Visit stand-by letter of credit is a method used in international trade to guarantee payment for certain transactions. Although it offers financial security for the companies involved, it also presents a number of risks. disadvantages such as high fees and extended lead times. This article will examine the advantages and disadvantages of using stand-by letters of credit in the context of international trade.

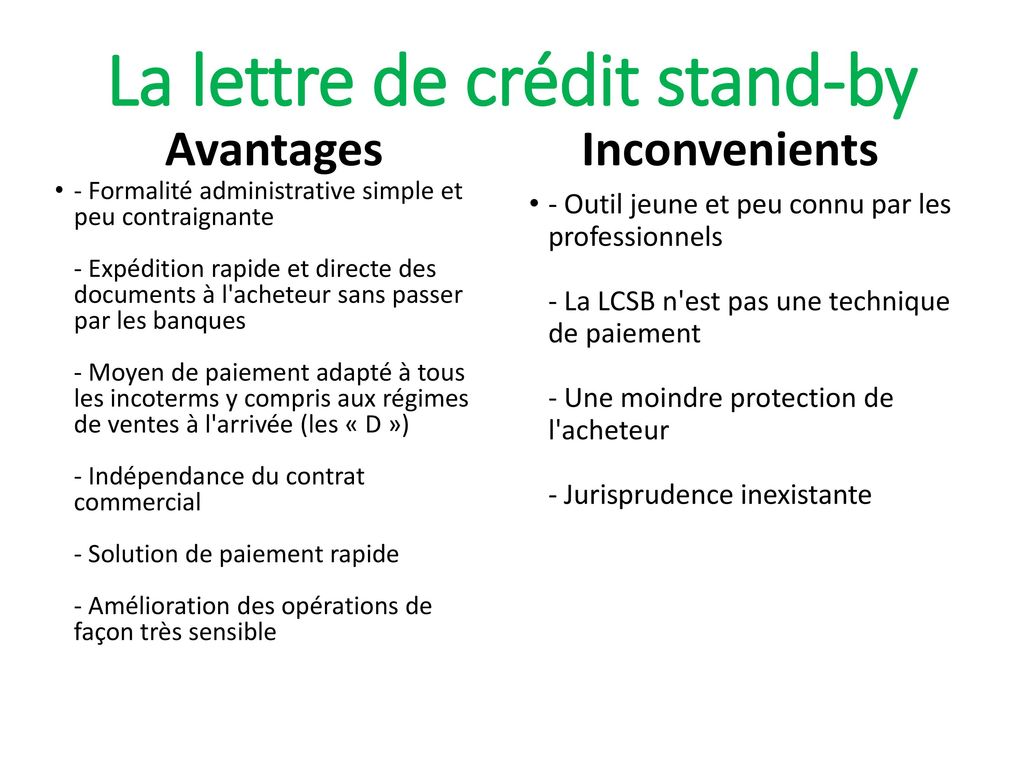

Advantages and disadvantages of stand-by letters of credit.

The stand-by letter of credit is a financial instrument often used in international trade. It offers several advantages, such as guaranteed payment for the beneficiary in the event of non-compliance with the terms of the contract by the buyer. This provides a degree of security for both parties, and can facilitate the conclusion of commercial contracts.

However, there are also disadvantages to using a stand-by letter of credit. Firstly, it can be costly, due to the fees associated with setting it up. What's more, it can be complicated to use, often requiring the help of a professional to draft and execute.

Ultimately, the use of stand-by letters of credit will depend on the individual needs and preferences of each company. It's important to weigh up the pros and cons before deciding whether or not to use it.

In short, the stand-by letter of credit offers a payment guarantee for the beneficiary, but can be costly and complicated to use.

(SBLC) ALL ABOUT THE STANDBY LETTER OF CREDIT IN 2021

[arve url="https://www.youtube.com/embed/TQ4mBI0_IK4″/]

I asked the SWISS: what is your SALARY?

[arve url="https://www.youtube.com/embed/vFmuVDKFKMc "/]

What is a stand-by letter of credit?

A stand-by letter of credit is a financial instrument used in international commercial transactions. It is regarded as a bank guarantee that ensures payment to the seller if the buyer fails to comply with the terms and conditions of the contract.

In other words, the Stand-by letter of credit is a form of guarantee given by a bank to a seller in the event that the buyer fails to pay on time or fulfill his contractual obligations. It ensures that the seller will be paid for its goods or services even if the buyer defaults.

A stand-by letter of credit differs from an irrevocable letter of credit in that it is not intended to be used to make a payment. Instead, it remains inactive until a payment is made. debtor's default (the buyer) as part of the commercial contract. At this point, the seller can use the letter of credit to obtain payment from the bank.

In short, the stand-by letter of credit is an important financial tool in international commercial transactions, enabling the parties involved to protect themselves against the risk of default or non-fulfillment of contractual obligations.

