The income statement is an essential tool for assessing a company's financial performance. It measures revenues, expenses and profits over a given period. However, it also has its limitations, particularly in terms of data reliability and the inclusion of non-financial items. It is therefore important to understand the advantages and disadvantages of this tool for a complete financial analysis.

Chart of Accounts: 52 Accounts to Learn by Heart (A Survival Kit that will help you)

[arve url="https://www.youtube.com/embed/42onWPEY8Dk "/]

What's the point of an income statement?

A profit and loss statement is an essential tool for news sites, as it measures the company's financial performance over a given period.

Income statement provides a clear view of revenues and expenses related to the production activities of a news site. It is used to determine whether the company has achieved a profit or a loss during the period under review.

This is particularly important for investors, shareholders and potential partners of the news site, as they can assess the company's profitability and ability to generate revenue. The income statement also enables year-on-year performance to be compared, helping to identify trends and make strategic decisions.

Income from a news site can come from a variety of sources, such as advertising, subscriptions, partnerships or merchandising. Expenses include content production costs, marketing costs, salaries, technical maintenance costs, among others.

In short, the income statement is a key tool for assessing the financial health of a news site. It enables you to make informed decisions to improve the company's profitability and overall performance.

What are the advantages and disadvantages of accounting?

Accounting is an essential part of a company's financial management, and has both advantages and disadvantages. Here are a few important points to consider:

Advantages of accounting :

1. Informed decision-making : Accounting provides accurate, reliable information on a company's financial health, enabling managers to make informed decisions on investment, spending and strategy.

2. Transparency : Accounting ensures the transparency of a company's financial operations, in particular by verifying compliance with tax and accounting regulations.

3. Performance evaluation : Accounting makes it possible to assess company performance over time, by analyzing key indicators such as sales, profits, losses, margins and so on.

4. Risk management : Accounting helps to identify and manage financial risks, for example by identifying areas of low profitability or cash flow problems.

Disadvantages of accounting :

1. Complexity : Accounting can be complex, requiring a thorough understanding of accounting principles and standards. This can make it difficult for some people to enter and analyze financial data.

2. Cost : Setting up an efficient accounting system can represent a significant cost for a company, particularly in terms of software, training and dedicated human resources.

3. Limits : Accounting has its limits, and does not always capture all aspects of a company's economic reality. For example, certain intangible assets such as a company's reputation are not easily quantifiable in financial statements.

4. Possible handling : Although accounting principles are designed to ensure the integrity of financial data, it is always possible to manipulate figures to hide problems or mislead stakeholders.

In conclusion, accounting offers many advantages in terms of decision-making, transparency and risk management, but it also has disadvantages linked to its complexity, costs, limitations and potential for manipulation. Understanding these aspects is essential if you are to take full advantage of accounting in the context of a financial news site.

How do you know if an income statement is good?

To determine whether an income statement is a good one, several key elements need to be analyzed. Here are some important points to consider:

1. Revenue growth : A good income statement should show a steady increase in revenue over time. This may indicate that the company is attracting new readers and generating more traffic to its news site.

2. Profit margins : It's important to look at profit margins to assess a company's profitability. High margins may indicate that the company is managing to generate significant profits in relation to its costs.

3. Operating expenses : It's essential to analyze operating expenses, such as editorial, production and distribution costs. If these expenses are under control and in line with the revenues generated, this can be a good sign.

4. Cash management : Examining cash management is crucial to assessing a company's ability to cover expenses and invest in future growth. Good cash management translates into a positive balance and the ability to deal with any unforeseen circumstances.

5. Debt : It's also important to check the company's level of debt. Too much debt can compromise long-term financial stability.

In short, a good income statement is characterized by steady revenue growth, high profit margins, controlled operating costs, good cash management and reasonable debt levels.

What are the 3 main lines of an income statement?

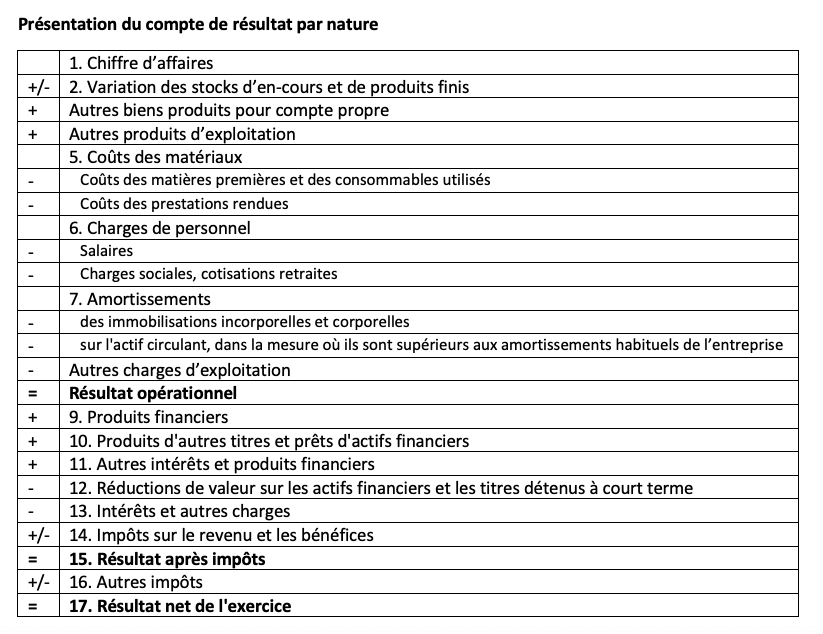

An income statement is a financial document that measures a company's performance over a given period. It generally comprises three main lines:

1. Sales figures : This line represents the company's total sales for the period. It is a key indicator of the company's growth and activity. It may include revenues from the sale of products, services or other sources.

2. Operating expenses : This line covers all expenses related to running the business. These may include production costs, personnel costs, marketing costs, rental costs, administrative costs, etc. These expenses are deducted from sales to determine operating income. These expenses are deducted from sales to determine operating income.

3. Net income : This line represents the company's net profit or loss after all expenses and revenues have been taken into account. It is calculated by subtracting operating expenses from sales. A positive net result indicates that the company has made a profit, while a negative net result indicates a loss.

It's important to note that these three main lines represent only a simplified overview of the income statement. In reality, there may be several sub-categories of income and expenses included in each line. The full income statement provides a detailed view of a company's financial performance, and is often used by investors, banks and shareholders to assess its financial health.

In conclusion, the income statement has both advantages and disadvantages for companies. On the one hand, it provides a clear, synthetic view of a company's economic performance over a given period. The financial data are organized in a structured way, facilitating analysis and decision-making.

On the other hand, the income statement also has its limitations and drawbacks. It focuses primarily on financial aspects and does not take into account other important factors such as the company's social responsibility or its environmental impact. In addition, it can be influenced by accounting practices that may distort the actual results.

Despite these limitations, the income statement remains an essential tool for assessing a company's performance and making informed financial decisions. It should therefore be used with caution, and supplemented by other relevant indicators and information.

In short, the income statement is a key element in a company's financial management, but it should not be seen as the sole indicator of its economic health. It is important to contextualize and analyze it, taking into account the business sector, market trends and other non-financial aspects that can influence the company's overall performance.