Traditional banking is often considered the safest and most reliable choice for managing one's finances. However, digital alternatives are rapidly emerging on the market. In this article, we'll take a look at some of them. benefits and disadvantages of traditional banking.

Traditional banking: strengths and weaknesses

Traditional banking has both strengths and weaknesses in the context of a news site. In terms of strengths, traditional banks generally have a long history and extensive experience in the financial sector. As such, they can inspire greater confidence in customers when it comes to the security of their funds. In addition, traditional banks often have a well-developed network of physical branches, giving customers easy access to face-to-face advisors for personalized financial advice.

However, traditional banks also have weaknesses. Firstly, they can often charge high fees for their services, which can be an obstacle for low-income earners. In addition, their loan application and account opening processes can be long and tedious, which can put off potential customers. Finally, traditional banks tend to be less innovative than online banks, which can make them less attractive to customers looking for new and innovative financial solutions.

In conclusion, Traditional banks have advantages and disadvantages in the context of a news site. It's important for customers to weigh up these pros and cons to find the best financial solution for their needs.

Open a Swiss bank account for 1 euro

[arve url="https://www.youtube.com/embed/bXTte6BMmCM "/]

The micro-business bank account 💳

[arve url="https://www.youtube.com/embed/Snn6nZCmNNI "/]

What are the advantages and disadvantages of a bank?

Bank profits : Banks are indispensable to the economy, playing a crucial role in collecting deposits and distributing credit. Banks also offer a variety of financial services such as savings accounts, travelers' cheques, credit cards, mortgages and more.

Banks give individuals access to comprehensive and specialized financial services not otherwise available. They also provide enhanced security for deposited funds, protecting savers against theft, fraud and loss.

The disadvantages of banks : Banks can sometimes be criticized for their lack of transparency, the high cost of their services and their lack of ethics in certain financial transactions. In addition, banks' abuse of power can also lead to irresponsible lending practices, contributing to financial crises.

The 2008 financial crisis highlighted problems associated with banks, such as excessive leverage, market speculation and inadequate risk management practices. These problems led to a loss of public confidence in banks, with negative economic effects worldwide.

In short, although banks play an important role in the economy, they can have drawbacks such as lack of transparency, high costs and irresponsible lending practices that can have disastrous economic consequences.

What are the benefits of banking?

Bank benefits are many and varied. First and foremost, banks play an essential role in the economy, offering financial services to individuals and businesses. They make it possible to deposit and withdraw money securely, make electronic payments, borrow money to finance projects such as buying a house or a car, or invest money for higher returns.

In addition, banks contribute to financial stability monitoring the activities of other financial institutions to ensure that they comply with applicable rules and regulations. They are also responsible for managing the risks associated with their own activities, to ensure their long-term financial viability.

Finally, banks can also play an important role in economic development by offering credit to small businesses and entrepreneurs. These loans often enable businesses to expand, create new jobs and stimulate economic growth.

In short, banks are a crucial player in the modern economy, bringing many benefits to society.

What is the definition of a traditional bank?

Traditional banking is a financial institution offering banking products and services to its customers. What sets it apart from online banking is its physical presence, with a network of branches to welcome customers and process their banking transactions. Traditional banks These include current accounts, bank cards, credit, loans, insurance, investments and wealth management services. However, there are a number of they are often criticized for their high fees and lack of innovation in the face of online banks and fintechs. Despite this, they remain major players in the banking sector with a loyal customer base.

What's the difference between a classic bank and a contemporary bank?

The main difference between a classic bank and a contemporary bank lies in their approach to technology. Classic banks tend to be more traditional, with a focus on face-to-face transactions and basic banking services such as deposits, withdrawals and cheques. By contrast, contemporary banks use more advanced technologies to offer a wider range of banking services.

Today's banks also offer more advanced online functions. Customers can carry out banking operations online, such as bill payment, funds transfer and account management. They also offer easy access to their services via mobile applications and user-friendly websites.

Another important difference is our approach to customer relations. Classic banks tend to focus on face-to-face relationships, while contemporary banks are more focused on digital interactions. Contemporary banks often have customer service teams available 24 hours a day to answer questions or resolve problems online.

In short, today's banks are distinguished mainly by their increased use of advanced technologies and their more digitally-oriented approach to customer relations.

What are the advantages and disadvantages of traditional banking compared to online banking?

The advantages of traditional banking:

- The physical presence of bank branches enables a more personal relationship with customers.

- Traditional banks offer a wide range of financial products and services such as loans, credit cards, investments and more.

- Traditional bank accounts are often associated with rewards programs, such as loyalty points or cash back.

