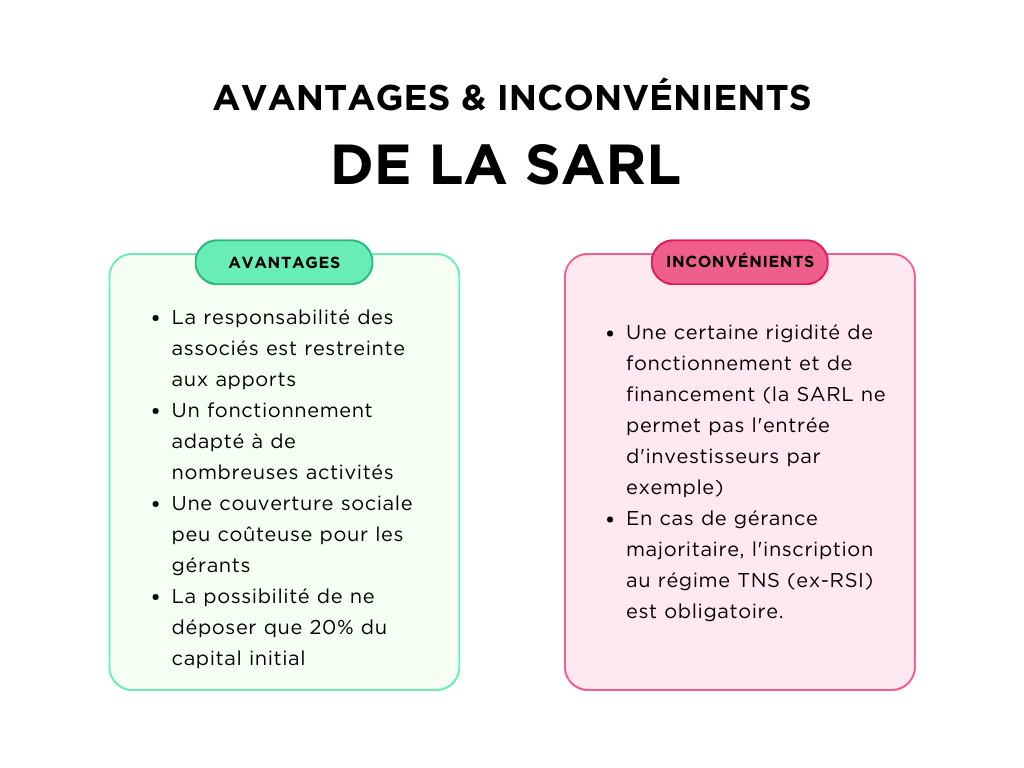

SARLs are a very common legal structure for businesses. They offer several advantages, such as limited liability for partners and ease of management. However, they can sometimes have disadvantages, such as high set-up costs and a certain complexity in their operation. So it's important to weigh up the pros and cons carefully before choosing this type of company for your business.

MICRO - EI - EURL - SASU: what's the best legal status for starting out on your own in 2024?

[arve url="https://www.youtube.com/embed/HEzrVNKYDMQ "/]

What are the disadvantages of an LLC?

The SARL (Société à Responsabilité Limitée) is a very common and popular legal form for small and medium-sized businesses in France. However, it also has certain disadvantages:

1. Limited liability but high costs: The main feature of the SARL is the limited liability of the partners. This means that their liability is limited to the amount of their contributions to the company. However, to set up an SARL, it is necessary to draw up articles of association and call in a notary, which entails high costs.

2. Lack of transparency: Unlike publicly traded companies, LLCs are not required to make their financial information public. This can make it difficult for potential investors or business partners to assess the company's financial health.

3. Limited flexibility: SARLs are subject to strict management and decision-making rules. Partners must follow certain procedures when making important decisions, which can make the decision-making process lengthy and complex.

4. Difficulty getting out of the company: Unlike sole proprietorships, it can be difficult to withdraw from an SARL. Partners must comply with the provisions of the Articles of Association concerning the transfer of shares, which may limit their ability to leave the company.

It's important to note that these disadvantages can vary depending on the specific situation of each company. It is therefore advisable to consult a business law expert for personalized advice before choosing your company's legal form.

What are the advantages of the SARL?

A limited liability company (SARL) offers many advantages for a news site.

1. Limited liability : One of the main advantages of the SARL is the limited liability of the partners. This means that the company's debts and obligations are limited to the amount of share capital contributed by the partners. The partners are therefore not personally liable for the company's debts, which protects their personal assets.

2. Easy to create : Setting up an SARL is relatively quick and easy. All you have to do is draw up the articles of association, appoint a manager and file the registration form with the Trade and Companies Registry. This simplicity saves time and resources during the company formation process.

