Choosing the best financing method can make all the difference to your business. In this article, we will review the advantages and disadvantages of each form of financing pdffrom traditional loans to angel investors, to help you make an informed decision about how to finance your business.

Financing comparison: advantages and disadvantages

When we compare different types of funding for a news site, there are advantages and disadvantages to each. Traditional advertising funding has long been the dominant model in the media industry, but it can be difficult to maintain a stable and predictable revenue stream with this method. In addition, there is also strong competition in the online advertising market, which means that prices can be quite low.

Another common financing model is paid subscription.This offers advantages such as a more stable income and the possibility of creating quality content without being subject to advertising requirements. However, it can also reduce the site's audience, as not everyone wants to pay for access to news.

Participatory financing is another optionwhere readers can make voluntary donations or become patrons to support their favorite news site. This can be a great way to raise funds, but again, it will depend on the audience's interest in the platform.

On the whole, each funding model has its advantages and disadvantages. News sites need to strike a balance between creating high-quality content and generating sufficient income to support their activities. Ultimately, the key is to understand your audience and propose a model that meets their needs and desires.

It is important to note that the HTML tags have been placed in key phrases to help highlight important points.

Investing in the stock market for dummies (free training)

[arve url="https://www.youtube.com/embed/ZXPetj42rEs "/]

How to get rich with the stock market (beginner)

[arve url="https://www.youtube.com/embed/TVYQsSVnFVQ "/]

What are the advantages and disadvantages of the various forms of financing?

The advantages and disadvantages of the various forms of financing for a news site are as follows:

1. Advertising: Advertising is one of the most common forms of funding for news sites. The advantages of this form of funding include a regular source of income, which allows the news site to continue producing content without needing to charge its users. However, advertising can be intrusive and make it difficult for users to read the content, which can lead to a loss of traffic to the site.

2. Subscriptions : Subscriptions are another form of financing for news sites. The main advantage of this form of financing is that it allows the news site to generate regular revenue while offering its users quality content without intrusive advertising. However, subscriptions can limit access to information for those who can't afford to pay for access, which can result in a loss of traffic to the site.

3. Grants: Grants are a form of funding where the government or private organizations provide funds to support a news site. This form of funding has the advantage of providing a stable and regular source of funding for the news site, but it can also be perceived as unbiased or influenced by the interests of its donors, which can damage its credibility.

4. Participatory funding: Participatory funding is a form of funding where news site users can make donations to support the site. The benefits of this form of funding include direct support from the community, which can strengthen user engagement with the site and encourage greater participation. However, this form of funding can be volatile, as it depends on ongoing user support.

In short, each form of funding has its advantages and disadvantages when it comes to news sites. It's important for news sites to strike the right balance between generating revenue and providing quality content without hindering the user experience.

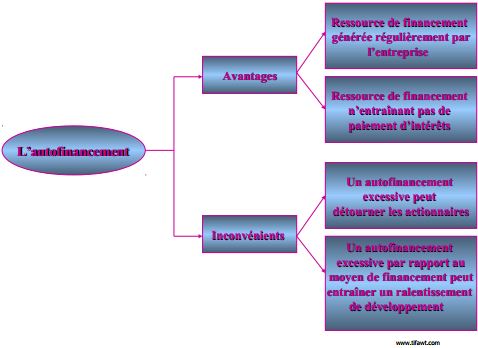

What are the benefits and limitations of internal financing?

The benefits The advantages of internal financing for a French-language news site are numerous. Firstly, it enables the company to maintain total control over its cash flow, and avoid having to repay debts or interest to external investors.

In addition, internal financing saves on borrowing and credit costsThis can increase the company's profits. Revenues generated by content creation can be reinvested in business expansion or the development of new projects.

However, there are also limits internal financing. For a company wishing to grow rapidly, internal financing may not be sufficient and may limit its growth potential. What's more, if the company's equity is insufficient, this may compromise its ability to finance new projects or meet customer demands.

Finally, internal financing can also limit the company's ability to diversify its activities or invest in new initiatives, which can affect its long-term growth. In short, although internal financing is a profitable strategy for a company, it must balance the benefits and limitations to decide whether it is the best option for its development and growth.

What are the disadvantages of external financing?

The disadvantages of external financing for a news site are as follows:

1. Debt : When you finance your news site with borrowed capital, you take on debt, incurring repayment obligations and interest payments that reduce your profit margin.

2. Loss of control : If you accept external investors, you have to grant them a measure of control over your business, which may limit your ability to make important decisions independently.

3. Earnings pressure : External investors expect a high return on investment, which can put considerable pressure on your company to maintain steady growth and profits.

4. Risk of conflict of interest : External investors may have different interests to you, and seek to impose their own agenda or strategy.

5. Financial disclosure : External investors may require significant financial disclosure, which can be damaging to your business if it falls into the wrong hands.

Overall, external financing can be a practical option for news sites seeking additional capital, but there are also risks associated with this approach. It's important to weigh up the pros and cons before making a decision.

What are the different types of financing?

There are different ways to finance a news site. Here are a few examples:

1. Advertising: advertising funding is the most common form of funding for news sites. Companies pay to display their ads on the site, and the site earns money based on the number of clicks or views.

