In this review article, we'll take a look at the Berkus valuation method, a commonly used approach to evaluating startups. We will review the advantages and disadvantages of this method to determine its effectiveness in the evaluation process of emerging companies. It is essential to understand the different perspectives and limitations of the Berkus method. to make informed decisions when investing in startups.

Valuation for startups in the seed phase (3 rules to know)

[arve url="https://www.youtube.com/embed/tjLwP9G9XgA "/]

What are the different valuation methods?

There are several evaluation methods for news sites:

1. Quantitative evaluation : This method is based on measurable criteria such as number of visitors, bounce rate, time spent on the site, clicks on articles, etc. This data is used to analyze the popularity and attractiveness of the site.

2. Qualitative assessment : This method focuses on the quality of the content offered by the news site. Articles are assessed for relevance, objectivity, reliability and originality. The analysis can be carried out by experts or specialists in the field concerned.

3. Impact assessment : This method aims to measure the news site's influence on its readers and on society in general. We can measure user engagement on social networks (shares, comments), references or citations in other media, as well as influence on public debates.

4. Assessing user satisfaction: This method involves gathering opinions and feedback from news site users. We can carry out satisfaction surveys, analyze comments left on the site or on social networks, and take into account the opinions expressed to improve the site's content and functionalities.

5. Evaluating advertising performance : This method concerns news sites that generate revenue through advertising. We evaluate the effectiveness of advertising campaigns (click-through rate, conversion rate) and the profitability of advertising spaces.

It's important to combine these different evaluation methods to get a complete picture of a news site's performance.

How to assess the value of a start-up?

Assessing the value of a start-up can be a complex process. However, there are several key elements to take into account when properly valuing a start-up in the context of a news site.

1. Business model: It's essential to carefully examine the start-up's business model. Does it offer an innovative product or service that meets a market need? Does it have a clear competitive advantage? Does it generate revenues and have a solid plan for growth?

2. Team : The founding team plays a crucial role in a start-up's success. Check out the team's background and skills. Do they have relevant experience in the field? Are they capable of managing challenges and growing the business?

3. Traction and growth : Traction and growth are key elements in assessing the value of a start-up. Look at growth metrics, such as number of customers, revenues, active users, etc. The more a start-up has proven itself and shown solid growth potential, the higher its value will be.

4. Market : Analyze the market in which the start-up operates. Is it a fast-growing market? How big is the market and what is its growth potential? A start-up that addresses a buoyant market will generally be worth more.

5. Financing and investors : Examine the start-up's previous funding and investors. If it has managed to attract investment from large venture capital funds or well-known investors, this can also increase its perceived value.

6. Competition : Assess the competition in the start-up's industry. If there is strong competition, this may affect the company's valuation. However, if the start-up has a clear competitive advantage or differentiation, this can work in its favor.

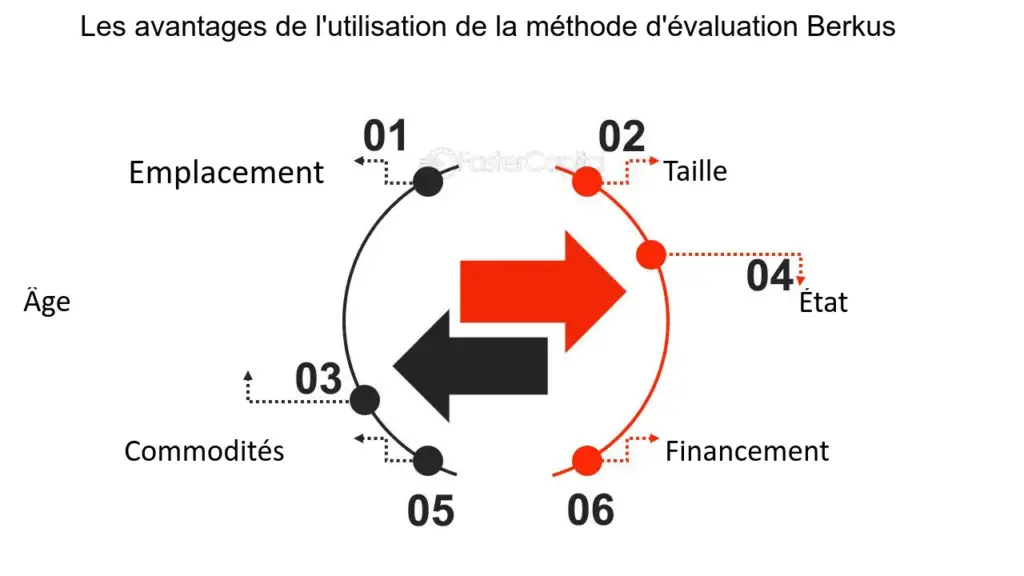

In conclusion, assessing the value of a start-up in the context of a news site requires an in-depth analysis of the business model, team, traction, market, financing and competition. A combination of these elements will provide a better understanding of the start-up's true value.

In conclusion, the Berkus valuation method has several advantages and disadvantages to consider.

On the benefits sideThanks to its approach based on concrete criteria, this method enables projects to be assessed quickly and easily. In addition, it emphasizes the importance of market validation, which can be a strong indicator of a company's success. What's more, the Berkus method offers investors a degree of flexibility, enabling them to adjust the various criteria to suit their own preferences.

However, there are also a number of disadvantages. First of all, the Berkus method can be too simplistic, failing to take into account all the complex and specific aspects of a project. Furthermore, it does not take into account a company's future profitability, focusing solely on its potential valuation. Finally, the use of subjective criteria such as the entrepreneur's experience and passion can lead to a lack of objectivity in the assessment.

It is therefore important to consider these advantages and disadvantages when using the Berkus valuation method. Although it can offer an initial indication of a project's value, it is essential to combine this approach with other, more comprehensive and in-depth methods to obtain a more accurate and reliable valuation.