Have you ever heard of matrimonial property regimes? These are legal rules that define the management of a married couple's assets and debts. In this article, we'll explore advantages and disadvantages to help you make the best choice for your matrimonial situation.

Understanding matrimonial property regimes: advantages and disadvantages.

Understanding matrimonial property regimes: advantages and disadvantages is a crucial subject for couples considering marriage. The two main matrimonial regimes are community of property reduced to acquests and separation of property.

Community of property reduced to acquests means that property acquired during the marriage is considered to belong to both husband and wife. However, each spouse retains his or her personal assets acquired before the marriage, as well as those given or bequeathed to him or her during the marriage.

The advantages of this matrimonial regime are joint management of the family assets and greater protection in the event of the death of one of the spouses. In the event of death, half of the joint assets will automatically revert to the surviving spouse.

Disadvantages of community of property reduced to acquests lies in the fact that debts contracted by one of the spouses may affect the joint assets, and that the management of these assets may be a source of conflict.

In the separation of propertyIn the case of a marriage, each spouse retains ownership of his or her personal property. Property acquired during the marriage belongs to the person who acquired it.

The advantages of this matrimonial regime is that each spouse is responsible for his or her own debts.

The downside of separation as to property is that, in the event of death, the surviving spouse has no rights to the other's assets.

In conclusion, choosing your matrimonial property regime is an important decision that must be made according to each couple's goals and needs.

Marriage. Choosing your matrimonial regime, your marriage contract. Henry Royal youtube

[arve url="https://www.youtube.com/embed/zYILjJcyWf4″/]

Marriage: separation as to property with partnership of acquests

[arve url="https://www.youtube.com/embed/IPsl9exjsZk "/]

What are the advantages and disadvantages of different matrimonial property regimes?

The different matrimonial regimes :

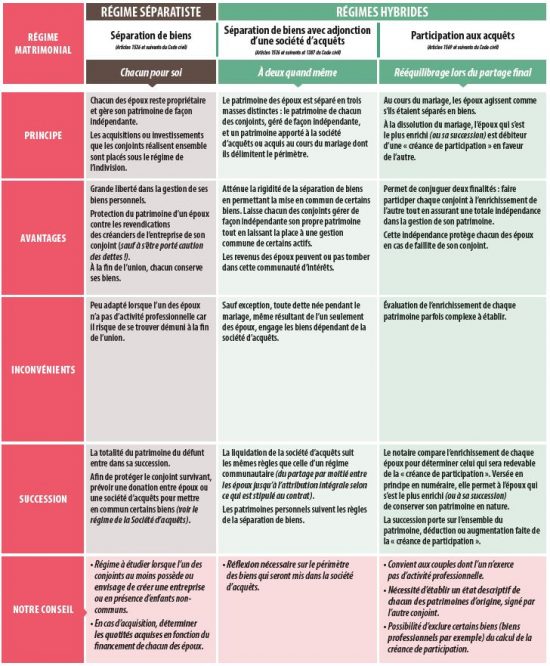

In France, there are different matrimonial property regimes, each with its own advantages and disadvantages. The choice of matrimonial regime depends on the objectives and wishes of the future spouses. The four most common matrimonial regimes are: separation as to property, universal community of property, reduced community of acquests and participation.

The advantages of the separation of property regime :

Under this system, each spouse retains ownership and management of his or her own property. The debts of one spouse cannot be charged to the other. This system is therefore recommended if one of the spouses has substantial debts, children from a previous union, or if one of the spouses is a self-employed professional.

The advantages of universal community :

Under this system, the spouses pool all their assets. They therefore own together all the assets they acquired before or during the marriage. This system is recommended for couples who wish to pool everything together. It also avoids conflicts in the event of the death of one of the spouses.

The advantages of the community of acquests regime :

Under this system, assets acquired before the marriage remain the property of each spouse. Assets acquired during the marriage, on the other hand, are considered to belong to both spouses in equal shares. This system is suited to couples who wish to pool assets acquired during the marriage, while retaining a degree of autonomy over their personal assets.

The advantages of the profit-sharing plan :

Under this system, each spouse retains management of his or her own property. However, assets acquired during the marriage are managed jointly. This system is recommended for couples who want an equitable division of assets acquired during the marriage, while retaining autonomy over their own assets.

The disadvantages of different matrimonial property regimes :

Each system has its drawbacks. Under the separation of property regime, it can be difficult to meet certain joint expenses, such as household charges or taxes. With the universal community property regime, it is important to note that all assets are pooled. In the event of death, this can pose a problem for the transfer of assets. The reduced community of acquests regime is often considered too rigid and does not offer sufficient autonomy. Finally, the participatory regime can lead to conflict in the event of disagreement over the management of joint assets.

What are the benefits of marriage?

Marriage offers many advantages legal, social and financial. It's a commitment that brings security and stability for partners and family alike. In legal terms, marriage confers rights in areas such as inheritance, health insurance, taxation and social security. Visit social benefits include official recognition of the union and protection in the event of separation or death of one of the partners. Finally financialIn addition, marriage can offer tax advantages such as tax breaks or more advantageous bank loans. However, marriage is also a personal choice that must be made on the basis of deep-seated values and feelings.

What are the advantages and disadvantages of the community of acquests regime?

The regime of community of acquests is a matrimonial regime for spouses married without a marriage contract. Here are its advantages and disadvantages:

Advantages :

– The law considers that assets acquired during the marriage belong to both spouses in equal shares.This favors a certain equality of assets between the spouses. This favors a certain equality of assets between the spouses.

