In this article, we take a look at the pros and cons of EMU according to renowned economist Patrick Artus. Artus highlights the potential economic benefits of a monetary union, such as financial stability and economic integration. However, It also highlights challenges such as the loss of monetary sovereignty and economic imbalances between member countries. We will analyze these arguments to better understand the implications of EMU.

Europe - C'est pas sorcier

[arve url="https://www.youtube.com/embed/c6t10ANgtKQ "/]

Why the euro may burst Artus?

The euro faces many challenges that could lead to its break-up. Here are some potential reasons:

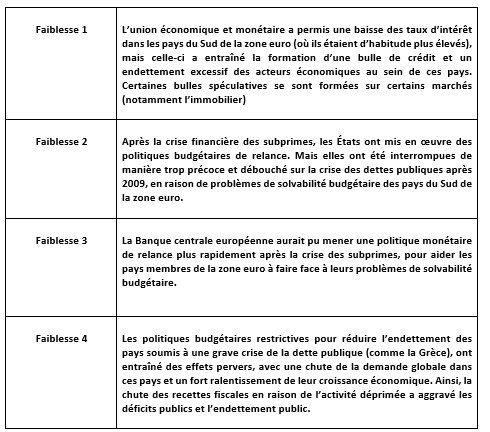

1. Economic divergence : Eurozone member countries have very different economies in terms of productivity, growth and competitiveness. This economic divergence creates tensions within the euro zone and makes it difficult to adopt common policies that suit all countries.

2. Sovereign debt crisis : Some eurozone countries, such as Greece and Italy, have accumulated high levels of public debt. These sovereign debts may become unsustainable, jeopardizing not only the financial stability of these countries, but that of the eurozone as a whole.

3. Lack of political integration : The euro is a common currency used by several countries, but there is no real deep political integration between them. This means that economic and fiscal decisions are taken at national level, which can lead to economic and political imbalances within the euro zone.

4. Political resistance : Some political parties in eurozone member countries are opposed to the very existence of the euro and advocate a return to their national currencies. These political movements are gaining in popularity, which could jeopardize the euro's solidity.

5. Economic crisis : The COVID-19 pandemic led to a deep economic crisis in many eurozone countries. This crisis highlighted the structural weaknesses of the euro zone and rekindled fears of a possible break-up of the single currency.

It is important to note that the break-up of the euro would have major consequences for all eurozone member countries, as well as for the European Union as a whole. It would therefore be essential to take measures to reinforce the stability of the eurozone and promote greater economic and political integration between its members.

Why does Patrick Artus believe that increasing heterogeneity between euro countries is inevitable?

Patrick Artuseconomist and head of research at Natixis, believes that increasing heterogeneity between eurozone countries is inevitable. In his view, this heterogeneity is mainly due to structural differences between the economies of the various euro zone member countries.

Artus points out that some countries have export-led economic models, while others rely more on domestic demand. There are also differences in terms of labor market dynamism, productivity, taxation and regulation. These structural disparities make it difficult to harmonize economic policies, and lead to divergent economic performances between countries.

In addition, Patrick Artus points out that the eurozone's unique monetary policies cannot compensate for these differences. The European Central Bank (ECB) adopts a common monetary policy that cannot be adapted to the specificities of each national economy. As a result, euro member countries face different challenges and have to adjust individually, leading to increased heterogeneity.

Faced with this reality, Patrick Artus considers it essential to find mechanisms for solidarity and cooperation within the eurozone to mitigate the negative effects of increased heterogeneity. This could include budget transfers between countries, risk-sharing mechanisms or closer coordination policies.

In conclusion, according to Patrick Artus, increased heterogeneity between eurozone countries is inevitable, given the structural differences between their economies. However, measures of solidarity and cooperation could be put in place to attenuate these disparities and guarantee the stability and prosperity of the eurozone as a whole.

In conclusion, Patrick Artus highlights both the advantages and disadvantages of Economic and Monetary Union (EMU). On the one hand, he highlights the potential benefits of EMU, such as the elimination of exchange costs, price stability and trade facilitation. These factors can certainly stimulate economic growth and strengthen cohesion between member countries.

On the other hand, Artus also highlights the challenges facing EMU. In particular, he mentions the absence of a monetary policy tailored to each member country, leading to difficulties in adjusting interest rates and fiscal policies to national needs. In addition, he points out that EMU can exacerbate economic divergences between countries and create social tensions.

It is important to note that while EMU has undeniable advantages, it is essential to take these disadvantages into account when assessing its effectiveness and relevance. A balanced and pragmatic approach is needed to maximize the benefits of EMU while mitigating any negative effects.

Ultimately, the question of EMU remains a complex and constantly evolving debate. The advantages and disadvantages must be considered as a whole, taking into account the specific features of each member country. This will promote informed decision-making and enable us to work collectively to continually improve EMU.