The disadvantages of traditional banking:

- Banking fees are often higher than for online banks.

- Application processes for loans or credit cards can be longer and more complex due to the need to produce and provide paper documents.

- Bank branch opening hours are often limited.

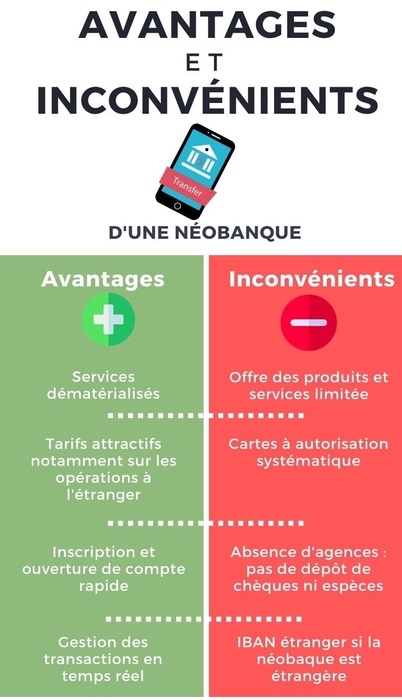

The advantages of online banking :

- Bank charges are often lower thanks to reduced operating costs.

- Online banks often offer faster and simpler application processes for loans and credit cards.

- Online banks have more flexible service hours, often 24 hours a day, 7 days a week.

The disadvantages of online banking:

- The absence of a physical presence can lead to a less personal relationship with customers.

- The financial products and services on offer may be limited in comparison with traditional banks.

- Customers may find it difficult to get immediate answers to their questions or problems.

What are the advantages and disadvantages of traditional banking versus credit unions?

The advantages and disadvantages of traditional banking compared to credit unions are as follows:

Advantages of traditional banking :

- Traditional banks generally have more branches and ATMs, making them more accessible to customers.

- Traditional banks' online and mobile services are often more developed and offer a wider range of functions.

- Traditional banks tend to offer more attractive rewards programs for credit cards.

Disadvantages of traditional banking :

- Banking fees are generally higher at traditional banks and may include hidden charges.

- Traditional banks often have stricter lending policies, which can make it harder for some people to get a loan.

- Traditional banks have a more rigid hierarchical structure, which can lead to delays in processing service requests.

Advantages of credit unions :

- Credit unions are often more community-oriented and can offer lower interest rates on loans and deposits.

- As members of the cooperative, customers have a voice in the cooperative's decision-making process.

- Credit unions often have fewer fees and lower charges than traditional banks.

Disadvantages of credit unions :

- Credit unions often have a limited number of branches and ATMs, which can make them less accessible to some customers.

- Credit unions' online and mobile services may be less developed than those of traditional banks.

- Credit unions have less developed rewards programs for credit cards.

What are the advantages and disadvantages of traditional banking compared to private banking?

The advantages of traditional banking:

– AccessibilityTraditional banks generally have a strong physical presence and are easily accessible to the general public. This makes it easier for customers to carry out banking transactions in person.

– Diversified servicesTraditional banks offer a wide range of products and services, from deposit accounts to mortgages, credit cards and investments.

– Security: Large, traditional banks are considered more stable and reliable than smaller, private banks, which can offer customers a degree of security.

The disadvantages of traditional banking:

– High costsTraditional banks can charge high fees for banking services and investments, which can be a disadvantage for customers with limited funds.

– Slow processesLarge banks: Due to their size and organizational structure, large banks may have slower processes for loan applications and other banking services.

– Lack of customizationThe big traditional banks can lack personalization in the way they treat their customers, offering standardized services rather than tailor-made solutions.

The advantages of private banks:

– Personalized advicePrivate banks often offer a more personalized banking package, with dedicated advisors to help customers make financial decisions.

– Specialized investmentsPrivate banks can offer specialized investment services, such as wealth management and alternative investments.

– AnonymityPrivate banks often offer a certain degree of anonymity, which can be an advantage for people wishing to preserve their privacy.

The disadvantages of private banks:

– Poor accessibilityPrivate banks are often reserved for wealthy customers and have a limited physical presence, which can make access difficult for the general public.

– High costsPrivate banking services can be expensive, which can be a disadvantage for clients with limited funds.

– RiskSmaller, privately-owned banks can represent a greater risk to financial stability than larger, traditional banks.

In short, traditional banking offers undeniable advantages such as proximity to financial advisors and transaction security. However, it can also present certain disadvantages, such as high banking fees and limited access to online services. So it's important to weigh up the pros and cons carefully before choosing the bank that best suits your needs. At the end of the dayEach individual has to decide which option best suits his or her financial habits and banking requirements.