2. Subscriptions: some news sites offer paid subscriptions to access exclusive content or to avoid advertising. This type of financing is often used by niche sites with a loyal audience.

3. Subsidies: news sites may also receive subsidies from governmental or non-governmental organizations to cover operating costs.

4. Participatory funding: news sites can ask their community of readers to contribute financially to support their work. This form of funding is often used by independent or non-profit news sites.

It's important for a news site to diversify its funding sources to ensure its long-term viability.

What are the advantages and disadvantages of bank financing compared with participatory financing, as described in a PDF file?

The advantages of bank financing :

- Banks are regulated and reliable financial institutions, offering guarantees to investors.

- Bank loans generally offer a lower interest rate than other financing options.

- Bank loans can be used to finance a variety of projects, including business expansion or the purchase of new equipment.

The disadvantages of bank financing :

- Banks may have strict collateral requirements and may require a personal guarantee from the borrower.

- Loan application processes can be long and complicated, requiring a great deal of documentation and verification before approval.

- In the event of non-repayment or default on loans, the banks can seize the borrower's assets to recover their money.

The advantages of participatory financing :

- Participatory financing enables small businesses to access additional funds without having to go through the constraints of banks.

- Participatory financing can be faster and more flexible than bank loans, enabling companies to respond quickly to their financial needs.

- Participatory financing offers investors the opportunity to support projects they believe to be worthwhile, and to see their invested money generate high returns.

The disadvantages of equity crowdfunding :

- Participatory financing can be risky for investors, as there are no guarantees that the project will be successful.

- The costs of crowdfunding can be higher than bank loans, due to transaction fees and commissions for crowdfunding platforms.

- Companies may find it difficult to reach their financing target on time, leading to delays or project cancellation.

How to compare the advantages and disadvantages of equity and bond financing in PDF format?

Introduction : Financing is an essential element in a company's growth. Among the various options available, equity and bond financing are two important sources of funding for a company. In this article, we'll look at the advantages and disadvantages of these two options.

Advantages of equity financing :

– Flexibility: Equity financing enables a company to raise funds without incurring debt. Unlike debt, shares have no maturity date. Equity investors are also willing to take on additional risk, as they have a higher earning potential than creditors.

– Ability to attract investors: Companies looking to raise funds by issuing shares can attract a wide variety of investors interested in different levels of risk. It can also help the company improve its reputation and profile with potential investors.

– Higher growth potential: By raising capital through share issues, a company can access the funds it needs to finance growth projects and long-term investments.

Disadvantages of equity financing :

– Dilution of existing shareholders' interests: By issuing new shares, the company dilutes the ownership stake of each existing shareholder, which can lead to a fall in the value of existing shares.

– Pressure for higher yields: Equity investors often seek high returns, which can put additional pressure on the company to increase profits and dividends.

– Risk of loss of control: If the company issues too many shares, this can lead to a loss of control and even a hostile takeover.

Advantages of bond financing :

– Fixed interest: Bonds offer fixed interest rates that are predictable for companies and investors.

– Flexibility: Bond maturities are often longer than short-term debt, which can give companies greater flexibility in repaying debt.

– Less risk for existing shareholders: Unlike equity financing, bond financing does not dilute the shares of existing shareholders.

Disadvantages of bond financing :

– Increased indebtedness: Bond financing increases the company's debt and may affect its ability to obtain other types of financing in the future.

– High interest rates: Bond investors often seek higher interest rates than equity investors, which can increase financing costs for the company.

– Default risk: If the company is unable to repay the bonds when due, this could lead to default and a loss of credibility with investors.

In conclusion, equity and bond financing each have their advantages and disadvantages. Companies need to consider their long-term financial objectives and their ability to assume the risks associated with each option.

What are the differences in advantages and disadvantages between short-term and long-term financing, as presented in a PDF document?

Financing for short-term are loans that must be repaid within one year. They are often used to meet immediate cash needs, such as paying suppliers or wages. The advantages of these types of financing are that they are generally easier to obtain and offer flexibility in terms of repayment. However, the disadvantages are that interest rates can be higher and repayment must be made quickly.

Financing for long termLoans of this kind are loans that have to be repaid over a period of more than one year, and sometimes even several decades. These types of financing are often used for major investments such as the purchase of real estate or new machinery. The advantages of these types of financing are that interest rates are generally lower and repayment can be spread over a longer period, facilitating cash flow management. However, the disadvantages are that obtaining such financing can be more difficult, and repayment over an extended period can result in higher interest costs over the total term of the loan.

In conclusion, it's important to weigh up the advantages and disadvantages of each form of pdf financing before making a decision. Visit leasing may offer lower monthly payments and easy equipment upgrades, but it may cost more in the long run and not offer ultimate ownership of the asset. The loanIn the case of a mortgage, ownership of the financed asset is possible, and may be less costly in the long term, but may require more up-front financing and higher monthly payments. Finally, thefactoring can offer fast financing and reduced risk for creditors, but can have higher costs and require close accounts receivable management. So it's vital to understand your business needs and choose the form of pdf financing that best suits your long-term objectives.