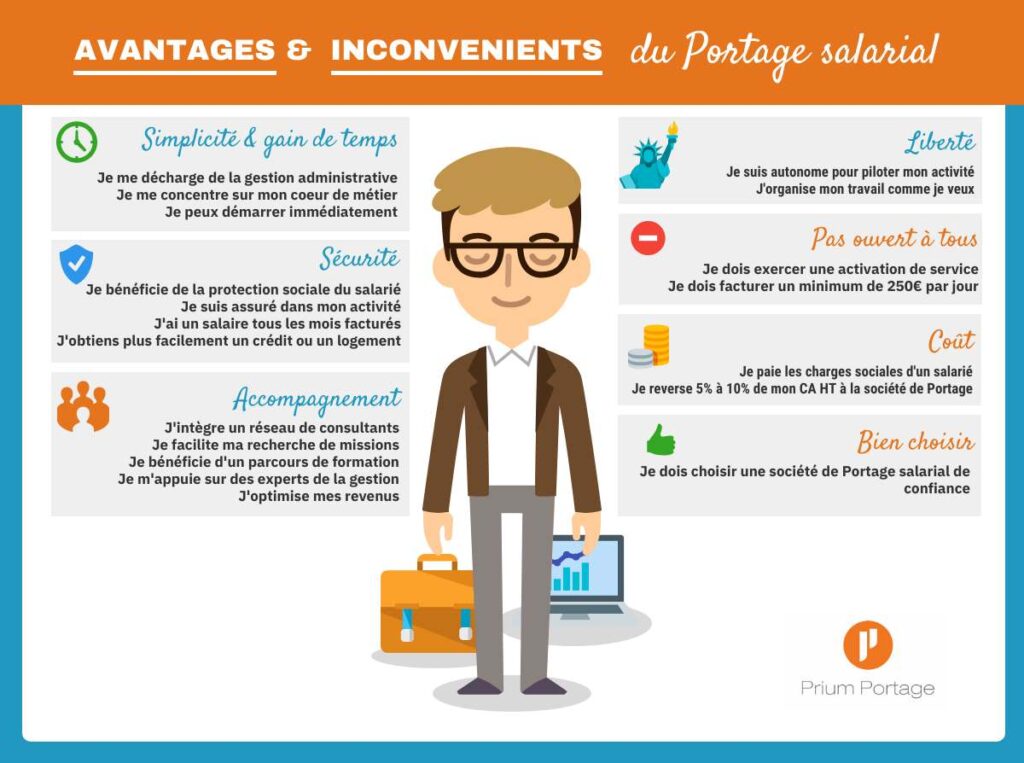

The status of "portage salarial offers many advantages for the self-employed. They benefit from social security and legal protection, while retaining a degree of freedom and flexibility in their work. However, it also has its drawbacks, such as high management costs and dependence on the "portage" company. It is therefore essential to weigh up the pros and cons carefully before opting for this status.

Why choose a microenterprise?

[arve url="https://www.youtube.com/embed/XkbRe70a7d8″/]

What are the disadvantages of freelance administration?

There are a number of disadvantages to freelance administration that are important to bear in mind. Here are some of the main ones:

1. High cost : Freelance administration generally entails significant costs, as the administration companies deduct a commission from the self-employed worker's sales. This reduces the net remuneration received by the freelancer.

2. Administrative constraints : The status of ported employee requires certain additional formalities and administrative procedures, which can be restrictive for some. There are also tax and social security obligations, which can be more complex than those of a conventional self-employed worker.

3. Lack of financial stability : As a ported employee, you have to constantly find new contracts to ensure a regular income. Unlike traditional salaried employment, there is no guarantee of long-term financial stability.

4. Contractual requirements : Some client companies may impose strict contractual conditions on ported employees, which can limit their freedom and autonomy in carrying out their business.

5. Limitations on social protection : Ported employees may not benefit from certain social protections, such as unemployment insurance or compulsory supplementary pension schemes. It is therefore important to take these aspects into account when comparing with other professional statuses.

It is important to consider these disadvantages of freelance administration in order to make an informed decision as to which professional status is best suited to your needs and objectives.

