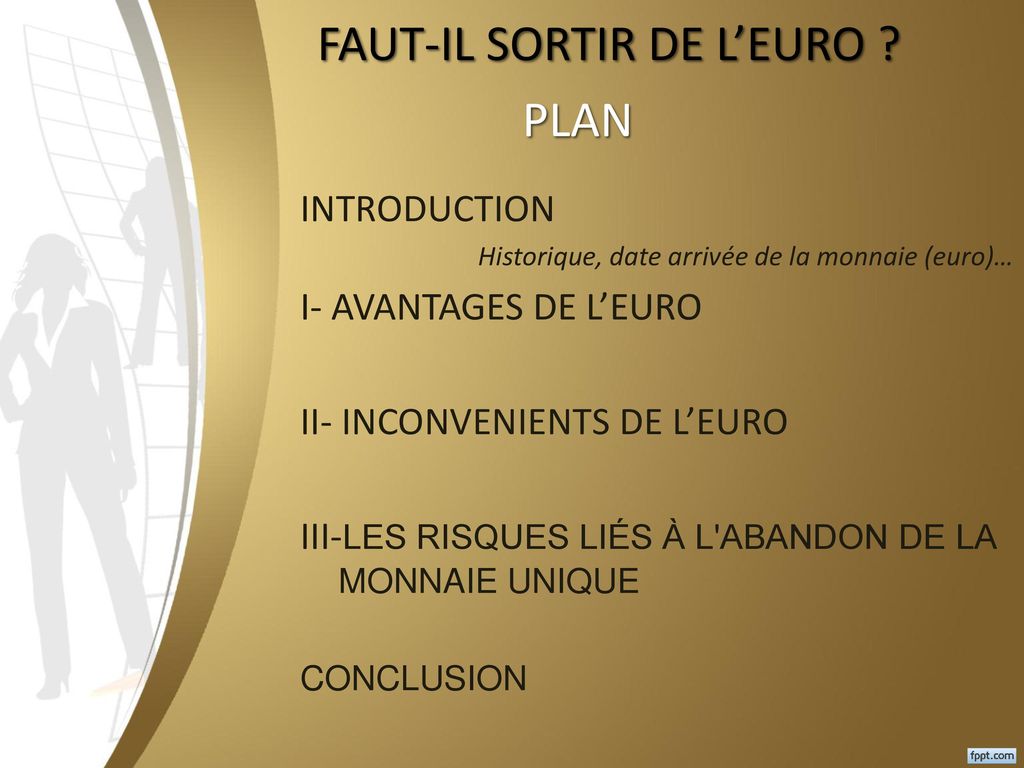

Exiting the euro is a hotly debated topic. Some believe it would bring many economic and political benefits. However, others fear negative consequences that this could entail. In this review, we take a close look at the potential advantages and disadvantages of such an important decision.

What happens if France leaves the EU and the euro?

[arve url="https://www.youtube.com/embed/s7eahRdVboo "/]

What are the disadvantages of the euro?

The euro was adopted by many European Union countries in 1999, with the aim of facilitating trade and unifying economies. However, there are a number of disadvantages associated with using this single currency.

1. Monetary rigidity : One of the main disadvantages of the euro is the loss of monetary flexibility. Each member country of the euro zone cannot individually adjust its monetary policy to meet its specific economic needs. This can lead to difficulties for countries whose economies are less developed or face particular challenges.

2. Loss of sovereignty : By adopting the euro, member countries relinquish part of their monetary sovereignty. The European Central Bank (ECB) takes the political decisions on common monetary policy and interest rates, limiting the ability of national governments to steer their economies autonomously.

3. Asymmetrical economic difficulties : The member countries of the Eurozone have different economies and levels of development, which leads to difficulties when it comes to adopting common economic policies. Some countries may face specific economic problems, such as high unemployment or financial crises, but cannot independently adjust their monetary policies to remedy them.

4. Transition costs : Adopting the euro has required significant investment in terms of updating IT systems, converting prices and training staff. These costs can be considerable for companies and governments alike.

5. Loss of competitiveness : Eurozone member countries share the same currency, which means that the value of the euro is determined by an average of European economies. This can affect the competitiveness of countries with weaker economies, as their currencies cannot be devalued to stimulate exports.

