In this article, we take a look at advantages and disadvantages of investment. As a popular financial activity, investing can offer opportunities for financial growth and portfolio diversification. However, it also entails risks such as market volatility and the possibility of financial loss. Understanding these key aspects is essential to making informed investment decisions.

Growth, maturity or decline? Situate a company in 1 minute

[arve url="https://www.youtube.com/embed/kbPSjhfmivE "/]

What are the disadvantages of investing?

There are several disadvantages to this investment:

1. Financial risk : Investing is often associated with a certain level of risk. Financial markets can be volatile, and investors can lose some or all of their capital.

2. Lack of liquidity : Certain types of investment, such as real estate or unlisted shares, can lack liquidity. It can be difficult to sell these assets quickly if cash is urgently needed.

3. Complexity : Some investments, such as complex derivatives, can be difficult for novice investors to understand. A poor understanding of the risks and mechanisms involved can result in substantial losses.

4. Fees and commissions : Investments often come with fees and commissions, such as management fees, brokerage fees and so on. These costs can reduce potential investment returns.

5. Emotional stress : Investing can be emotionally stressful, especially in times of market fluctuations. Investors can be tempted to make impulsive decisions based on their emotions, which can be detrimental to their performance.

It is important to be aware of these drawbacks and to take them into consideration when making investment decisions. We recommend diversifying your portfolio and consulting a professional financial advisor before making any investment decisions.

What are the benefits of investing?

Investing offers many advantages for people interested in managing their finances. Here are some of the main advantages:

1. Capital growth : Investing increases the value of your initial capital. By investing in assets such as stocks, bonds or real estate, you have the opportunity to make long-term profits.

2. Protection against inflation : Investing in assets can help protect your purchasing power against inflation. As the prices of goods and services rise, the value of certain investments tends to follow suit, helping you to maintain your standard of living.

3. Diversification : Investing offers the opportunity to diversify your portfolio. By placing your funds in different asset classes, geographical regions or industrial sectors, you reduce the risk of loss in the event of underperformance of a single investment.

4. Additional income : Certain types of investment, such as stock dividends or property rents, can generate regular additional income. This can be particularly advantageous for retirees or those looking to boost their income.

5. Tax benefits : Certain types of investment offer tax advantages. For example, you can benefit from tax breaks by investing in retirement savings accounts or special investment funds.

6. Financial autonomy : By investing wisely, you can achieve a degree of financial independence. When your investments generate enough income, you can be less dependent on a full-time job or other sources of income.

It is important to note that investing also involves risks, and that it is essential to exercise caution and seek professional advice before making any investment decisions.

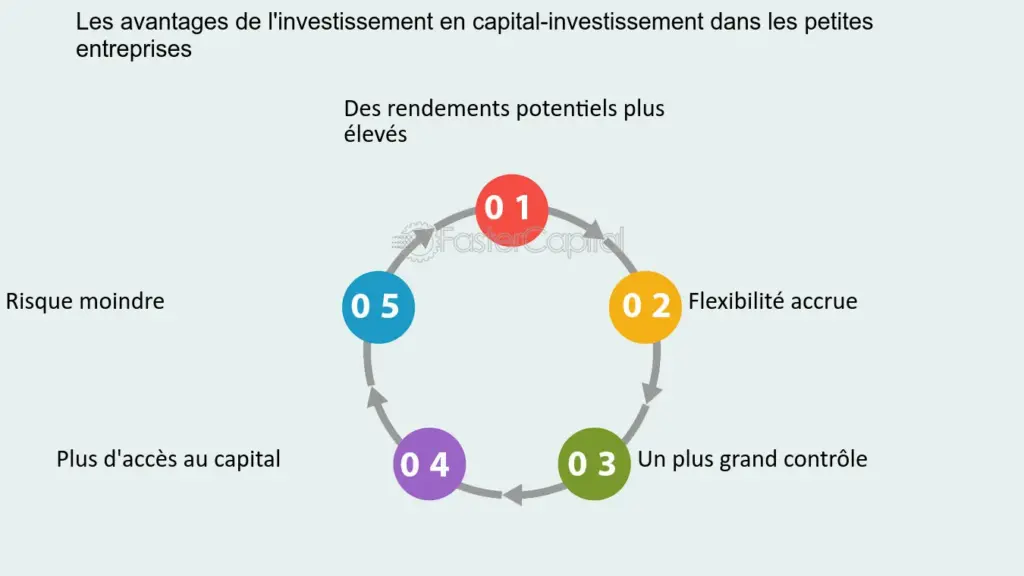

What are the advantages of capital investment for the company?

Capital investment offers many advantages for a company. First and foremostThis enables the company to strengthen its financial structure by increasing its capital. This can be crucial when a company needs additional funds to finance expansion projects, research and development, or to cope with financial difficulties.

In additionCapital investment can bring valuable expertise and advice to business leaders. Investors can share their experience and professional network, which can help the company make strategic decisions and access new opportunities.

In additionThe entry of new investors can strengthen a company's credibility and reputation in the marketplace. This can make it easier to forge business partnerships, win contracts and attract future investors.

FinallyCapital investment can give a company greater financial flexibility. Compared with other forms of financing, such as bank loans, capital investment does not impose periodic repayments and interest charges. This can relieve the financial pressure on the company and give it greater latitude to develop its activities.

It's important to note that capital investment also entails certain responsibilities. Investors become shareholders in the company and may have voting rights, as well as a share in profits. It is therefore essential to choose your investors carefully, and to put in place clear agreements to protect the company's interests.

In conclusion, equity investment offers many advantages to a company, from strengthening its financial structure to benefiting from expertise and a professional network, as well as market credibility and financial flexibility. However, to maximize the benefits of this form of financing, it's important to make informed decisions and manage investor relations properly.

What are the effects of investment?

The investment has many effects, both on the economy and on society in general. Here are some of the main effects of investment:

1. Job creation : Investment enables the creation of new businesses or the expansion of existing ones, which in turn creates jobs. This helps reduce unemployment and stimulates economic growth.

2. Economic growth : Investment plays a key role in economic growth. By increasing an economy's productive capital, it boosts output and income. This stimulates consumption and innovation, and promotes sustainable development.

3. Infrastructure improvements : Investment also helps to improve public infrastructure such as roads, bridges, water and electricity networks. This facilitates the transport of goods and people, promotes trade and improves citizens' quality of life.

4. Innovation and technological development : Investment in research and development (R&D) promotes innovation and technological development. This encourages the emergence of new industries, products and services, and strengthens the competitiveness of companies on national and international markets.

5. Increase in exports : Investment in productive sectors increases a country's export capacity. This strengthens international trade, encourages the inflow of foreign currency and helps reduce the trade deficit.

6. Improved standard of living : Investment can also help improve living standards. By creating jobs, stimulating economic growth and fostering innovation, it raises incomes and improves living conditions.

In short, investment is an essential driver of economic and social development. It plays a key role in job creation, economic growth, innovation, infrastructure improvements and the well-being of populations.

In conclusion, investment has both advantages and disadvantages. On the one hand, it offers the opportunity to grow capital and generate additional income. This can help you achieve your long-term financial goals and build a solid estate. In addition, the investment can offer diversification and protection against inflation.

On the other hand, it's important to consider the risks associated with investing. Market fluctuations can lead to significant financial losses. So it's vital to be well informed and to diversify your investments to reduce risk. What's more, investing requires time, research and regular monitoring to make informed decisions.

In short, investing can be an interesting strategy for growing your capital, but it does entail risks that need to be taken into consideration. It is therefore advisable to consult a financial expert before making any investment decisions.