What are the advantages of freelance administration?

Freelance administration offers many advantages for the self-employed. Here are just a few of them:

1. Social security : Self-employed freelance workers are covered by the social security system. They are affiliated to the general scheme and are therefore eligible for health insurance, old-age pension and provident schemes.

2. Administrative simplification : With freelance administration, you don't have to worry about the administrative and accounting side of your business. This task is handled by the freelance administration company.

3. Employee status : As a salaried employee, self-employed workers have the status of an employee. This gives them better social protection and a degree of financial stability.

4. Billing and payment management : The "société de portage" takes care of invoicing the services provided by the freelancer, and keeps track of payments. This avoids late payments and the hassle of financial management.

5. Access to training : Portage salarial freelancers have access to professional training. This enables them to develop their skills and improve their employability.

6. Freedom and autonomy: Despite their employee status, freelance workers retain their freedom and autonomy in their choice of assignments and clients.

In short, freelance administration offers an attractive alternative to the self-employed, providing social security, simplified administration, employee status, easier billing management, training and a certain amount of freedom.

How to optimize your freelance salary?

Portage salarial is a form of employment that allows you to enjoy the benefits of salaried status while retaining a degree of independence and autonomy in your work. If you work on a freelance basis and would like to optimize your salary, here are a few tips:

1. Negotiate your average daily rate : When you sign a freelance administration contract with a freelance administration company, you must set your average daily rate (ADR). Make sure you negotiate a fair and competitive A.D.R. based on your experience and the market.

2. Maximize your working time : With freelance administration, your remuneration depends on your activity. The more you work, the more you earn. Try to optimize your schedule to increase your availability and maximize your billable hours.

3. Diversify your customers : Working with just one client can be risky in freelance administration, because if you lose that client, you also lose your income. Try to diversify your clients and work with several companies to reduce risk and increase your income opportunities.

4. Improve your skills : The more competent you are in your field, the more attractive and better-paid your assignments. Invest in your professional development by taking training courses, obtaining certifications and keeping up to date with the latest trends in your sector.

5. Manage your finances efficiently : As a ported employee, you have to manage your own social security contributions, taxes and professional expenses. Make sure you have a good understanding of these financial aspects, and keep regular track of your expenses and income to optimize your tax situation.

By following these tips, you'll be able to optimize your freelance salary and make the most of the advantages of this status. And don't forget to check out the latest news and websites specializing in freelance administration to keep up to date with the latest developments and opportunities in this field.

How much does freelance administration cost?

The cost of freelance administration depends on several factors important. First of all, you need to take into account the management fees charged by the freelance administration company. These fees generally cover administration, contract management, payment tracking and so on. They can vary from one company to another, but are generally between 5% and 10% of the sales generated by the freelancer.

Then there are the social security costs. Ported employees must pay their social security contributions, which are calculated on the basis of their sales and family situation. These contributions include social charges (social security, unemployment insurance, pension, etc.) and the continuing professional education contribution.

Last but not least, you'll need to factor in bank management fees. To work as a "portage salarial", the employee must open a bank account dedicated to his or her activity. Account management fees may apply.

To sum up, the total cost of a "portage salarial" arrangement includes the management fees of the "portage" company, social security contributions and bank management fees. These costs can vary according to a number of parameters, so it's advisable to contact the portage companies for more precise information.

In conclusion, the status of "portage salarial" has both advantages and disadvantages.

On the benefits side, it offers a high degree of flexibility and autonomy to freelancers who wish to pursue their professional activity while benefiting from social security and legal protection. What's more, freelancers can concentrate on their core business without having to worry about administrative and accounting tasks, which are taken care of by the "portage salarial" company.

However, freelance administration also has its drawbacks. It involves fairly high management fees, as well as a commission rate deducted from the freelancer's sales. What's more, some professionals may find it frustrating not to be able to invoice their clients directly, and to be subject to the contracts signed with the freelance administration company.

Ultimately, it's important for each individual to weigh up the pros and cons, and make a decision based on his or her own needs and professional situation. Whether you choose freelance administration or another form of self-employment, it's essential to have a clear vision of your objectives and to take into account all the aspects linked to your professional activity.