Joint ownership is a legal situation in which several people own a property jointly. This option can be advantageous to facilitate acquisition, share maintenance and renovation costs, or protect a family property. However, it can lead to management conflicts, difficulties in selling or inheriting the property, and significant tax consequences. It is therefore important to think carefully before embarking on joint ownership.

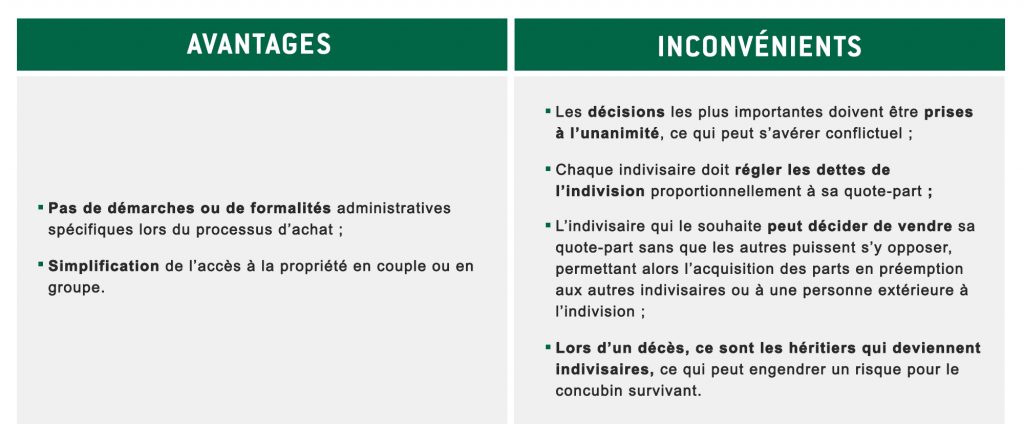

The advantages and disadvantages of joint ownership: a critical look.

Joint ownership is a form of co-ownership that can have both advantages and disadvantages.

On the one handWith the indivision option, a property can be kept in the family when there are several heirs. Management costs are lower, as there are no property division fees, and taxes are lower.

On the other handIf the heirs do not agree on how the property should be managed, indivision can cause problems. Decision-making can be difficult, and there can be conflict between heirs.

It's important to note that indivision can also lead to high legal costs in the event of a dispute, and selling the property can be more complicated as all owners have to agree.

All in allJoint ownership can be an interesting option for keeping real estate in the family, but it's important to think carefully about the potential consequences and to set up a clear organization to avoid conflicts.

How much inheritance tax will your heirs pay if you don't organize your estate?

[arve url="https://www.youtube.com/embed/LKmRn_r81Do "/]

[ JUDICIAL INFORMATION - PART 1 ]

[arve url="https://www.youtube.com/embed/TxhHxcBzY8Y "/]

What are the disadvantages of joint ownership?

Indivision is a situation in which several people own a property without having divided it into separate shares. This situation can result in considerable disadvantages for the co-owners, and make it difficult to manage the common property.

The first disadvantage of joint ownership is the lack of freedom. in property decisions. Each co-owner must obtain the agreement of the others before making important decisions, which can lead to delays and conflicts.

The second disadvantage is the risk of conflicts between co-owners.These can arise when there are differences of opinion over the management of property or the use of financial resources. These conflicts can become very difficult to resolve, especially if they involve family members.

Finally, undivided ownership can make it difficult to sell the property.This is because the sale of a property requires the unanimous agreement of all the co-owners. If one of them refuses to sell, this can block the sale and lead to financial losses for the other co-owners.

In conclusion, undivided ownership can be a complex situation for co-owners to manage, with high risks of conflict and financial loss. It is therefore important to take these disadvantages into account before deciding to share an undivided property.

What are the obstacles to joint ownership?

Obstacles to joint ownership are numerous, and can be highly problematic for the parties involved. Indeed, indivision is a situation in which several people own the same property, such as a house, apartment or other real estate asset. This can happen, for example, through an inheritance or a joint purchase.

The first obstacle is often linked to the difficulty of making decisions. This can lead to disagreements, blockages and delays in decision-making.

Another obstacle is financial management. Property-related costs, such as property taxes, condominium fees, works and maintenance must be borne by all undivided co-owners according to their share. However, some may be reluctant to pay or invest in the property, which can lead to financial disputes.

What's more, undivided ownership can make it difficult to sell the property. All undivided co-owners must give their consent to sell the property, which can be difficult if some people don't want to sell or if they ask too high a price.

Finally, joint ownership can also lead to rental management problems. If the property is rented out, the rental income must be divided between the joint owners according to their share. This can lead to disagreements over rental management, as well as delays in rent payments.

In short, joint ownership can be a complex and difficult situation to manage. So it's important to think carefully before embarking on such a situation, and to establish clear rules for decision-making and financial management.

What are the advantages of joint ownership?

Joint ownership is a legal form of property ownership that offers several advantages in the context of a news site:

1. Easy to install : When several people wish to acquire a property together, indivision is the easiest form of ownership to set up. It requires no special formalities, nor the filing of articles of association or the creation of a legal entity.

