Currency appreciation is often seen as a sign of economic strength. However, it can also have disadvantages such as loss of competitiveness for exporters or higher import prices. Discover in this article the advantages and disadvantages of currency appreciation and how it affects the global economy.

Advantages and disadvantages of currency appreciation.

Currency appreciation can have both advantages and disadvantages for news sites. On the one hand, a strong appreciating currency will make imports cheaper, which could reduce costs for online media companies purchasing electronic equipment or services from other countries. In addition, a strong currency can stimulate economic activity in the country, which can lead to increased demand for news.

On the other hand, currency appreciation can make exports more expensive, which can negatively affect news sites that export their content to other countries. Production costs may also rise, as raw materials may become more expensive due to a stronger currency.

Ultimately, the impact of currency appreciation on a news site will depend on its reliance on imports and exports, as well as the impact on the cost of producing its content. It is important for news sites to monitor currency fluctuations and take steps to minimize the risks associated with them.

In a nutshellcurrency appreciation can have both positive and negative effects on news sites, particularly in terms of production costs and competitiveness on international markets.

Pacific wallet, the power of compound interest and Pi rewards for investors

[arve url="https://www.youtube.com/embed/gRlEQrcJ4F0″/]

Understanding the world S3#8 - Dominique Plihon - "The dollar, international currency: until when?"

[arve url="https://www.youtube.com/embed/AVAMMqcmtfM "/]

What are the impacts of currency depreciation?

Currency depreciation can have a number of impacts on a country's economy, and consequently on the business news. Firstly, it can boost a country's exports by making products cheaper for foreign buyers. This can lead to higher profits for exporting companies, improving the balance of trade. However, a depreciating currency can also increase import costs, which can lead to a higher prices for domestic consumersincluding imported raw materials for companies.

In addition, a depreciating currency can have an impact on foreign investment in the country. Investors may be deterred from investing if the currency is weak, as this may mean they will have lower returns when converting their currency. It can also lead to a capital flight of the country, which can be detrimental to the national economy.

Finally, a depreciating currency can appear as a indicator of a weak economyThis can deter investors and adversely affect consumer confidence. As a result, economic growth may fall, and the value of domestic assets may decline.

In short, currency depreciation can have a significant economic impact on a country and can therefore be important information for readers to keep an eye on. business news.

What are the advantages and disadvantages of currency?

The benefits of money :

Money is an essential tool for facilitating commercial and financial exchanges between individuals and companies. It enables us to buy goods and services, invest in projects, repay debts and generate profits.

Money also plays an important role in economic stability, providing a measure of economic value and helping to regulate inflation and deflation.

Finally, currency can be used to support social programs and government economic policies, such as education, healthcare and scientific research.

The disadvantages of money :

However, money can also have negative effects on society and the environment. For example, excessive use of money can lead to an increase in economic and social inequalities, as well as the exploitation of natural resources.

What's more, the current monetary system can be vulnerable to economic and financial crises, which can have serious repercussions on people's lives and the global economy.

Finally, money can encourage excessive consumption of non-durable goods, which can lead to environmental problems such as pollution and wasted resources.

What is currency valuation?

The valuation of a currency, in the context of news sites, refers to the evolution of its value on the foreign exchange market. When a currency is valuedThis means that it is gaining in value against other currencies. This may be due to increased demand for the currency, often as a result of economic factors such as higher interest rates or positive growth prospects. Conversely, a devaluation of a currency occurs when its value falls relative to other currencies. This can be caused by low demand for the currency, budget or trade deficits, or other negative economic factors. Currency valuation and devaluation can have a significant impact on financial markets and the global economy, making it an important topic for financial news sites.

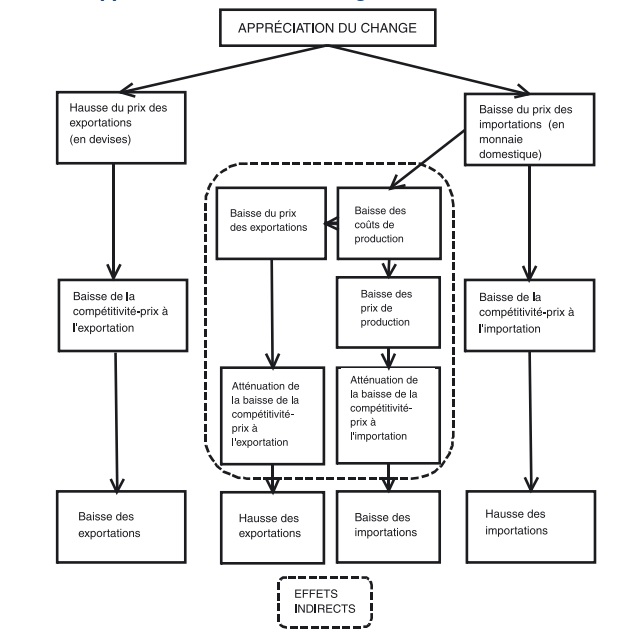

What effect does currency appreciation have on a country's exports and imports?

