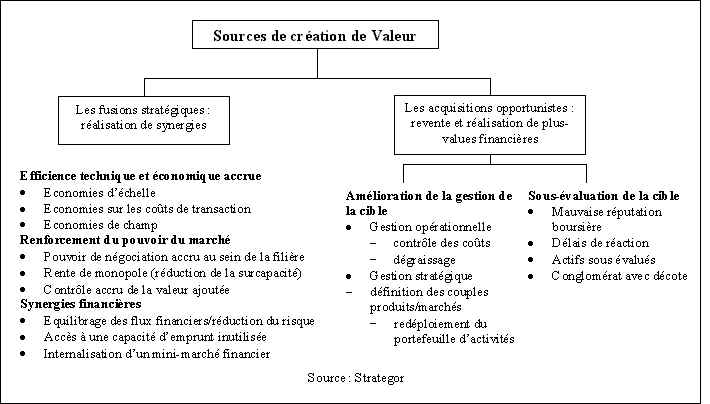

Mergers and acquisitions are a common strategy used by companies to consolidate their activities. While it has advantages such as market expansion and cost reduction, it also has disadvantages such as the loss of the absorbed company's identity and cultural conflicts. It is important for companies to weigh up these aspects carefully before deciding to merge.

REACTORS #4 - Fast breeder and fast breeder reactors

[arve url="https://www.youtube.com/embed/mIKYQ9Boq3Y "/]

What are the disadvantages of the merger?

Merging companies can have certain disadvantages.

1. Loss of identity : When two companies merge, one of the entities may lose its distinct identity. This can create a sense of loss of identity for the company's employees and customers.

2. Different corporate culture : Merged companies may have different corporate cultures. This cultural difference can lead to friction and difficulties in managing teams and work organization.

3. Resistance to change : Employees of merged companies may be reluctant to the idea of change. They may fear the disruption and necessary adjustments to their duties and responsibilities.

4. High initial costs : A merger can involve significant up-front costs, such as legal fees, restructuring costs and costs associated with integrating IT systems. These costs can put financial pressure on the merged company.

5. Risk of losing customers : Some customers may be wary of the merger, fearing changes in commercial policy or service quality. This can lead to a loss of customers for the merged company.

It is important for companies to recognize these disadvantages and put in place appropriate mitigation strategies to overcome the challenges associated with the merger.

What are the advantages and disadvantages of a merger?

The advantages of a merger are as follows:

1. Synergy : A merger makes it possible to combine the resources and skills of both companies, which can lead to greater efficiency and better overall performance.

2. Expansion : By merging, companies can access new markets or expand their presence in existing ones. This can give them a competitive edge and enable them to generate more revenue.

3. Economies of scale : A merger can generate savings by consolidating certain functions or operations. This may include consolidating teams, reducing production costs, or improving process efficiency.

4. Diversification : A merger can enable companies to diversify their activities or products, reducing their dependence on a single market or sector.

The disadvantages of a merger are as follows:

1. Complex integration : Merging two companies can be a long and complex process, requiring careful planning and effective management. Integrating corporate cultures, information systems and processes can be difficult.

2. Internal disturbances : During the merger process, there may be internal disruptions within each company, particularly with regard to employee roles and responsibilities, which can affect productivity and motivation.

3. Financial risks : A merger can be costly, whether in terms of legal fees, consultancy or systems integration. In addition, there is a risk that the merger will not generate the expected results, which can have a negative financial impact on both companies.

4. Concentration of power : By merging, there can be a concentration of power between the managers of the two companies. This can lead to less competition and fewer opportunities for smaller companies in the market.

It's important to note that the pros and cons of a merger can vary according to the specific circumstances of each company and the industry in which it operates.

Why merge?

A merger-absorption is a strategic operation in which one company absorbs another, integrating its activities and resources. It can offer several advantages for a news site:

1. Expanding readership : By merging with another news company, the site can reach a wider audience by combining subscribers and users from both platforms. This can increase the company's visibility and attract new readers.

2. Synergies and complementarity : Mergers combine the strengths of two companies by exploiting their complementary skills. For example, if one company specializes in financial news and the other in sports news, the merger can create a platform offering a wider range of content, which can attract a diverse audience.

3. Economies of scale : By merging, companies can benefit from economies of scale by reducing operational costs. Marketing, technology development and management expenses can be rationalized, which can improve efficiency and increase overall profitability.

4. Access to new resources : Mergers and acquisitions can also give a new site access to new resources, such as talent, technology or financial investment. This can strengthen the company's ability to innovate, adapt to market changes and remain competitive in a constantly evolving sector.

However, it's important to note that M&A can also present challenges, such as cultural integration, resistance to change and human resources management. It is crucial to carry out thorough due diligence before undertaking such an operation, in order to minimize risks and maximize potential benefits.

What are the advantages of M&A?

Mergers & Acquisitions is a strategic operation that consists of combining two distinct companies into a single entity. This practice has several advantages for the companies involved:

1. Accelerated growth : M&A enables a company to grow rapidly by acquiring another existing company. This gives it access to new markets, customers, products or technologies. It's an opportunity for the company to extend its influence and increase its market share.

2. Economies of scale : By merging with another company, certain functions can be streamlined or consolidated, thus achieving economies of scale. For example, administrative, logistics or management departments can be grouped together, reducing costs and improving overall company efficiency.

3. Increase in shareholder value : When a company successfully completes an M&A deal, it can lead to a significant increase in the value of its shares. Investors often see this operation as a sign of future growth and prosperity, which can stimulate demand and lead to a rise in the share price.

4. Geographic expansion : Mergers & Acquisitions can enable a company to expand its geographical presence by acquiring a company already established in a specific region. This facilitates entry into new markets and reduces the risks associated with international expansion.

5. Access to new skills and resources : By merging with another company, you gain access to new skills, talents and resources. This can be particularly advantageous in areas such as research and development, technology or sector expertise.

It's important to note that every M&A deal is unique and carries potential risks. Companies must therefore carry out thorough due diligence to ensure that corporate cultures are compatible, that the merger process is efficiently managed, and that the various entities are successfully integrated.

In conclusion, mergers and acquisitions have both advantages and disadvantages. On the one hand, it enables companies to achieve economies of scale, access new markets and strengthen their market position. It can also facilitate the sharing of resources and skills, thereby fostering innovation and growth. On the other hand, mergers and acquisitions can lead to job cuts, organizational disruption and dilution of shareholder control. In addition, it can lead to a loss of strategic focus and management challenges linked to the integration of the two entities. It is therefore essential for companies to carefully assess the potential costs and benefits before embarking on a merger-absorption transaction. Although this strategy can offer interesting opportunities, it is essential to consider the risks and long-term implications.. Ultimately, the decision to merge or be absorbed must be taken carefully, based on the objectives and specific situation of each company.