2. Sharing costs and expenses : Members of the joint venture can share the costs and expenses associated with ownership of the news site, such as maintenance costs, property taxes and condominium fees.

3. Flexibility : Joint ownership allows great flexibility in the management of the news site. The members can decide together on the rules for managing and distributing the income generated by the site.

4. Protecting members' interests : In the event of financial difficulties on the part of one of the undivided members, the news site property is protected, as it cannot be seized to settle the debts of a single member.

5. Easy exit from indivision : If one of the members wishes to leave the indivision, he or she can sell his or her share to a third party or to the other members of the indivision without the need for a lengthy sale process.

In conclusion, joint ownership offers many advantages in the context of a news site, particularly in terms of flexibility and the sharing of costs and expenses.

What are the reasons for avoiding indivision?

L'indivision is a legal situation in which several people jointly own a property without having divided it up. This situation can be problematic for several reasons. First of all, it can generate conflicts between co-ownersThis is particularly the case if no agreement can be reached on the use and maintenance of the property. Each joint owner has equal rights to the property, but also joint obligations. If some want to sell while others want to keep the property, this can lead to tension.

In addition, theThis can hamper the efficient and profitable management of the property.. Indeed, the need for all co-owners to agree to decisions can make it difficult to carry out renovation or refurbishment work, which can lead to a devaluation of the property over time. Furthermore, if co-owners fail to pay common charges or refuse to contribute to necessary expenses, this can lead to financial difficulties for the other owners.

Finally, thejoint ownership can make it difficult to sell the property. Indeed, potential buyers may be reluctant to buy an undivided property because of the potential risk of conflict between owners and the difficulty of making important decisions.

In short, it's best to avoid indivision by taking steps to divide property between owners as soon as possible.

What are the advantages and disadvantages of joint ownership of a family inheritance?

Undivided ownership of a family inheritance is a complex subject, with both advantages and disadvantages.

The benefits:

- First and foremost, indivision enables the family estate to be preserved in its entirety. Assets are not dispersed among the heirs, which can guarantee the continuity of the inheritance.

- Joint ownership also means that strategic choices concerning real estate can be deferred. In this way, heirs can take their time to decide whether certain properties should be sold or retained, without rushing.

- Finally, joint ownership can also help protect the interests of more vulnerable heirs (minors, disabled people, etc.). Decisions concerning the management of property can be taken jointly, thus limiting the risk of conflict.

Disadvantages:

- Indivision can lead to tension between heirs, particularly if there is disagreement over the management of assets. So it's important to establish clear rules from the outset.

- Joint ownership can also be a source of considerable expense, particularly in the event of disputes between heirs. Management costs (co-ownership charges, works, etc.) must also be shared between the heirs.

- Finally, joint ownership can be restrictive, particularly when it comes to selling property. Decisions have to be taken unanimously, which can lengthen sale times and limit negotiation possibilities.

In conclusion, joint ownership can be an interesting solution for a family inheritance, but it also entails risks that need to be taken into account. So it's important to weigh up the pros and cons before making a decision.

How does undivided ownership work when renting or selling a property?

Indivision is a situation where several people own a property together without there being any material division of the property. This means that each co-owner has rights over the entire property.

When it comes to renting, the rules are fairly straightforward. Each joint owner has the right to rent out the property without the agreement of the other owners. However, they must share the rental income and jointly bear the rental-related expenses.

When it comes to selling, the situation is more complex. If an undivided co-owner wishes to sell his share, he must first propose to the other co-owners that they buy his share in proportion to their respective shares. If no one wants to buy, the undivided co-owner can sell his or her share to a third party. In this case, the other co-owners have a right of pre-emption and can buy the third party's share at the price set out in the sales contract. If no one exercises their right of pre-emption, the sale is completed.

On the other hand, if all the co-owners wish to sell the property, they must all agree on the price and conditions of sale. If they are unable to agree, they can ask the court to appoint an agent to sell the property.

Finally, it should be emphasized that joint ownership can sometimes pose management and decision-making problems, as each joint owner has equal voting rights regardless of his or her share in the property. It is therefore important to lay down clear operating rules from the outset to avoid conflicts.

What are the legal and tax risks to consider when opting for joint ownership rather than co-ownership?

When opting for joint ownership rather than co-ownership, there are several legal and tax risks to consider:

Firstly, in the event of a dispute between undivided co-owners, it can be difficult to reach a decision, given the indivisible nature of the property as a whole. What's more, each undivided co-owner is free to dispose of his or her share, which can complicate the management of the whole.

For tax purposes, each joint owner must declare his or her share of income generated by the joint assets. In the event of resale, each joint owner is taxed on the capital gains realized on his or her share of the sale.

It is therefore essential to draw up a precise indivision contract to define the rules of management and organization. It is also advisable to consult a legal professional to ensure that all clauses comply with current legislation. In short, joint ownership can present certain legal and tax risks that should be taken into account before making this choice.

In conclusion, undivided ownership offers benefits such as the possibility of preserving a family property or simplifying the management of an estate. However, the disadvantages such as the loss of freedom to dispose of the property or conflicts between co-owners, must be taken into account. It is therefore advisable to think carefully before choosing indivision as a way of managing your assets, and to plan, if possible, for an exit from indivision.