In this review article, we look atadvantages and disadvantages universal gift. This practice raises questions about theequitable distribution of goods, but also offers the possibility ofminimize future conflicts and facilitatesimplification of inheritance procedures. Discover the arguments for and against this form of donation and form your own opinion on this controversial subject.

10 things NEVER to do in Clash of Clans! ☠️⚠️

[arve url="https://www.youtube.com/embed/Gk3JBTDYQGw "/]

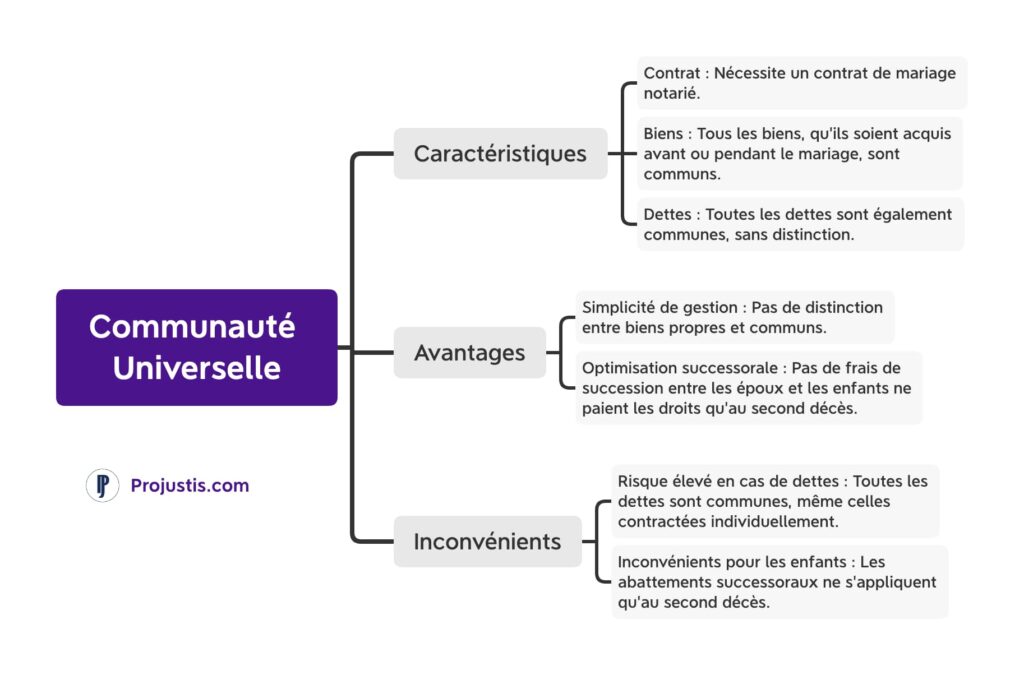

What are the disadvantages of the universal community system?

The regime of universal community of property is a matrimonial regime with certain disadvantages.

1. Joint and several liability for debts : Under this system, both spouses are jointly and severally liable for the debts incurred by one of them, even if these debts were incurred before the marriage. This means that if one spouse accumulates significant debts, the other spouse may be held responsible for repaying them.

2. Management of own assets : Under the universal community property regime, all assets acquired before the marriage, or received by gift or inheritance, remain private property and do not form part of the community. However, it can be difficult to prove the origin of assets and distinguish them from those acquired during the marriage. This can lead to conflicts when it comes to dividing assets in the event of divorce or death.

3. Freedom to dispose of property : Under this system, each spouse is free to dispose of his or her own property, without the agreement of the other spouse. This can cause problems, particularly in cases of reckless spending or concealment of assets.

4. Protecting the surviving spouse : In the event of the death of a spouse, the universal community of property regime can cause difficulties for the surviving spouse. The surviving spouse may be left with a limited share of the community, particularly if the deceased's own assets are substantial.

In conclusion, although the regime of universal community of property has certain advantages, it also has disadvantages that should be taken into account before adopting it.

How does an estate with a universal gift work?

When an inheritance is made with a universal gift, the deceased's entire estate is transferred to a single heir. There is therefore no division between different beneficiaries. With this form of gift, the beneficiary receives all the deceased's assets and debts.

The universal gift is often used when the deceased wishes to favor a particular heir and pass on all his assets. However, it is important to note that this option can have significant financial consequences for the beneficiary if the deceased's estate includes debts.

To create an estate with a universal gift, it is necessary to draw up a will that complies with current legal requirements. It is advisable to consult a notary to ensure that the document is valid and complies with the law.

In conclusion, an inheritance with a universal gift enables the entire estate to be passed on to a single heir. However, it is essential to consider the potential financial consequences, particularly with regard to the deceased's debts.

Why make a universal gift?

Universal donationalso known as universal basic income, is a proposal that is attracting growing interest in many countries.

What is a universal gift? It's a system in which every citizen receives a regular income, whether rich or poor, without any preconditions. It is a financial allocation designed to guarantee all individuals an economic base sufficient to cover their basic needs.

Why make a universal gift? There are several arguments in favor of this proposal. Firstly, it would reduce poverty and social inequality. By offering everyone a basic income, the most disadvantaged people would be able to meet their basic needs, thus helping to combat precariousness.

In addition, universal donation could simplify social benefit systems and reduce administrative costs. By replacing multiple existing benefits with a single one, the system would be more transparent and less complex to manage.

In addition, universal giving could encourage innovation and creativity. By providing an economic safety net, individuals would be more inclined to take risks and explore new professional opportunities. This could stimulate entrepreneurship and encourage innovation.

It should be noted, however, that the introduction of a universal gift also raises questions and challenges. Some fear that it would encourage laziness and discourage job-seeking. Others point to the high costs associated with such a measure, and wonder how it could be financed on a sustainable basis.

Ultimately, universal donation is a concept that is ripe for debate and exploration. Many countries have already set up pilot projects to assess its effectiveness and potential impact. There is still much research and discussion to be done before we can conclude on the pros and cons of this proposal.

How much does a universal gift cost?

The price of a universal gift is a complex and hotly debated topic in society. There is no single answer to this question, as opinions on the amount and implications of such a measure vary considerably.

Universal donation is a proposal to give every individual an unconditional basic income, regardless of their economic situation or employment. Some argue that this could help reduce poverty, stimulate the economy and guarantee human dignity for all.

However, There are also concerns about the financial cost of implementing such a measure. Some feel it would require significant funding from taxes or other public revenue sources. Others worry about possible negative effects on work motivation and the economy as a whole.

In a nutshell, there is no consensus on the price of a universal gift. It's a complex debate that requires in-depth analysis of the economic and social implications.

In conclusion, the universal gift has both advantages and disadvantages. On the one hand, it offers a fairer solution, guaranteeing an equal distribution of wealth and combating economic inequality. It also simplifies inheritance procedures and avoids inheritance-related family conflicts. In addition, it fosters intergenerational solidarity by encouraging mutual support between family members.

HoweverHowever, there are a number of potential drawbacks. Universal gifting can discourage wealth accumulation and entrepreneurship, as individuals may feel less motivated to work hard and invest if they know their wealth will be redistributed equally after their death. Moreover, it may be perceived as unfair by some individuals who feel they have worked harder or taken more risks to obtain their wealth.

At the end of the dayThe universal gift is a complex concept with many different implications. It is important to take into account the specificities of each situation and the personal values of each individual. A balanced approach could be to promote greater solidarity while taking into account the need to preserve economic incentives and individual will.