It's important to note that, despite these drawbacks, the euro also offers many advantages, such as ease of transactions and economic stability within the euro zone. Whether the advantages outweigh the disadvantages often depends on the specific economic context of each member country.

What were the expected advantages and disadvantages of the euro?

Expected benefits of the euro:

- The creation of a single currency for several member countries of the European Union (EU) facilitates trade and financial exchanges, reducing currency conversion costs and promoting economic integration.

- The euro reinforces monetary stability by avoiding excessive exchange rate variations between member countries, thus helping to reduce the risks associated with currency fluctuations.

- It improves price transparency and makes it easier to compare products and services across euro zone countries, stimulating competition and encouraging lower prices.

- The euro also strengthens Europe's international role as an economic power, offering a credible alternative to the US dollar on international markets.

Expected disadvantages of the euro:

- Some countries have had to submit to a single monetary policy, which limits their ability to adjust their interest rates and monetary policy to their specific economic situation.

- The abolition of exchange rates can also lead to a loss of autonomy for national economic policies, as governments can no longer devalue their currencies to stimulate exports or mitigate economic shocks.

- The introduction of the euro also required strict economic convergence criteria, which sometimes led to austerity policies and unpopular structural reforms in certain countries.

- Finally, the introduction of the euro has also made some goods and services more expensive in certain countries, particularly those with lower inflation than the eurozone average.

What are the advantages of the euro?

The euro offers several important advantages in the economic and financial context.

First and foremost, the euro facilitates trade within the euro zone. Member countries use the same currency, eliminating exchange costs and reducing the risks associated with exchange rate fluctuations. The result is greater economic integration and increased trade flows between euro zone countries.

Secondly, the euro reinforces monetary stability. Before the introduction of the euro, some European countries regularly experienced currency crises and devaluations. With the euro, these risks are considerably reduced, fostering a more stable economic environment for businesses and consumers alike.

In addition, the euro strengthens the credibility of the eurozone on international financial markets. As the world's second reserve currency after the US dollar, the euro plays a major role in international transactions and investments. This gives the euro zone greater visibility and economic and political influence.

Finally, the euro facilitates travel within the euro zone. Citizens of member countries can use the same currency in all euro zone countries, simplifying transactions and avoiding exchange costs when traveling.

In short, the euro offers significant advantages in terms of trade facilitation, monetary stability, international credibility and ease of travel within the euro zone.

What are the consequences of the euro's decline?

The euro's decline can have several important consequences. First and foremost, A depreciation of the single European currency can boost exports from eurozone countries, making their products cheaper for foreign buyers. This can boost the competitiveness of European companies on international markets.

Next, A falling euro can also encourage tourism in Europe. Foreign travelers will find their expenses less expensive, and will therefore tend to visit more eurozone countries, stimulating the local economy and creating jobs in the tourism sector.

However, there are also negative consequences to consider. A fall in the euro can lead to higher import prices, as goods and services from outside the eurozone become more expensive. This can translate into higher costs for companies and pressure on inflation.

What's more, A devaluation of the euro may also attract the attention of foreign investors looking for cheap buying opportunities. This can lead to financial speculation and increased volatility on the financial markets, which can be detrimental to the European economy.

In conclusion, While the euro's decline may bring benefits for exports and tourism, it can also lead to higher import costs and financial instability. It is essential for political and economic leaders to keep a close eye on these developments and take appropriate measures to minimize any potential negative effects.

In conclusion, leaving the euro presents both advantages and disadvantages. On the one hand, this would enable a country to regain monetary sovereignty and control over its economic policy. Countries leaving the euro could devalue their currencies, potentially boosting their exports and making their products more competitive on the international market. What's more, they could adjust their monetary policy to suit their own economic needs.

On the other hand, leaving the euro could lead to high exchange rate volatility, which would be detrimental to companies that depend on imports and exports. Moreover, it could also disrupt European financial markets, which would have a negative impact on the global economy. It is important to note that the introduction of a new currency and the transition to a new monetary system would take time and considerable effort.

Ultimately, the decision to leave the euro is a complex one, and needs to be carefully weighed up.. The potential advantages must be weighed against the disadvantages and risks associated with such a move. A thorough analysis of the economic, political and social consequences is necessary before taking such an important decision for the country's future.