The advantages and disadvantages of separation of property

Separation of property is an option that many couples choose before getting married or cohabiting together. It implies that each individual retains ownership of his or her property before and after the relationship, which can be advantageous in some cases.

The benefits:

One of the most obvious advantages of property separation is that it protects the individual property of each spouse in the event of separation or divorce. In addition, it also avoids conflicts linked to joint financial management, particularly when income and expenses are not equitably divided between partners. Finally, it can be a solution for people with substantial inheritances or debts that they wish to keep separate from their spouse.

Disadvantages:

While this solution may seem ideal for some couples, it can also create certain disadvantages. Indeed, it can make it difficult to acquire joint assets, particularly when buying a house or cohabiting in general. In addition, it often complicates the management of joint expenses such as bills and daily living costs. Finally, it can also have an impact on the couple's tax situation.

In conclusion, separation as to property is an option with both advantages and disadvantages. It is important for couples to find out about the financial and legal consequences of this decision before adopting it.

Le Régime de la Communauté de Biens Réduite aux Acquêts : Matrimonial property regimes

[arve url="https://www.youtube.com/embed/ooIcmkfVB4w "/]

Collective bargaining agreement - How does it work, and how does it differ from the legal system?

[arve url="https://www.youtube.com/embed/ZaYHi5iRNGo "/]

What are the rights of the surviving spouse in the event of separation of assets?

In the event of separation of assets between the spouses, the surviving spouse has limited rights. In France, the law requires hereditary reservationwhich guarantees a minimum inheritance to the couple's children (or their descendants) and to the surviving spouse.

This minimum share, known as the available shareThe inheritance tax is equal to half of the estate assets if there is one child, and to 2/3 of the estate assets if there are several children. The remainder of the inheritance, called the freely available sharecan be distributed as they see fit by the deceased.

Thus, if the surviving spouse's share of the inheritance exceeds the available portion, he or she will only be entitled to a fraction of the estate, and will have to renounce the remainder in favor of the reserved heirs.

However, there are cases where the spouse may benefit from special protection, such as in the case of a will or a last living gift. It should also be noted that matrimonial regimes can modify the inheritance rights of the surviving spouse.

When is a separation of property necessary?

Separation as to property allows married couples to manage their assets independently. It can be carried out at any time, before or during the marriage.However, it is advisable to consider it before marriage to avoid any confusion or disputes in the event of divorce.

Separation as to property allows each spouse to own and manage his or her own property.. This means that assets acquired before and after marriage, as well as debts, belong to each spouse individually. In the event of divorce, this facilitates the distribution of assets and avoids any potential conflict.

It is important to note that separation of property does not prevent spouses from sharing property or acquiring it jointly. They can always buy goods together or pool certain goods.However, they must be diligent in documenting these transactions to avoid any subsequent confusion.

In short, separation as to property is a viable option for married couples who wish to manage their assets independently and avoid potential disputes in the event of divorce. It is possible to do so at any time, but it is best to consider this option before marriage.

What is the best matrimonial property regime?