– In the event of the death of one of the spouses, the other automatically receives half of the assets acquired during the marriage.The other half goes to the deceased's heirs. The other half goes to the deceased's heirs. This provides some financial security for the surviving spouse.

– Debts contracted by one spouse during the marriage are debts common to both spouses.. Each spouse contributes to the debt according to his or her financial capacity.

– This plan is relatively simple and inexpensive to set up.There is no need to draw up a marriage contract.

Disadvantages :

- Assets acquired before marriage are not part of the community of acquests, so they belong exclusively to the spouse who acquired them. This can cause conflicts in the event of separation or divorce.

- If one of the spouses owns a business or has a liberal profession, the profits and debts associated with this activity are not included in the community of acquests. This can complicate asset management in the event of separation or divorce.

- Spouses cannot freely dispose of their joint property without mutual agreement. They must obtain their spouse's agreement to sell, exchange or give away joint property. This can slow down certain transactions and cause tension between the spouses.

What are the disadvantages of civil marriage?

Civil marriage is often considered a milestone in a couple's life. However, there are certain disadvantages to take into account.

First and foremostCivil marriage can be costly in France. Application fees must be paid, and vary from commune to commune. What's more, if weddings take place on Saturdays or Sundays, additional fees may be charged.

ThenCivil marriage can be seen as an important legal commitment that entails certain financial obligations. In the event of divorce, the assets acquired during the marriage will be shared, and the debts contracted by one of the spouses during this period will also be shared.

In additionIn France, civil marriage may involve restrictions on the choice of matrimonial property regime. Under French law, married couples are automatically governed by the regime of communauté de biens réduite aux acquêts, which means that all assets acquired before marriage remain the property of each spouse.

FinallyCivil marriage can also raise questions of religion and individual freedom. Some couples may not agree with the values and traditions associated with civil marriage, but may feel obliged to marry for legal or administrative reasons.

In short, while civil marriage is an important step for many couples, it's important to consider the potential disadvantages before making a final decision.

What are the advantages and disadvantages of the universal community estate?

The regime of universal community of property is a French matrimonial regime. which can be chosen by the spouses at the time of their marriage. This system is characterized by the total merger of the assets of the spouses, who then become joint owners of all the property they owned before the marriage and all that they will acquire during the marriage. In terms of inheritance, this system has both advantages and disadvantages.

The advantages of the universal community estate :

- Firstly, it ensures greater equality between children and heirs, as they are entitled to an equal share of the couple's assets, regardless of each spouse's own assets.

- Secondly, in the event of the death of one spouse, the other spouse inherits all the joint assets, enabling him or her to maintain his or her standard of living without having to sell assets to pay inheritance tax.

- Finally, the universal community property regime protects the surviving spouse by guaranteeing him or her a significant share of the couple's assets, even if they were the exclusive property of the other spouse.

The disadvantages of the universal community estate system :

- The main disadvantage is that descendants cannot benefit from a larger share of the couple's assets than the surviving spouse. As a result, the surviving spouse may find himself or herself in possession of too large a share of the couple's assets, which can pose problems in the event of remarriage or if the surviving spouse has no children of his or her own.

- Furthermore, the management of joint assets can sometimes pose difficulties in the event of disagreement between the spouses.

In conclusion, the universal community of property regime has both advantages and disadvantages when it comes to inheritance. It is therefore advisable to think carefully before choosing this matrimonial regime, and to consult a notary for advice on the inheritance consequences of such a choice.

How are assets divided under the separation of property regime?

Under the regime of separation as to property, each spouse retains ownership and enjoyment of his or her personal property, whether acquired before or during the marriage. Assets acquired jointly are divided equally between the spouses on dissolution of the marriage.

This means that if a couple under the separation of property regime decides to separate, each spouse keeps his or her own assets (inheritances, purchases, etc.) as well as the income derived from them. It's a system that allows a degree of financial autonomy.

On the other hand, if property has been acquired jointly during the marriage, both spouses own it in equal shares. In this case, they will have to come to an agreement on the division of the property upon separation. If no agreement is reached, the judge will decide on the division.

It is important to note that debts contracted by one of the spouses are also his or her own responsibility and cannot be charged to the other spouse under the regime of separation as to property.

What are the tax consequences of the regime of participation aux acquêts for married couples?

The regime of participation aux acquêts is a matrimonial regime that can have significant tax consequences for married couples. Under this regime, each spouse retains ownership and management of his or her personal property, but upon dissolution of the marriage, gains realized during the marriage are shared equally between the spouses.

From a tax point of view, this system can result in higher taxation for married couples.. In fact, when the gains of the communauté réduite aux acquêts are divided, the assets acquired by each spouse during the marriage are considered to have been sold at half their value. This fictitious sale may generate a taxable capital gain, which must be declared on the income tax return.

This taxation can be avoided if the spouses opt for the regime of separation as to property.This allows each spouse to retain ownership and management of his or her personal assets, without sharing any gains acquired during the marriage. However, in this case, the spouses must be careful to distinguish their personal assets from those of the community, so as not to confuse the two assets.

In conclusion, the choice of matrimonial property regime has significant tax consequences for married couples. It is therefore advisable to seek professional advice before making a decision that could have a significant impact on their tax situation.

In conclusion, the choice of matrimonial property regime is an important decision for any couple. It can have a major impact on the assets acquired during the marriage and on the financial future of each partner. Each regime has its advantages and disadvantages (advantages and disadvantages of matrimonial property regimes). It is therefore essential to fully understand the implications of each regime before making a decision. It's best to seek advice from a family lawyer to make the right choice. In any case, it's important to discuss financial matters openly with your partner and make the best decision for your personal situation. (make the best decision for your personal situation).