

Finally, it is important to follow news and updates on the crypto-currency marketThis can enable you to quickly detect any suspicious or fraudulent activity. By being vigilant and taking appropriate security precautions, you can invest safely in crypto currencies.

In conclusion, the crypto currencies have revolutionized the world of finance by offering a decentralized alternative to traditional monetary systems. On the one hand, they are extremely secure thanks to cryptography, require no intermediaries and enable fast, low-cost transactions. On the other hand, they remain vulnerable to piracyThey have volatile values and can be used for illegal purposes due to their anonymity.

However, despite their drawbacks, crypto currencies continue to grow in popularity and their usefulness is undeniable in many situations. It is important for investors to exercise caution due to their instability and lack of regulation. Nevertheless, crypto currencies represent considerable potential in the future of finance, and undoubtedly deserve the attention of those involved in the financial sector.