Fiscal stimulus is an economic strategy often used by governments to stimulate growth. By injecting funds into the economy, this measure can bring benefits such as job creation and increased investment. However, it can also have drawbacks such as inflation and debt. It is therefore crucial to carefully analyze the potential consequences before implementing such a policy.

The pros and cons of fiscal stimulus in politics

Fiscal stimulus is a political method used to boost a country's economic growth. It involves increasing public spending to boost economic activity and create jobs. This method has its advantages and disadvantages.

The benefits:

Fiscal stimulus can be effective in pulling a country out of recession and stimulating private investment. By increasing public spending, the government can stimulate demand and economic activity, which in turn can encourage businesses to invest and hire. Fiscal stimulus can also help maintain essential public services, such as health, education and roads.

Disadvantages:

However, fiscal stimulus can lead to inflation and increased public debt. If the government continues to spend more than it takes in, it will have to borrow money to finance its spending. This can lead to an increase in public debt, which in turn can generate additional costs for future generations. What's more, if fiscal stimulus is poorly managed, it can lead to inflation, by raising the prices of goods and services.

In conclusion, fiscal stimulus can be a powerful tool for stimulating economic growth. However, it must be used carefully and responsibly. Governments must be careful to avoid mismanagement and keep public debt under control.

Draw me the eco: What is competitiveness? And how can we improve it?

[arve url="https://www.youtube.com/embed/uHDpRAXiiq0″/]

Draw me the economy: How the state budget is drawn up

[arve url="https://www.youtube.com/embed/TQkuaDfjmyU "/]

What are the benefits and restrictions of fiscal stimulus policies?

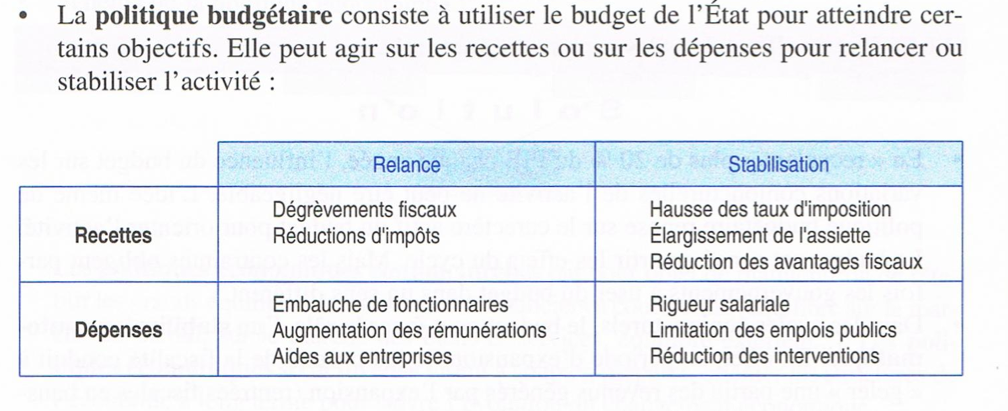

Fiscal stimulus policies aim to increase aggregate demand in the economy by increasing public spending and/or reducing taxes. This can have positive effects on economic growth, employment and financial stability, but there are also important restrictions to take into account.

The benefits Stimulative fiscal policies include an increase in aggregate demand, which can boost production, employment and economic growth. Stimulus measures can be particularly useful during periods of recession or financial crisis, when the economy needs extra support.

Restrictions of fiscal stimulus policies are important to consider. Firstly, the effectiveness of these policies depends on the government's ability to finance additional spending or cut taxes without increasing the budget deficit. In some cases, increasing the deficit could lead to reduced investor confidence and higher interest rates, which could slow economic growth.

Furthermore, it is important to note that fiscal stimulus policies cannot solve all economic problems. For example, if the economy is facing structural problems such as a lack of productivity or low competitiveness, stimulus measures will not be effective in the long term.

Finally, it's important to stress that fiscal stimulus policies have short-term costs. Additional public spending or tax cuts can lead to higher inflation or currency devaluation, which could harm financial stability in the long term.

In conclusion, fiscal stimulus policies can be useful for boosting economic growth, but they must be used with caution and in the light of significant restrictions.

What are the potential drawbacks of this stimulus policy?

One of the main drawbacks of a relaunch policy on a French-language news site is the audience limit. Restricting the site to a single language excludes non-French speakers, which can considerably reduce the number of people who can access the content. This can lead to a loss of traffic and advertising revenue for the site.

Another potential drawback is that this may limit the diversity of information sources and perspectives presented on the site. If the site focuses solely on French news, it may miss important events in other countries or cultures. This can also affect the site's credibility, as readers may question the objectivity of the content if only one perspective is always presented.

Finally, creating French-only content can also limit the scope for international partnershipsThis can hinder the site's growth and reach. Online news sites are often called upon to work with partners to provide comprehensive international coverage, but this can be difficult if limited to a single language.

In short, a relaunch policy limited to a single language may have advantages, such as building loyalty among the French-speaking audience, but it may also have disadvantages, such as restricting the audience, limiting the prospects presented and holding back the development of international partnerships.

What are the impacts of a fiscal stimulus policy?

