In this article, we'll look at the advantages and disadvantages of step loans. The loans notPayday loans, also known as payday loans or cash advances, offer a quick solution to urgent financial problems. However, these loans can also lead to high interest rates and debt cycles that are difficult to overcome. We'll take a look at the positive and negative aspects of this rapid form of credit to better understand how it works.

Car purchase : Leasing vs Credit vs Cash - The most profitable | Personal Finance

[arve url="https://www.youtube.com/embed/orF-unaGLb0″/]

What are the advantages of a pas loan?

The pas loan, also known as the zero-rate loan, offers several advantages for borrowers. Here are some of the main advantages:

1. No interest to repay: The pas loan is an interest-free loan, meaning that the borrower pays only the amount borrowed, with no additional interest charges.

2. Additional amount : The pas loan enables borrowers to obtain an additional amount to finance their real estate project. This amount depends on income and property location.

3. Flexible repayment terms : Repayment of the pas loan can be deferred for a certain period, offering borrowers financial flexibility. What's more, repayment is often made over a longer period than traditional loans, which can reduce monthly payments.

4. Accessibility : The pas loan is aimed at households with modest or intermediate incomes, making it accessible to a larger number of people wishing to buy their own home.

5. Home ownership assistance : The pas loan is designed to facilitate home ownership by offering financial assistance to borrowers who do not have the necessary means to finance their real estate project.

It's important to note that the pas loan is subject to certain conditions and eligibility criteria, which should be checked with the relevant financial organizations or authorities.

Why PAS?

The Safety Support Program, known as PAS, is an important initiative in the context of the news site. It aims to promote safety in our society by providing a platform for users to access crucial information on the latest safety-related news and events.

The main advantage of PAS lies in its ability to :

1. Raising awareness : PAS raises readers' awareness of current safety issues by providing up-to-date, accurate information. Users can thus stay abreast of important developments in their community, enabling them to take appropriate precautions.

2. Inform : With PAS, users have access to a variety of safety news. This includes reports on recent crimes, natural disaster prevention measures, changes in safety regulations, and much more. This information is essential to enable individuals to make informed decisions about their own safety.

3. Communicating : PAS also offers an interactive space where users can share their own safety experiences and advice. This encourages open communication between members of the community, which can help to strengthen collective security.

In conclusion, The Safety Support Program plays a crucial role in promoting safety by providing valuable information, raising user awareness and encouraging communication between members of the community. It's an essential resource for keeping abreast of safety developments and taking the necessary precautions to protect our society.

What is the interest rate on PAS?

The SSP interest rate is set by the banks according to the conditions in force. PASor Prêt à l'Accession Sociale, is a government-subsidized property loan for low-income households wishing to buy their principal residence. The SSP interest rate is often more advantageous than market rates, as it benefits from government guarantees and certain tax advantages. However, interest rates can vary according to the policies of individual banks and real estate market conditions. We therefore recommend that you contact your bank to find out the current interest rate for PAS.

What kind of collateral do I need for a loan?

What kind of collateral do I need for a loan?

In the context of loans, there are several types of collateral that borrowers can offer to lenders. However, it is important to note that a "loan not" does not necessarily require collateral.

A "prêt pas" is a type of loan granted by certain financial organizations, generally to finance the purchase of a principal residence. Unlike other types of property loan, a "prêt pas" does not require a mortgage guarantee, i.e. the property is not used as collateral for the loan.

The advantage of this type of loan is that it enables borrowers who do not have sufficient savings to make a substantial downpayment to become homeowners. However, it also means that lenders are more exposed to risk, as they have no tangible guarantee in the event of non-repayment of the loan.

To compensate for this increased risk, lenders may ask for stricter conditions when granting a "loan not". For example, they may require a higher interest rate, borrower's insurance or additional proof of creditworthiness.

In conclusionA "loan not" does not require collateral in the traditional sense of the term, but lenders can take steps to protect themselves against risk by increasing eligibility criteria and loan conditions.

In conclusion, the loans not have both advantages and disadvantages. On the one hand, they enable people with bad credit or a precarious financial situation to obtain a loan. This can be a temporary solution to urgent financial difficulties. What's more, pas loans bring a degree of flexibility in terms of repayment, with payment options more suited to borrowers.

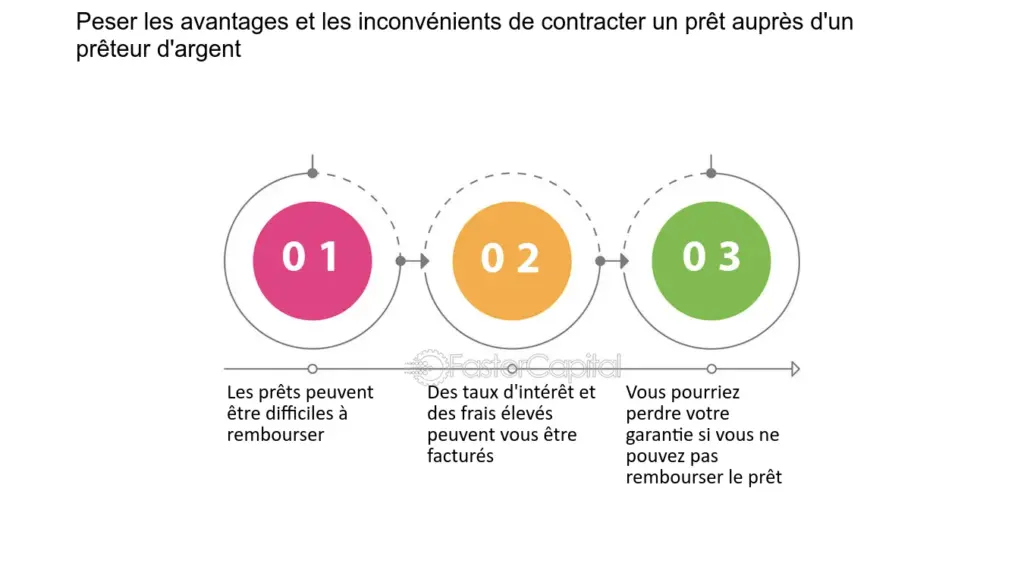

However, it is important to note that loans not are often accompanied by high interest rates, which can make repayment costly over the long term. In addition, borrowers need to be cautious about the companies or organizations offering these loans, as some may be unscrupulous lenders who take advantage of borrowers' predicament.

In short, the loans not may be an option to consider in certain situations, but it's essential to carefully weigh up the pros and cons before committing to this type of loan. It is advisable to research alternatives and consult a financial advisor to determine the best solution for your specific financial situation.