Financial investments are an attractive option for making your money grow, but they also entail certain risks. It's important to be aware of advantages and disadvantages for each type of investment actions at obligations through the mutual funds . In this article, we look at the different types of financial investments to help you make informed decisions.

Financial investments: advantages and disadvantages.

Financial investments are a popular option for people wishing to invest their money. There are many different types of investment, each with its own advantages and disadvantages. The benefits include the possibility of earning interest on your money and making it grow over the long term. What's more, some investments offer tax advantages, such as Registered Retirement Savings Plans (RRSPs). However, financial investments also involve disadvantages. For example, some investments can be risky and you could lose money. What's more, interest rates can vary, which can affect your potential earnings. It's important to research the different types of investments before making a decision.

3 Reasons Why You're Not an Income Earner!?

[arve url="https://www.youtube.com/embed/rV8MpOk60ec "/]

HOW TO INVEST 1000€ PASSIVELY (Top 10 investments 2023)

[arve url="https://www.youtube.com/embed/bNKLF0O2zVI "/]

What are the advantages and disadvantages of short-term financial investments?

The advantages of short-term financial investments:

- The possibility of obtaining faster yields than on long-term investments.

- The flexibility offered by these investments make a quick profit and high availability of cash.

- The reduced level of risk because they are generally associated with safe, stable assets.

However, short-term financial investments also have their drawbacks:

- The returns offered are often lower than on long-term investments.

- They can be subject to significant fluctuations due to short-term market volatility.

- They can encourage a certain impatience and impulse investors, who may rush to make decisions without properly assessing the risks involved.

In short, short-term financial investments can offer advantages such as rapid returns, ample liquidity and reduced risk. However, they also have drawbacks such as lower returns, increased volatility and a tendency to encourage haste and impatience among investors.

How do you weigh up the pros and cons of long-term financial investments?

How do you weigh up the pros and cons of long-term financial investments?

Long-term financial investments have their advantages and disadvantages. On the one hand, they offer the possibility of higher returns due to the longer investment period. On the other, there's an increased risk of capital loss due to market fluctuations.

To weigh up the pros and cons of long-term financial investments, it's important to consider several key factors. First of all, the level of risk you're willing to assume is crucial. If you're comfortable with risk, long-term investments can be an attractive option.

Next, it's important to consider the fees you'll have to pay to invest for the long term. Fees can have a significant effect on your returns, so it's important to understand and take them into account when making investment decisions.

Finally, it's essential to consider your long-term financial goals. If you need short-term liquidity, long-term financial investments may not be the best option for you.

In short, before deciding to invest for the long term, it's important to weigh the pros and cons, taking into account your risk tolerance, costs and long-term financial goals.

What are the advantages and disadvantages of the different types of financial investments (stocks, bonds, mutual funds, etc.)?

Actions : The advantages of equities are that they offer long-term growth potential and can generate substantial gains for investors. However, they also carry a high level of risk, as their value can fluctuate considerably depending on company performance and economic conditions.

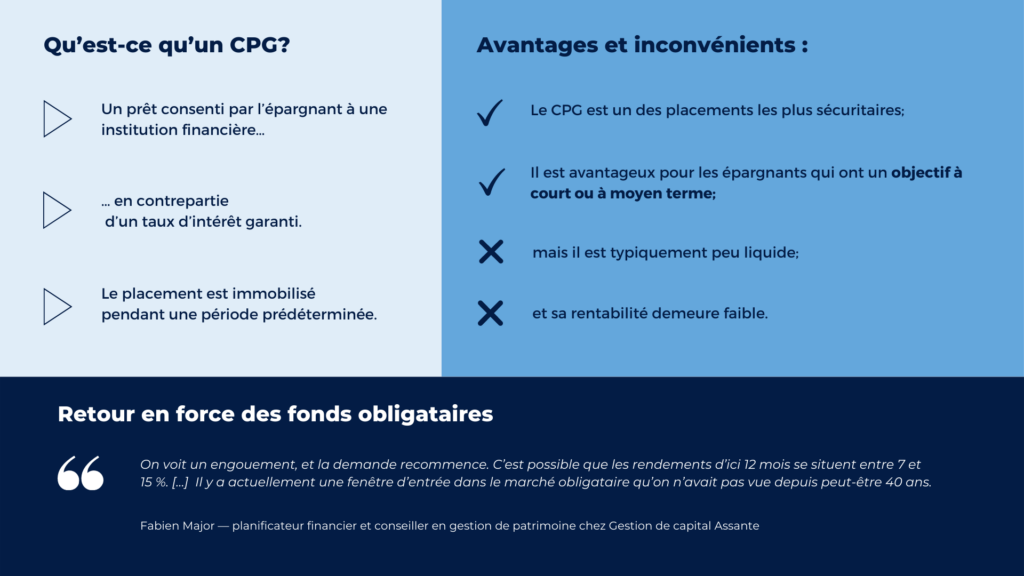

Obligations : Bonds are considered less risky than equities because they offer a guaranteed fixed income with a fixed maturity. They are therefore often considered a safer investment choice for people seeking stable, long-term income. However, bond yields are generally lower than those of equities, which can limit potential gains.

Mutual funds : Mutual funds are a popular way to invest in a diversified portfolio of securities. They are often considered a safer investment choice than buying individual stocks, as they spread risk across a number of different securities. They also offer high liquidity, meaning investors can easily buy and sell units whenever they wish. However, the fees associated with mutual funds can reduce potential returns.

Alternative investments : Alternative investments, such as real estate or commodities, offer unique advantages to investors. For example, real estate can offer stable rental income, while commodities can provide protection against inflation. However, these types of investments often carry high fees and have limited liquidity, which can limit investors' flexibility.

Ultimately, the choice of different types of financial investment will depend on each investor's investment objectives and risk profile. Understanding the advantages and disadvantages of each type of financial investment can help investors make more informed decisions to achieve their long-term financial goals.

In conclusion, financial investments can be an excellent option for making your money grow. However, it's important to be aware of the following risks and understand how the different types of investment work before you invest. You should also choose an investment according to your financial targets short, medium and long term, as well as risk tolerance. Finally, we recommend diversify your portfolio to reduce the risks associated with a single investment category. In short, if you're prepared to take the time to learn and invest carefully, financial investments can be an excellent way to grow your savings.