3. Flexible management : The SARL offers great flexibility in the management of the company. The partners are free to set the company's operating rules in the Articles of Association. They can also decide on the distribution of powers and profits among the partners, enabling the company structure to be adapted to the specific needs of the news site.

4. Tax benefits : SARLs generally benefit from an advantageous tax regime. Profits made by the company are subject to corporation tax (impôt sur les sociétés - IS) at a reduced rate, which can help reduce the tax burden compared with other legal forms. In addition, certain specific tax regimes may apply to press companies, which may result in additional tax benefits.

5. Credibilidad y acceso a financiamiento : The SARL is a recognized and well-established legal form in France, which can give a news site added credibility with business partners and investors. What's more, the SARL structure allows access to various sources of financing, such as bank loans or the contribution of new partners.

In conclusion, the SARL offers many advantages for a news site, including limited liability, ease of creation, management flexibility, tax benefits and access to financing. This legal form protects partners, optimizes company management and offers attractive tax benefits.

What are the advantages and disadvantages of an EURL?

Advantages of a EURL :

1. Limited liability : One of the main advantages of an EURL (Entreprise Unipersonnelle à Responsabilité Limitée) is that the liability of the sole shareholder is limited to the amount of his or her contribution to the company's share capital. This means that the company's debts cannot be charged against the partner's personal assets.

2. Administrative simplicity : Setting up and running an EURL is relatively straightforward compared with other legal forms of business. Administrative formalities are reduced, and there's no need to draw up complex articles of association.

3. Flexibility in profit distribution : The sole shareholder of an EURL is free to determine the distribution of profits, which can be advantageous for optimizing personal taxation.

4. Tax treatment : EURL profits are subject to income tax as industrial and commercial profits (BIC) or non-commercial profits (BNC), depending on the company's activity. This often results in lower taxation than companies subject to corporate income tax.

Disadvantages of an EURL :

1. Organizational rigidity : As a sole partner, you'll be the sole decision-maker in the company, which can limit decision-making and collaboration with others.

2. Financial responsibility : Although liability is limited, the sole shareholder may be held liable for the company's debts if he or she commits serious mismanagement or incurs personal liability.

3. Additional costs : Setting up an EURL involves administrative costs, such as registering with the RCS (Registre du Commerce et des Sociétés) and publishing annual financial statements.

4. Limiting growth : As an EURL, it can be more difficult to attract new partners or investors, which can limit the company's growth.

It's important to consult a chartered accountant or legal advisor before choosing a legal form for your news site, to assess the advantages and disadvantages specific to your situation.

What are the advantages and disadvantages of the company?

The advantages of a news site business are many. Firstly, it offers the opportunity to share information in real time with a wide audience. This allows users to be constantly informed of the latest news and to stay up to date on important events.

What's more, a news site business can generate revenue through online advertising. By delivering targeted ads to their audience, businesses can earn additional revenue, which can contribute to their growth and development.

Another advantage is the ability to create original, quality content. News site companies are often staffed by experienced journalists and editors who can produce informative, well-written articles. This allows them to stand out from the competition and build audience loyalty.

However, there are also a few drawbacks to consider. First and foremost, competition in the online media world is fierce. There are many other companies that also offer news site services, and it can be difficult to stand out and attract the public's attention.

What's more, managing the veracity of information can be a challenge. With the rise of fake news and misleading information, it's important for news website companies to maintain their credibility by carefully checking their sources and providing accurate, reliable information to their audience.

Finally, the business model of some news site companies can be heavily dependent on online advertisingThis makes them vulnerable to fluctuations in the advertising market. If advertising revenues fall, this can have a negative impact on the company's profitability and viability.

In short, a news site business offers many advantages, such as the ability to share information in real time, generate revenue through online advertising and create original, quality content. However, it must deal with competition, manage the veracity of information and sometimes rely heavily on online advertising.

In conclusion, the SARL has both advantages and disadvantages. On the one hand, it offers a flexible legal structure that's easy to set up, enabling entrepreneurs to benefit from limited liability and tax advantages. In addition, the SARL offers a certain image of stability and credibility in the eyes of business partners and potential investors.

HoweverHowever, there are a number of disadvantages to consider. Firstly, the SARL can be costly to set up and maintain, with administrative costs and accounting obligations. In addition, strategic decisions can be slowed down by the collective decision-making process and regulatory constraints. Finally, the SARL limits the possibility of raising funds, due to restrictions on the transfer of shares.

In a nutshellThe limited liability company (SARL) is an attractive option for many entrepreneurs, offering a degree of legal protection while allowing them to benefit from certain tax advantages. However, it is important to carefully evaluate the costs and constraints associated with this legal form, as well as the specific objectives of the business, before making a decision.