Visit Simplified joint-stock company (SAS) is one of the most popular legal forms for entrepreneurs in France. It offers many advantages, such as flexibility in management, the ability to raise capital and limited liability. However, it also has its drawbacks, such as administrative complexity and high set-up and management costs. In this article, we explore the advantages and disadvantages of SAS.

SAS: a strategic choice for companies, but risks to consider

The use of a simplified joint stock company (société par actions simplifiée - SAS) has become a common strategic choice for companies, due to the flexibility offered by this type of structure. The SAS gives shareholders considerable freedom in organizing the company, and limits their financial liability. However, it is important to bear in mind the risks involved in setting up such an entity in the context of a news site. The SAS requires a minimum share capital, as well as administrative and legal formalities that can prove onerous for the uninitiated. So it's important to seek professional advice before embarking on the SAS adventure. Creating an SAS can be a wise choice for a company, but it requires strategic thinking and professional expertise.

SASU, EURL, or Micro Entreprise - Which legal status for sole partners?

[arve url="https://www.youtube.com/embed/qQJ9eYJ9O2I "/]

Chairman of SASU: what risks and how to avoid them? 🤔

[arve url="https://www.youtube.com/embed/R0-pRGrQns0″/]

What are the disadvantages of SAS?

The SAS (Société par Actions Simplifiée - simplified joint-stock company) offers a number of advantages disadvantages for a news site. First of all, one of the main limitations is the complexity setting up: the administrative and legal formalities are more onerous than for a sole proprietorship or EURL. What's more, the tax system of the SAS is often less favorable than that of other legal forms, particularly for small businesses. Lastly, the SAS may be subject to more stringent constraints in terms of management, with increased annual reporting and bookkeeping requirements. However, these disadvantages can be offset by the advantages offered by the SAS, such as the safety provided by the company's status or the flexibility legal situation.

Why make the switch to SAS?

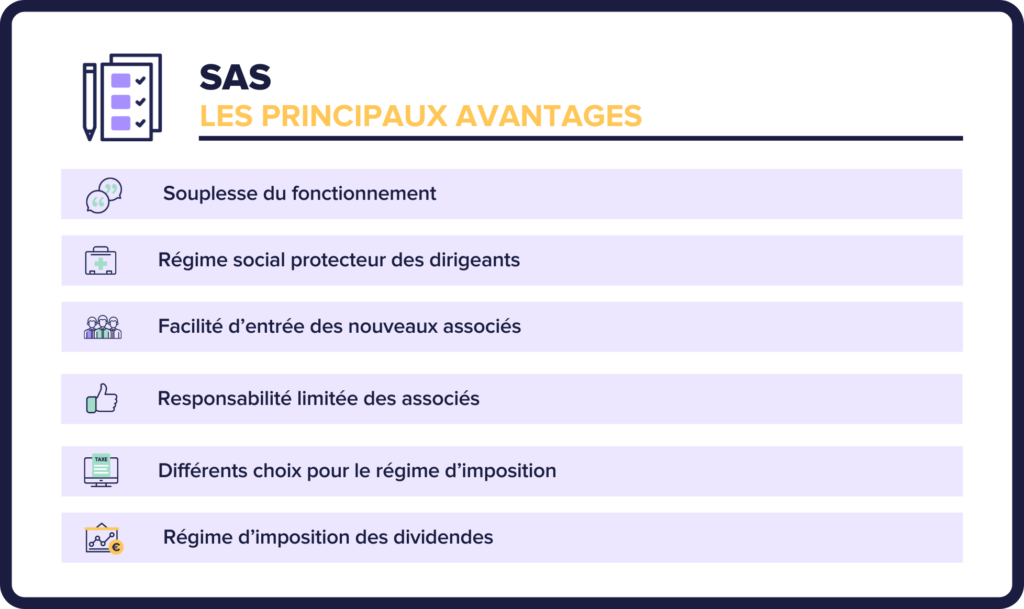

The creation of a news website is often accompanied by the choice of a legal form for the company. One possible option is the SAS (Société par Actions Simplifiée), which offers several advantages:

1. SAS offers great flexibility in company organizationThis is particularly true of the division of powers between the various partners. The operation of an SAS is largely determined by the company's bylaws, which may contain specific rules in this area.

2. SAS offers great flexibility in terms of share capital. Depending on the company's needs, it is possible to set a minimum or maximum share capital, as well as specific procedures for increasing or decreasing it.

3. The SAS makes it possible to limit partners' liabilityThis is a significant advantage in the event of financial or legal difficulties encountered by the company.

4. The SAS offers a particularly advantageous tax regimeThis is particularly true in terms of the taxation of company profits and the possibility of remunerating associates.

In conclusion, the SAS is a highly attractive legal form for entrepreneurs wishing to set up a news site. It offers great flexibility in business organization, flexibility in terms of share capital, limited liability for partners and an advantageous tax regime.

What are the benefits and limitations of a SASU?

The benefits of a SASU in the context of a news site are as follows:

– Limited liability : as sole director of a SASU, your liability is limited to the amount of your initial contribution. This means that you will not be personally liable for the company's debts.

– Organizational flexibility : as sole shareholder and manager, you have total control over the company's management and can make important decisions quickly.

