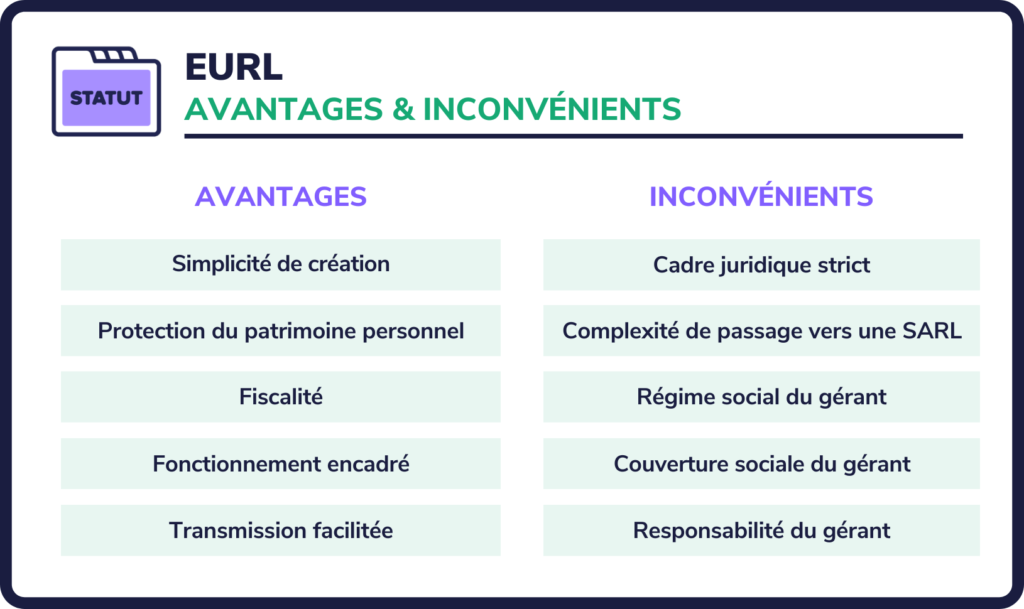

In this article, we take a look at advantages and disadvantages EURL (Entreprise Unipersonnelle à Responsabilité Limitée). We'll analyze the positive aspects, such as the limited liability of the sole director and administrative simplicity, as well as the negative aspects, such as the lack of flexibility in profit-sharing. Find out if EURL is the right legal form for your company!

Investing in your own name or in an SCI for your first rental investment

[arve url="https://www.youtube.com/embed/sX5BbAfSrMU "/]

What are the disadvantages of EURL?

The EURL has a number of disadvantages that need to be taken into account. Firstly, the EURL's limited liability may be perceived as a disadvantage. As a content creator on a news site, you may be faced with lawsuits or disputes related to your work. In an EURL, your liability is limited to the company's share capital, which means you won't be personally liable for the company's debts and obligations. However, this may also limit your ability to obtain financing or loans, as financial institutions may regard this structure as less reliable than other legal forms.

Secondly, administrative and accounting complexity can be an obstacle for content creators.. As the manager of an EURL, you have certain obligations in terms of bookkeeping, tax and social security declarations, which can be time-consuming and require a good knowledge of the regulations. This administrative complexity can therefore be a disadvantage for content creators who wish to concentrate primarily on their article-writing activity.

In addition, the EURL can present constraints in terms of flexibility in managing the business.. Unlike partnerships or auto-entreprises, where partners or the sole proprietor can make decisions quickly and informally, the EURL is subject to more formal rules of governance. Important decisions must be taken at the annual meeting of partners, and recorded in minutes. This can limit your ability to make decisions quickly and adapt to market changes.

Finally, it's worth noting that these disadvantages can be mitigated by calling on competent professionals, such as a chartered accountant or a business lawyer, to help you manage your EURL and ensure administrative and legal compliance.

It's important to weigh up the advantages and disadvantages of the EURL before choosing this legal form for your news site. We recommend that you consult a specialist advisor to make an informed decision.

Why create an EURL?

There are many advantages to creating an EURL (Entreprise Unipersonnelle à Responsabilité Limitée) for a news website:

1. Protection of personal assets : By creating an EURL, you separate your personal liability from that of the company. This means that your personal assets will not be affected in the event of financial difficulties or litigation relating to your news site.