Who is responsible for payment of the letter of credit?

Payment of the letter of credit is the responsibility of the issuing bank.. The role of the letter of credit is to guarantee the beneficiary that payment will be made as soon as the conditions stipulated in the document are met. Both parties involved in the transaction must ensure that the terms of the letter of credit are fully understood before any transaction takes place.

What are the advantages for the seller of an irrevocable confirmed letter of credit?

Irrevocable confirmed letter of credit offers several advantages for the seller. Firstly, it guarantees secure and rapid payment once the conditions stipulated in the letter have been met. Indeed, the seller can be sure that payment will be made by the bank issuing the letter of credit, which guarantees payment. What's more, an irrevocable, confirmed letter of credit is considered solid proof of the buyer's solvency, which can be reassuring for the seller when dealing with a new buyer or a major transaction. Last but not least, this letter also enables the seller to reduce the risks associated with currency fluctuations, since payment is generally made in the currency agreed at the time the letter of credit is signed.

How does a letter of credit work?

A letter of credit is a written contract between an issuing bank, a beneficiary bank and the holder of the letter of credit. It secures payment to a seller for goods or services provided to a buyer.

The letter of credit process begins when the buyer asks his bank (the issuer) to provide a letter of credit to the seller's bank (the beneficiary). The issuing bank verifies the buyer's creditworthiness before issuing the letter of credit. The seller can then ship the goods or provide the services and present the required documents (such as an invoice) to the beneficiary bank for payment. If the documents are correct, the beneficiary bank makes the payment to the seller.

Letter of credit is a form of bank guarantee that offers security to both parties involved in a commercial transaction. For the buyer, it means that the goods or services will be as agreed prior to payment. For the seller, it means that he will receive payment once the appropriate documents have been presented to the beneficiary bank.

What are the advantages of standby letters of credit for exporters?

Visit stand-by letter of credit offers several practical and financial advantages for exporters. Firstly, it provides a payment guarantee for the seller in the event of non-payment or default by the buyer. This enables the supplier to secure its commercial transactions abroad and minimize the risk of financial loss.

In addition, the stand-by letter of credit can simplify the process of negotiating the terms of sale between the parties involved. By establishing the terms and conditions of the transaction in advance, the stand-by letter of credit helps avoid misunderstandings and conflicts between the parties.

Finally, by providing proof of creditworthiness to the buyer, the stand-by letter of credit can encourage potential buyers to grant more favorable payment terms to exporters. This can facilitate the conclusion of commercial contracts and improve export profitability.

What are the disadvantages of standby letters of credit for importers in France?

The stand-by letter of credit may be an attractive option for exporters, but it also has certain disadvantages for importers in France.

Firstly, the use of a stand-by letter of credit entails a number of risks. additional costs for the importer, who is often required to provide a bank guarantee in order to benefit. These fees can add to the final cost of imported goods.

What's more, the complexity of the stand-by letter of credit process can make transactions more difficult for importers to manage. They may need a lawyer or cash manager to help them understand and negotiate the terms of the letter of credit.

Finally, the stand-by letter of credit can slow down the import processIt often takes days or even weeks to ensure that all conditions are met before goods can be exported. This can cause delays in delivery and disrupt the importer's business activities.

In conclusion, while the stand-by letter of credit is a viable option for some exporters, it can present disadvantages for importers in France, including additional costs, increased complexity and a slower import process.

What precautions should I take when using a stand-by letter of credit?

A stand-by letter of credit is a guarantee issued by a bank to protect the interests of a seller in the event of default by the buyer. The use of such a letter requires specific precautions to avoid any problems.

First of all, it is important to check that the bank issuing the stand-by letter of credit is reliable, and that the terms and conditions of the letter are clear and well understood. The seller must also ensure that the stand-by letter of credit corresponds to his specific needs.

In addition, the seller must pay close attention to the deadlines specified in the stand-by letter of credit. Late submission of documents may result in rejection of payment, and the seller will have to take steps to recover his money.

Finally, it is important to note that stand-by letters of credit are generally non-refundable and can be expensive to obtain. The seller must therefore take these costs into account when deciding to use a stand-by letter of credit.

In short, the use of a stand-by letter of credit can be beneficial in protecting a seller's interests, but it requires special precautions to avoid any potential problems.

In conclusion, the stand-by letter of credit offers undeniable advantages as a commercial guarantee tool. It provides financial security for both parties involved in an international transaction, and helps avoid disputes. It can also be used as a means of financing commercial operations.

However, it is important to note that the use of stand-by letters of credit involves additional costs for the parties involved, particularly in terms of bank charges. Moreover, it is not always considered an infallible guarantee in all countries.

Ultimately, the decision to use a standby letter of credit will depend on the specifics of each business transaction and the preferences of each party. Nevertheless, it is essential to understand the advantages and disadvantages of this payment method before making a final decision.