– Preferred social security : as Chairman of a SASU, you are considered to be self-employed, and as such benefit from an advantageous social security system.

However, there are also a few limitations to consider:

– Set-up cost : setting up a SASU can be more costly than setting up a sole proprietorship or micro-enterprise.

– Taxation : as sole director of a SASU, you will be subject to income tax, which may be higher than corporation tax.

– Legal obligations : As a company, a SASU is subject to certain legal obligations, such as keeping annual accounts and filing tax and social security returns on time.

In short, an SASU can offer great flexibility and limited liability, but it can also be more expensive and require some accounting and legal expertise to manage effectively.

What are the advantages of creating an SAS rather than a SARL?

Setting up an SAS (Société par Actions Simplifiée) offers several advantages for a news site over a SARL (Société à Responsabilité Limitée).

First of all, the SAS offers great flexibility in terms of organization and distribution of powers between partners. Unlike the SARL, where powers are determined by law and management is compulsory, the SAS offers the possibility of freely choosing managers and setting their powers in the articles of association.

In addition, the SAS can benefit from a advantageous tax system by opting for corporate income tax. This option means that profits will be subject to corporate income tax at a rate of 28%, which is generally more attractive than the income tax regime applicable to SARLs.

In addition, in the event of need to raise substantial fundsThe SAS is preferable to the SARL, as it offers the possibility of larger and easier capital increases.

Last but not least, the SAS can be more attractive to foreign investors because it allows 100% of the capital to be held by foreigners without restriction, unlike the SARL, which may have a shareholding restriction for non-residents.

In short, the SAS offers great flexibility in terms of organization and distribution of powers, an advantageous tax regime, the possibility of raising funds more easily and greater attractiveness to foreign investors.

What are the tax advantages of an SAS?

The tax advantages of an SAS are :

- The option of choosing between income tax (IR) or corporation tax (IS), depending on the situation of the company and its partners.

- If you opt for the corporation tax (IS), the SAS benefits from a lower tax rate than sole proprietorships.

- The SAS can also benefit from various tax measures, such as the research tax credit (crédit d'impôt recherche - CIR) or the territorial economic contribution (contribution économique territoriale - CET).

- Directors' remuneration is taxed more favorably than that of self-employed workers.

- The SAS can also set up company savings plans (PEE) and group retirement savings plans (PERCO), which are tax-advantaged for employees.

In short, the SAS offers a number of attractive tax advantages for companies and partners alike. However, it is important to seek the advice of a chartered accountant to choose the tax regime best suited to your company's situation.

How to limit the financial risks of an SAS?

SAS (simplified joint-stock company) is a legal form that offers many advantages to entrepreneurs, including flexibility and limited shareholder liability. However, it also presents financial risks that should be kept to a minimum.

Here are a few tips for limiting the financial risks of an SAS:

1. Building up sufficient share capital: The share capital of an SAS corresponds to the shareholders' contributions in cash or in kind. It must be commensurate with the company's activity, and be sufficient to meet any financial difficulties that may arise. It is advisable to build up a substantial amount of share capital as soon as the SAS is created.

2. Provide for an approval clause for new shareholders: The approval clause controls the entry of new shareholders into the SAS. It can thus limit the risks of capital dilution and conflicts between shareholders.

3. Drawing up a shareholders' agreement : The shareholders' agreement defines the operating rules of the SAS and sets out the procedures for shareholders to leave in the event of disagreement or financial difficulties.

4. Establish a risk management plan : The risk management plan enables us to anticipate any financial difficulties that may arise, and to implement actions to overcome them. It is advisable to plan for different scenarios, depending on the nature of the SAS business.

By following these tips, you can limit the financial risks of an SAS and ensure the company's long-term future.

What are the disadvantages of SAS compared with other types of legal structure?

The SAS also has certain disadvantages compared with other legal structures, particularly in terms of formalities and costs.

Formalities are more cumbersome than with an auto-entreprise or sole proprietorship. In particular, you need to draw up articles of association, convene general meetings, appoint a chairman, etc.

The cost of creation is also higher than with a sole proprietorship or auto-entreprise. A lawyer or chartered accountant must be called in to draw up the articles of association, which represents a considerable cost.

In addition, the SAS is subject to a more complex taxation than other structures. In fact, SAS profits are taxed under the corporate income tax (impôt sur les sociétés - IS) system, whereas auto-entreprises and sole proprietorships are taxed under the income tax (impôt sur le revenu - IR) system.

Finally, it is important to note that the SAS is a structure designed for medium-sized to large companies. It is therefore not suitable for small businesses or sole traders looking for a simple, low-cost solution.

In conclusion, the SAS is a very popular legal form for entrepreneurs, thanks to its great flexibility. Thanks to its structure and the division of roles between partners, it enables optimal management of the company. What's more, SAS offers shareholders considerable protection in the event of bankruptcy. However, the disadvantages should not be overlooked, such as the often lengthy and costly formalities involved in setting up the company, or the complexity of accounting and tax management. It is therefore important to think carefully before choosing this legal form for your company. To sum up, the SAS is an attractive option for entrepreneurs looking for flexibility and strong shareholder protectionBut it does require a certain expertise in business management.