2. Ease of management : As sole manager of an EURL, you have total control over the management of your business. You can make decisions quickly and efficiently, without having to consult or obtain the approval of other partners.

3. Tax benefits : EURL profits may be subject to income tax (IR) or corporation tax (IS), depending on the choice you make when you set up the company. This means you can opt for the tax system that's most advantageous for you.

4. Increased credibility : Creating an EURL gives you a more professional and credible image in the eyes of your customers, partners and suppliers. This can facilitate business relations and help you attract new investors if necessary.

5. Development potential : If you want to expand your news site in the future, you can transform your EURL into a SARL (Société à Responsabilité Limitée) by adding new partners. This allows you to open up your capital and benefit from additional financial backing to develop your business.

In short, creating an EURL for a news site offers protection for personal assets, ease of management, advantageous taxation, increased credibility and the possibility of future development.

Why create a EURL rather than a SARL?

Creating an EURL (Entreprise Unipersonnelle à Responsabilité Limitée) rather than a SARL (Société À Responsabilité Limitée) offers certain advantages for a news site. Here are some important points to consider:

Flexible management : As sole owner of an EURL, you have the power to make all decisions concerning the management of the company without having to consult other partners. This means you can react quickly to new developments and adjust your strategy accordingly.

Protecting your personal assets : The EURL legal structure limits your financial liability to the contributions you have made to the company. So, in the event of financial problems or litigation, your personal assets are protected.

Easy to create : Creating an EURL is generally simpler and less costly than setting up a SARL. You can get your news site business off the ground quickly, without excessive administrative hassle.

Tax benefits : As the manager of an EURL, you can opt for income tax. This means that the profits generated by your company will be added to your personal income, and will be subject to the progressive income tax scale. This can be advantageous if you're in a lower tax bracket than for corporate income tax.

However, it should be noted that every situation is unique, and the decision to set up an EURL or SARL will depend on your specific objectives and the advice of a qualified professional. It is advisable to consult a chartered accountant or a lawyer specialized in corporate law to help you make the decision best suited to your situation.

Why EURL rather than SASU?

The reason I'd opt for an EURL rather than an SASU in the context of a news site is linked to the structure and flexibility offered by the EURL legal form.

EURL (Entreprise Unipersonnelle à Responsabilité Limitée) is a limited liability company that allows a single person (the sole partner) to manage and operate the business. It offers a clear separation between the personal assets of the sole partner and those of the business, protecting the partner's personal assets in the event of financial difficulties.

In the context of a news site, it may be wise to choose the EURL for several reasons:

Limited liability : With EURL, the sole shareholder is liable only up to the amount of his or her capital contributions. This means that if problems arise, such as lawsuits or debts, creditors cannot seize the sole shareholder's personal assets.

Flexible management : As sole shareholder, you have total control over the management of the company. You can make decisions quickly and efficiently, without the need to consult other shareholders or partners.

Corporate income tax : By opting for EURL, you can choose to be taxed under the corporate income tax system. This can be fiscally advantageous, especially if you plan to reinvest part of the profits in your business.

However, it's important to note that the choice between an EURL and an SASU will depend on your specific needs and personal situation. It may be wise to consult a corporate lawyer for personalized advice before making a final decision.

In conclusion, EURLs (Entreprises Unipersonnelles à Responsabilité Limitée) have both advantages and disadvantages.

On the one hand, the advantages of EURL are numerous. Firstly, the EURL status gives entrepreneurs limited liability, protecting their personal assets in the event of financial difficulties. What's more, the EURL offers great management flexibility, giving the sole shareholder total control over decision-making. Finally, from a tax point of view, EURLs can opt for corporate income tax, which can prove advantageous depending on the company's financial situation.

On the other hand, there are a number of disadvantages associated with EURLs. The formation of an EURL requires a minimum share capital, which may represent a financial constraint for some entrepreneurs. What's more, the sole shareholder of an EURL is responsible for all the company's debts, which means taking on a considerable amount of risk. In addition, setting up and managing an EURL can be more complex, and generally requires the involvement of a legal or accounting professional.

In conclusion, the decision to create an EURL should be carefully considered, taking into account the advantages and disadvantages associated with this legal status. It is advisable to consult an expert in order to best assess the relevance of this choice to the entrepreneur's specific situation.