In this article, we'll look at the advantages and disadvantages of different business valuation methods. Whether you're an investor or an entrepreneur, understanding how to estimate the value of a business is essential to making informed decisions. We'll look in detail at the positive and negative aspects of the different approaches used in this field. Get ready to deepen your knowledge of business valuation!

The Ultimate Guide to Excel for Beginner Financiers - IFE

[arve url="https://www.youtube.com/embed/-bVWfquf-C4″/]

What are the various limitations of business valuation methods?

There are a number of limitations to be taken into account in the various methods of valuing companies. First and foremost, It is important to note that these methods are often based on historical data, which may not reflect the company's current or future reality. As a result, valuations may be based on obsolete data or fail to take account of recent economic or technological changes.

Next, Valuation methods can also be subject to subjective bias. Valuers may interpret financial data differently, and apply different assumptions when calculating the value of a company. This can lead to varied results that are difficult to compare between different valuations.

What's more, valuation methods may fail to take into account certain intangible aspects of the company, such as brand reputation, management quality or growth prospects. These elements can have a significant impact on the company's real value, but are not always taken into account by traditional valuation methods.

Finally, valuation methods may be limited by the lack of available information. Companies may not disclose all their financial or operational data, making accurate valuation difficult. In addition, some industries may have specific characteristics that require particular valuation approaches, which can pose additional challenges.

In conclusion, it is important to recognize the inherent limitations of business valuation methods. It is advisable to use a variety of complementary approaches, and to take several factors into account, to obtain a more accurate and complete assessment of a company.

What are the advantages and limitations of the DCF method?

The DCF (Discounted Cash Flow) method is a financial valuation method that estimates a company's intrinsic value based on its discounted future cash flows. It is based on the principle that a company's value lies in its ability to generate cash flows.

The advantages of the DCF method are :

1. Consideration of future cash flows : This method makes it possible to estimate a company's value by focusing on its expected future cash flows, giving a better view of the company's profitability and financial viability.

2. Flexibility : The DCF method can be adapted to different sectors and types of company, making it a versatile tool for financial valuation.

3. Discounted cash flows : By using an appropriate discount rate, the DCF method takes into account time and the time value of money. It therefore gives greater weight to future cash flows than to those generated in the past.

4. Value creation indicator : The DCF method measures a company's value creation over time by comparing its estimated current value with its initial value.

However, the DCF method also has a number of limitations:

1. Sensitivity to assumptions : The results of the DCF method depend heavily on assumptions made about future cash flows, discount rates and other variables. Slight variations in these assumptions can lead to very different estimates of a company's value.

2. Difficulty in estimating cash flows : Accurately forecasting future cash flows can be a challenge, especially for companies in a growth phase or in volatile sectors.

3. Complexity : The DCF method requires an in-depth understanding of financial concepts and a detailed analysis of a company's financial information. It can therefore prove complex for those unfamiliar with financial valuation techniques.

In conclusion, although the DCF method is a powerful tool for assessing a company's value, it is important to take into account its advantages and limitations, as well as the specificities of the business sector concerned, when using it on a news site.

Which business valuation method should I choose?

When it comes to valuing a company as part of a news site, there are several commonly used methods. Some of these may include:

Valuation based on financial statements : This method involves examining the company's financial statements, such as the balance sheet, income statement and cash flow statement. It allows you to analyze the company's financial situation, profitability, cash flow, etc.

Valuation based on market multiples: This method involves comparing the company's financial ratios with those of other similar companies that are listed on the stock exchange or have recently been sold. The most commonly used ratios are price/earnings, enterprise value/EBITDA, enterprise value/sales, etc.

Valuation based on discounted cash flows : This method involves estimating the future cash flows generated by the business and discounting them using an appropriate discount rate. This takes into account the time value of money and provides an estimate of the company's net present value (NPV).

Asset-based valuation : This method consists in valuing the company's assets, such as real estate, equipment, patents, brands, etc. It is mainly used for companies whose value is based primarily on their tangible assets. It is mainly used for companies whose value is based primarily on their tangible assets.

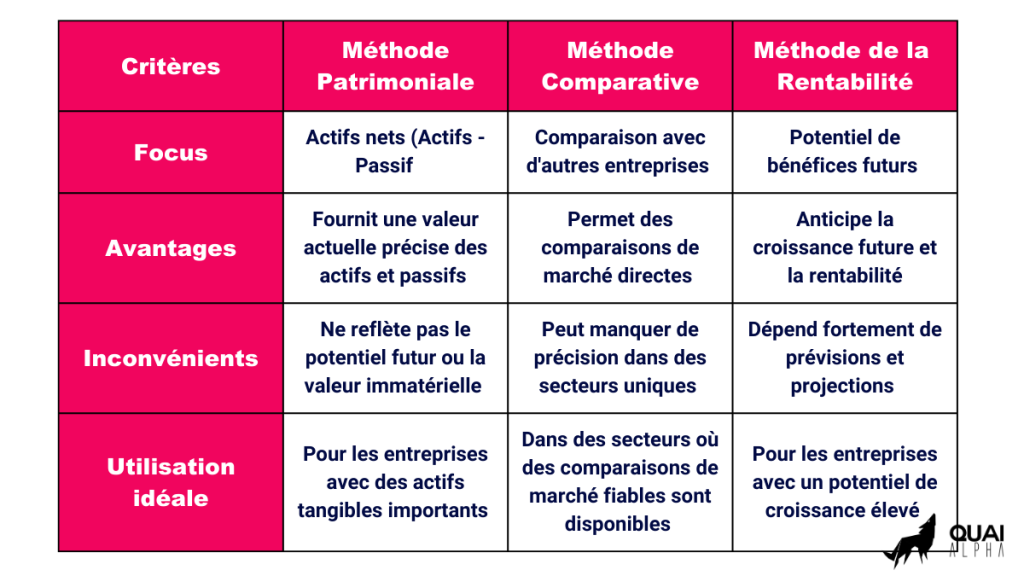

It's important to note that each valuation method has its own advantages and limitations, and that it may be wise to use several approaches in order to obtain an overall view of the company's value. It is therefore advisable to call in business valuation experts to carry out a thorough and objective analysis.

Why evaluate a company?

The valuation of a company is of major interest in the field of financial news. This is because.., understand and analyze a company's financial health is essential for investors, shareholders and financial professionals.

Evaluation measures performance of a company in terms of profitability, liquidity, solvency and operational efficiency. It provides a global view of a company's strengths and weaknesses, helping decision-makers to make informed decisions.

What's more, company evaluation can also play an important role in the decision-making process of consumers and the general public. For example, when evaluating a company in the environmental sector, this can help consumers choose environmentally-friendly products and services.

Finally, thecompany valuation contributes to transparency and trust in the financial market. Investors need accurate, reliable information to assess investment opportunities and minimize risks.

In short, company valuation is an essential tool in the context of financial news, as it provides a clear picture of a company's economic health, informs financial players and guides consumers in their choices.

In conclusion, business valuation methods have both advantages and disadvantages. The benefits is their ability to provide an objective assessment based on solid financial data. They also enable us to compare different companies and make informed investment or M&A decisions.

However, the disadvantages are also present. Some methods can be complex to implement, requiring specialized technical skills. What's more, some valuations may be based solely on historical data, which may not reflect the company's true future value.

It is therefore important to consider these advantages and disadvantages when choosing a business valuation method. It is preferable to use several complementary methods to obtain an overall view of a company's value. In the final analysis, business valuation remains a complex exercise requiring in-depth analysis and understanding of economic and financial factors.