Currency appreciation affects a country's exports and imports. When one currency appreciates against another, the country's goods and services become more expensive abroad, reducing the competitiveness of its exports. the country. However, it can also make cheaper imports for the country, as less of its own currency is needed to buy the same amount of foreign currency required to purchase foreign products. This can be beneficial for companies that depend on imports of raw materials and intermediate goods.

However, a prolonged appreciation of the currency can negatively affect exports of the country, as foreign buyers will be looking for cheaper alternatives. This can also negatively affect economic growth of the country, as exports often account for a large share of GDP. Governments can try to counter this by implementing exchange rate policies, such as lower interest rates or direct intervention in the foreign exchange market to drive down the value of their own currency.

What are the advantages and disadvantages of appreciating the national currency against other currencies?

The advantages of a stronger national currency are numerous. Firstly, it makes imports cheaper, which could create opportunities for domestic companies that import raw materials or need finished goods for their own production. What's more, a strong currency can attract foreign investment into the country, as it offers a greater return to investors when the currency revalues.

However, there are also drawbacks to the appreciation of the national currency. Firstly, it could make exports more expensive, as international customers will have to pay more for products or services. It could also make domestic companies less competitive on the international market, as their prices will be higher than those of their foreign competitors. What's more, a sudden appreciation of the national currency can have a negative impact on industries such as tourism, as foreign visitors may find prices too high.

In short, currency appreciation can have both advantages and disadvantages for a national economy. It is important for governments and businesses to be aware of these potential effects, so that they can make informed decisions to promote the country's economic development.

How can currency appreciation affect the national economy?

Currency appreciation can have a significant impact on the national economy. When a currency is appreciated This means it has a higher value than other currencies. This can lead to an increase in imports, as foreign products become cheaper for local consumers. However, it can also make a country's exports less competitive as local products become more expensive for foreign buyers.

This can have a considerable impact on local industries that depend on exports for their growth and survival. If exports are reduced as a result of currency appreciation, this can lead to job losses and lower overall economic output.

Currency appreciation can also affect the stock market. Companies with a strong presence abroad can suffer losses if the local currency becomes too strong, as this makes their products more expensive for foreign buyers and thus reduces their profitability.

In short, currency appreciation can have both positive and negative effects on the national economy, depending on overall economic conditions. It is important that governments carefully monitor exchange rate fluctuations and take appropriate measures to minimize negative impacts on the local economy.

Why do some countries seek to maintain a weak currency rather than a strong one, and what are the advantages and disadvantages of this strategy?

Many countries seek to maintain a weak currency for several reasons. Firstly, a weak currency makes exports more competitive lowering the cost of local products compared with foreign products. This can boost export sales, contributing to economic growth and job creation.

In addition, a weak currency makes travel in the country less expensive for foreign tourists, which can boost the tourism industry and associated revenues.

However, the weak currency can also have its drawbacks. Firstly, it can increase the cost of imports, as imported products become more expensive for consumers. This can lead to higher inflation, as the prices of many products rise.

In addition, a weak currency can discourage foreign investment, as investors may be discouraged by a weak currency and prefer to invest in countries with stronger, more stable currencies.

Finally, a weak currency can damage a country's financial credibility, as it can be perceived as a sign of economic weakness or currency manipulation. This can have a negative impact on interest rates and trade relations with other countries.

In conclusion, currency appreciation has a number of advantages advantages and disadvantages. On the one hand, a strong currency can boost foreign investor confidence and stimulate investment flows. However, it can also lead to price hikes on imported products, reducing consumers' purchasing power. What's more, a strong currency can make exports less competitive, which can adversely affect local export industries. Ultimately, currency appreciation needs to be managed with caution, weighing up the risks against the benefits. advantages and disadvantages to avoid any negative impact on the national economy.