Subrogation is a legal concept with both advantages and disadvantages. Subrogation guarantees repayment of a debtBut it can also lead to a loss of control over the assets or rights concerned. It is therefore essential to understand its implications and weigh up the pros and cons before deciding to use it.

(Note: HTML tags are not visible in the displayed text; they are used to highlight important words)

PAYE Understanding the pay slip in 30 minutes

[arve url="https://www.youtube.com/embed/h6kGa1qdoHg "/]

What is the advantage of subrogation?

Subrogation is a very important concept in insurance. It refers to the transfer of rights and remedies from one person to another. In the context of a news site, the value of subrogation lies in its ability to help insurance companies recover the sums they have paid out to their policyholders.

When a claim occurs and the insurer intervenes to compensate the insured, the latter automatically assigns his rights to the insurer via subrogation. This means that the insurer becomes the holder of the policyholder's rights, and can act on his behalf to recover the sums paid.

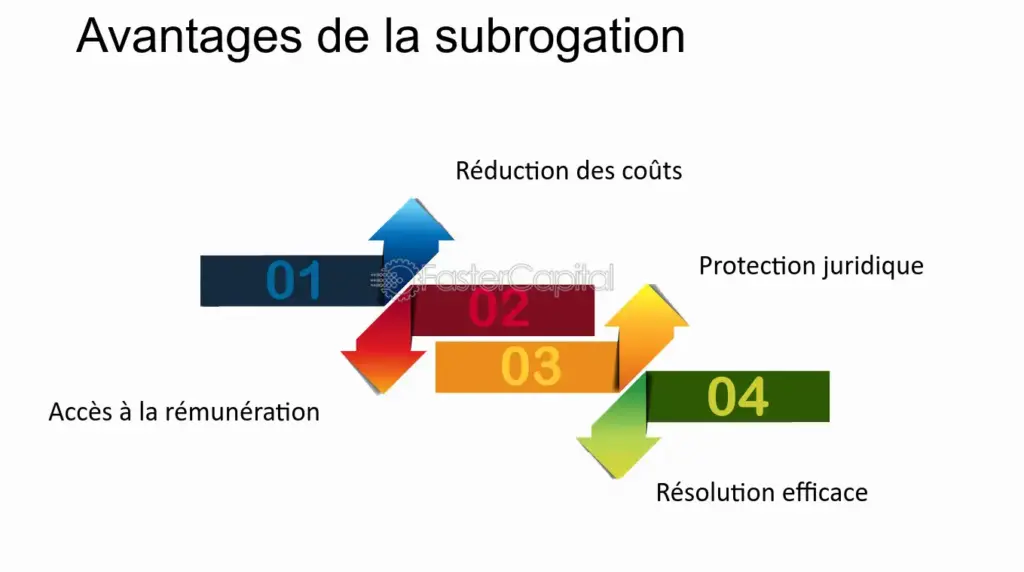

This practice has several advantages for insurance companies:

1. Recovery of funds : Thanks to subrogation, insurance companies can recover the sums they have paid out to their policyholders in the event of a claim. This enables them to limit their financial losses and maintain their economic equilibrium.

2. Pursuing those responsible : Subrogation also enables insurance companies to take legal action on behalf of their policyholders to pursue those responsible for the loss. In this way, they can take legal action to obtain compensation and recover the sums paid out.

3. Fraud prevention : Subrogation is also an effective tool in the fight against insurance fraud. With control over the policyholder's rights, insurance companies can conduct in-depth investigations to detect any fraud and take the necessary action.

In short, subrogation is a mechanism that enables insurance companies to recover sums paid to their policyholders in the event of a claim. This practice offers financial, legal and preventive advantages, making it an essential tool in risk management.

Why is my employer requesting subrogation?

Subrogation is a common request from employers for a variety of reasons. Subrogation may be requested by an employer when it wishes to manage employee benefits more efficiently. In practice, this means that the employer wishes to recover the funds paid by social security or any other insurance organization for an employee who has benefited from sick leave or compensation following a work-related accident.

This request for subrogation allows the employer to be reimbursed for the sums advanced by the social security or insurer, thus limiting its costs. This can be particularly interesting for employers who have to manage a large number of sick days or work-related accidents.

However, it is important to note that subrogation is not applicable in all cases, and that certain conditions must be met. For example, the employer must inform the employee of his request for subrogation and obtain his prior agreement. In addition, subrogation may be refused if the employee demonstrates financial precariousness, or if the sums requested by the employer are deemed excessive.

In short, subrogation is a frequent request from employers, enabling them to recover sums advanced by social security or the insurer for employees on sick leave or receiving compensation following work-related accidents. This practice enables the employer to limit costs, but conditions must be met and the employee's agreement is required.

What's the difference between salary continuation and subrogation?

Salary maintenance and subrogation are two terms commonly used in the French health insurance industry.

Salary continuation refers to the fact that an employer continues to pay all or part of the salary of an employee who is off sick. This means that the employee suffers no financial loss during his or her absence due to illness. Salary continuation is generally provided for in the collective or company agreement.

Subrogation, on the other hand, is a mechanism whereby the insurer takes over payment of daily social security benefits from the employer during the employee's sick leave. This means that the employer does not have to pay the daily benefits directly to the employee, but rather to the insurer, who takes his place. Subrogation enables the insurer to recover the amount of daily benefits paid from the social security system.

In short, salary continuation is the direct payment of salary by the employer during sick leave, while subrogation means that the insurer takes over the payment of daily social security benefits from the employer.

Note that these terms may vary slightly depending on the context and specific features of each insurance contract or company agreement. It is therefore important to refer to the corresponding official documents for precise information.

How long does subrogation last?

The duration of subrogation may vary according to various factors. In the context of a news site, it is important to emphasize that the duration of subrogation is determined by the terms of the contract drawn up between the parties concerned.

In general, subrogation can be temporary or permanent. A temporary subrogation is often used in specific cases and has a predetermined duration, usually indicated in the contract. On the other hand, a permanent subrogation is valid until it is cancelled or modified by the parties involved.

It is essential to note that each subrogation situation may be unique, which means that the duration may vary considerably depending on the particular circumstances. It is therefore advisable to consult official documents and information provided by the parties concerned to obtain an accurate estimate of the duration of subrogation in a given case.

In short, the duration of subrogation is determined by the terms of the contract, whether temporary or permanent, and may vary according to the specific circumstances of each case.

In conclusion, subrogation has both advantages and disadvantages.

On one side, subrogation offers a fast, efficient solution for recovering lost funds or property. It enables rights to be transferred from one person to another, facilitating repayment or restitution procedures. In addition, it enables the parties involved to avoid lengthy and costly litigation by offering an alternative out-of-court settlement.

On the other hand, subrogation can be complex and generate conflicts of interest. It often involves several parties, which can make procedures more difficult to manage. What's more, subrogation can lead to conflicts between the insured and the insurer, particularly when it comes to determining who is responsible for the damage caused.

It is important to consider the specifics of each situation to determine whether subrogation is the best option. In some cases, it may be preferable to opt for other solutions, such as negotiation or arbitration.

In the end, subrogation can be an invaluable tool for individuals and companies seeking to recover what is legally due to them. However, it requires a good understanding of the legal mechanisms and a thorough analysis of the advantages and disadvantages associated with this procedure.

It is therefore essential to seek information and advice from competent professionals before considering subrogation.. This will enable you to make an informed choice and optimize your chances of success in recovering funds or assets.