Fiscal stimulus is an economic strategy that involves increasing government spending to stimulate economic growth and reduce unemployment. This policy can have several impacts on a country's economy.

Impact on economic growth : Increased government spending can stimulate economic activity by creating jobs and boosting domestic demand. It can also encourage investors to invest in the economy, stimulating economic growth.

Impact on inflation : Increased government spending can lead to increased demand for goods and services, which in turn can lead to higher prices. This can lead to inflation if production capacity cannot keep pace with increased demand.

Impact on public debt : Fiscal stimulus can also have an impact on public debt. If government spending is financed by borrowing, this can lead to an increase in public debt. However, if fiscal stimulus helps stimulate economic growth, it can lead to an increase in tax revenues, thereby reducing public debt.

Conclusion: Fiscal stimulus can have a positive impact on economic growth and job creation, but it can also lead to inflation and increased public debt. It is therefore important to implement this policy with caution, taking into account the country's specific economic conditions.

What are the benefits of fiscal policy?

Fiscal policy is an important tool for governments seeking to stimulate the economy or maintain financial stability. The main benefits of fiscal policy include :

1. Stimulate economic growth - Governments can use government spending to stimulate aggregate demand in the economy. This can be achieved by increasing public spending on infrastructure, education and healthcare, among others. Such spending stimulates economic activity, creates jobs and encourages private companies to invest.

2. Stabilize the economy - Fiscal policy can also be used to stabilize the economy during a recession or economic downturn. In this case, the government may reduce taxes or increase spending to stimulate demand and avoid an economic contraction.

3. Reduce unemployment - Increased government spending can help reduce unemployment by stimulating job creation. Reducing unemployment can also promote economic growth by increasing consumption.

4. Managing public debt - An effective fiscal policy can help manage public debt by controlling spending and increasing revenues. If public debt becomes too large, it can have a negative impact on the country's financial stability, interest rates and borrowing costs.

In short, fiscal policy can be a powerful tool for stimulating the economy, stabilizing the market and maintaining a country's financial health.

What are the advantages and disadvantages of fiscal stimulus to boost the economy?

Advantages: increased domestic demand, job creation, boost to economic growth. Disadvantages: risk of inflation, increased public debt, long-term dependence on government spending.

What are the advantages and disadvantages of fiscal stimulus to boost the economy?

Advantages : L'increased domestic demand helps stimulate household and business consumption. This can lead to job creation and a boosting economic growth.

Disadvantages : This policy may result in inflation risk if demand outstrips available supply. There is also a risk ofincrease in public debtThis could have an impact on investor confidence and the country's credit rating. In addition, this policy creates a long-term dependence on government spendingwhich are not always durable or effective.

How has the budget's role in stimulus policy changed over time?

Advantages: evolution of the importance of the budget in economic policy, support for public and private investment, stimulation of innovation. Disadvantages: bureaucratic red tape, high political and social risks, disincentives to action.

The role of budget s role in stimulus policy has grown considerably over the years. It has become an essential tool for stimulating economic growth and employment, as well as a means of combating economic and financial crises.

The benefits of an expansionary fiscal policy are numerous. Firstly, the budget can support thepublic and private investmentThis stimulates aggregate demand and thus economic growth. Secondly, the budget can encourageinnovation by financing R&D projects or offering tax incentives to innovative companies.

However, an expansionary fiscal policy also has its drawbacks. disadvantages. The red tape can hinder government action, while the imposing political and social risks associated with such a policy can lead to tension and opposition. Finally, the obstacles to action that come with budget limits can prevent the government from implementing an effective economic stimulus.

How effective can fiscal stimulus be in times of economic crisis?

Advantages: ability to rapidly revive the economy, creating jobs and increasing consumption and production of goods and services. Disadvantages: risk of undesirable effects, increasing public debt, worsening economic imbalances.

Fiscal stimulus policy can be effective in an economic crisis to a certain extent. In fact, it can rapidly stimulate the economy by creating jobs and increasing consumption and production of goods and services. This can help reduce the negative effects of the economic crisis.

However, we must not forget the drawbacks of such a policy. The risks of undesirable effects are numerous, particularly with the increase in public debt, which can have harmful long-term consequences. What's more, it can exacerbate economic imbalances and foster structural inefficiencies.

In short, fiscal stimulus must be used prudently and in compliance with budgetary rules. Governments must ensure the efficient use of public funds to avoid undesirable effects and maximize the benefits of this policy. It is also important to take a long-term view of the economy to ensure the sustainability of public debt and the resilience of the economy as a whole.

In conclusion, fiscal stimulus policy can be beneficial in stimulating the economy during a recession. In particular, it can create jobs, boost consumption and support ailing companies. However, there are a number of caveats, it should be stressed that this policy also generates significant disadvantagesIn addition, fiscal stimulus often requires adjustments in public spending and tax increases, which can also have negative consequences for the economy. What's more, fiscal stimulus often requires adjustments in public spending and tax increases, which can also have negative consequences for the economy. It is therefore necessary to weigh up the pros and cons before making any decisions on budgetary policies. In short, fiscal stimulus needs to be used with care, bearing in mind the benefits it can bring, but also its limits and potential undesirable effects.