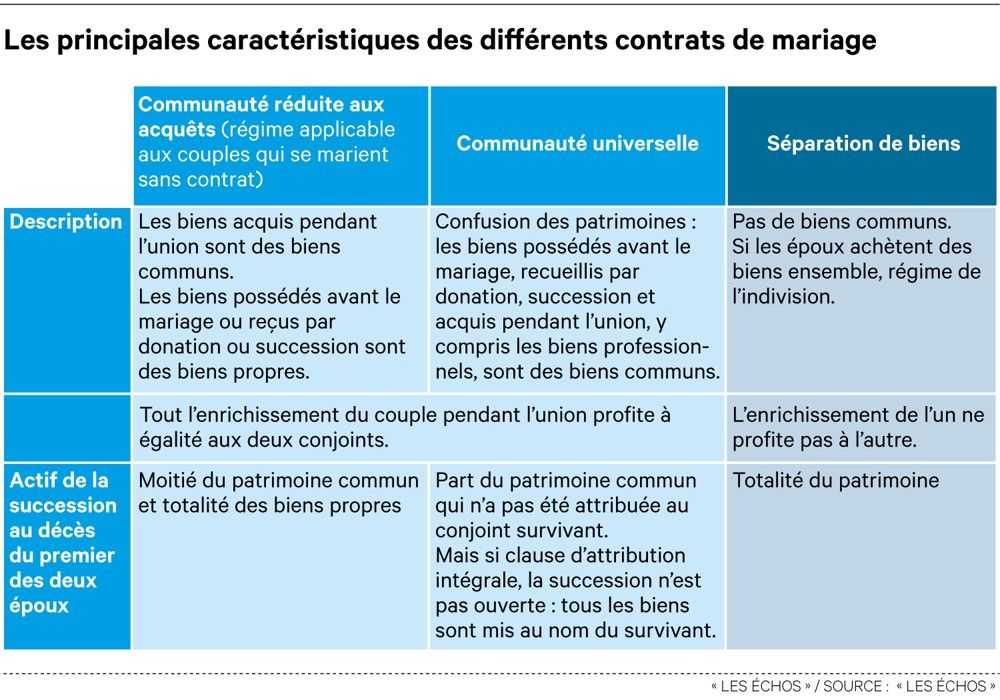

The best matrimonial property regime depends on the goals and preferences of each couple. There are different types of matrimonial property regimes, such as the regime of universal community, the regime of separation of property and the regime of participation in acquests.

The universal community regime is most advantageous for couples who wish to share all their assets, whether acquired before or during the marriage. However, this can become a disadvantage in the event of divorce, as the personal assets of each spouse are also shared.

The separation of property regime is best suited to couples who are financially independent or have substantial personal assets. Under this plan, each spouse retains exclusive ownership of his or her personal property and is responsible for his or her debts.

Finally, the regime of participation in acquests is a compromise between the two. It allows spouses to keep their personal assets while sharing the gains acquired during the marriage.

In conclusion, it's important for every couple to think carefully about which matrimonial property regime best suits their needs and financial situation.

What are the tax advantages of separation as to property?

There are many tax advantages to separating property for married couples. Firstly, each spouse is taxed separately on his or her income. So, if one spouse has a higher income than the other, he or she will be taxed in a higher marginal bracket. On the other hand, if both spouses are taxed together, their combined incomes may push them into a higher tax bracket, which may increase their overall tax rate.

What's more, in the event of the death of one of the spouses, separation as to property limits inheritance tax. If the couple's assets were community property, the surviving spouse would be taxed on half the total value of the community property at the time of his or her spouse's death. With separation as to property, on the other hand, each spouse is taxed only on his or her own assets.

It should be noted, however, that separation of property can also have disadvantages, particularly in terms of social protection and bank loans. It is therefore advisable to consult a legal advisor before making any decisions.

What are the legal disadvantages of separating property?

There are many legal disadvantages to separating property. Indeed, when a couple decides to separate by opting for the separation of property, they must divide all their joint property and assets equally. This can quickly become complex when the assets in question are substantial, and the two parties have different views on how they should be divided.

What's more, separation of property can lead to legal disputes between ex-spouses. Indeed, if one of them considers that the distribution has not been fair, he or she can challenge the decision in court. This process can be lengthy and costly, and can also lead to further tension between the ex-spouses.

Finally, separation of property can also have significant tax consequences. In fact, some property division operations can entail substantial taxes on capital gains, for example. It is therefore important to find out about the tax consequences before proceeding with a division of property.

On the whole, a separation of assets can be a useful solution for couples wishing to end their relationship, but it also entails legal and tax risks that should not be overlooked.

How to protect yourself in the event of separation of property?

How to protect yourself in the event of separation of property?

When property is separated, it's important to take steps to protect your interests. Here are a few tips to follow:

1. Drawing up a marriage contract : If you're married, it's a good idea to draw up a prenuptial agreement that clearly stipulates each spouse's property and joint property. This will enable you to settle any property distribution problems quickly in the event of separation.

2. Managing your bank accounts : If you have joint bank accounts with your spouse, it's best to keep them separate. You can open individual accounts for your personal income and expenses.

3. Documenting assets : To avoid any confusion over the ownership of goods, it's important to document their origin and acquisition. You can keep invoices, property deeds and bank statements.

4. Protect important assets: If you have important possessions such as jewelry, works of art or cars, you can insure them against theft or loss. This will prevent you from losing them in the event of separation.

5. Call in a professional: Finally, if you have complex assets or significant investments, it may be useful to call on a lawyer or financial advisor to help you protect your interests.

By following these tips, you can protect yourself effectively in the event of property separation.

In conclusion, property separation can offer better financial protection in the event of divorce, and can be beneficial for couples who prefer to keep their finances separate. However, it can also complicate the management of household finances and create a sense of non-sharing in the relationship. It is therefore important to carefully weigh up the advantages and disadvantages of this matrimonial regime before making a decision. Whether you choose separation as to property or not, the important thing is to discuss the matter openly with your partner to find the best solution for both of you. And don't forget that your choice of matrimonial property regime can have a major impact on your future life.