Low reference tax income: advantages and disadvantages - In this article, we take a closer look at the implications of the low reference tax income. How can this measure benefit certain taxpayers? What are the potential drawbacks of such a policy? Discover the answers to these questions and explore the various aspects of this controversial tax strategy.

PER: complete guide to the Plan Epargne Retraite (investing to reduce taxes 🏦)

[arve url="https://www.youtube.com/embed/RAa9FeHoBd8″/]

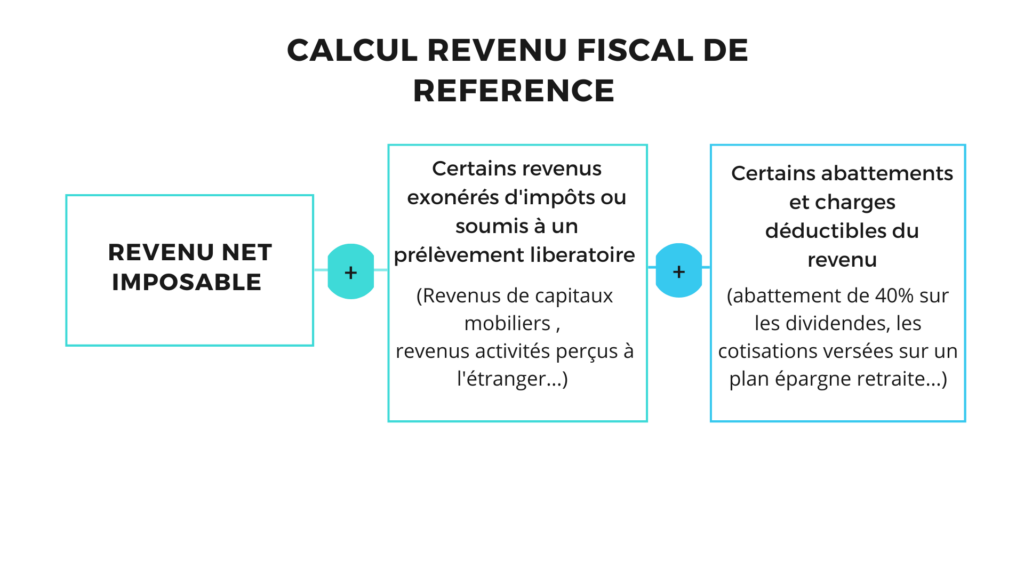

Why is the reference tax income lower than the taxable income?

The reference tax income is generally lower than the taxable income due to certain tax adjustments and deductions. These adjustments and deductions are made by the tax authorities to determine the amount actually taxable.

Adjustments are modifications made to gross income to exclude specific expenses. For example, compulsory social security contributions can be deducted from gross income to calculate taxable income. In addition, reductions or exemptions can be applied to income from certain economic activities, such as farming income.

DeductionsThese allow certain expenses to be deducted from gross income. Business expenses, family expenses, investments in specific savings products, and other authorized expenses can be deducted from gross income to reduce the taxable amount.

In short, reference tax income is an amount lower than taxable income, due to adjustments and deductions authorized by tax legislation. This difference makes it possible to more accurately reflect households' ability to pay tax, and to apply more equitable taxation.

What is the reference tax income advantage?

The revenu fiscal de référence is a tax figure used by the tax authorities to determine certain benefits or entitlements to which you are entitled. It is calculated by taking into account all the income of your tax household, including professional income, property income, pensions and allowances.

An important advantage of the reference tax income is that it is used to determine certain social benefits and financial assistance. For example, it can be used to assess your eligibility for family allowances, the "prime d'activité", the "complément de libre choix du mode de garde" or tax reductions such as the "crédit d'impôt pour la transition énergétique".

In addition, reference tax income is also used as a criterion for access to certain public services or specific benefits. For example, it can be requested when registering for a place in a crèche or nursery school, or to benefit from social rates for electricity or gas.

It is therefore important to take into account your "revenu fiscal de référence" to ensure that you qualify for the benefits and advantages to which you are entitled. It should also be noted that the reference tax income is updated each year, based on the tax return filed with the tax authorities.

What is the reference tax income for a single person?

The reference tax income for a single person is the total sum of income and expenses declared by that person when filing his or her tax return. It is an important value used to determine eligibility for certain social benefits and the amount of tax payable. The amount of reference tax income may vary from one year to the next, depending on declared income and expenses. It is generally calculated by taking into account various elements such as salaries, property income, family allowances, pensions, etc. It is important to note that reference tax income may differ from net taxable income, which is the amount on which taxes are actually calculated. To find out the precise amount of reference tax income for a given year, we recommend you consult official tax documents or contact the relevant tax authorities.

How much taxable income do I need to avoid paying tax?

The reference tax income for not being taxed varies according to your family situation and any exemptions you may be eligible for. However, for the 2021 tax year, the threshold for non-taxation is for a single person without children is set at 10,084 euros of reference tax income. This amount may vary slightly from one year to the next, so it is important to refer to the most recent information provided by the tax authorities.

In conclusion, low reference tax income has both advantages and disadvantages to consider. On the one hand, it reduces the tax burden on low-income households, giving them a degree of financial stability. It also enables them to benefit from social assistance and public services adapted to their economic situation.

On the other hand, this measure could create inequalities in terms of wealth redistribution and fiscal solidarity. Taxpayers with higher incomes could feel unfairly penalized, while those with lower reference tax incomes could be tempted not to seek to improve their financial situation.

It is therefore essential to strike a balance between the need to help low-income households and the promotion of individual effort to foster social mobility. A low reference tax income can be a step towards a fairer society, but it must be accompanied by incentives to encourage employment and vocational training.

It is therefore essential to carefully assess the implications of this measure to ensure a fair distribution of resources and a real opportunity for all to flourish economically.