In this article, we look at the advantages and disadvantages of joint-stock companies. The capital companies offer many advantages, such as limited shareholder liability and the possibility of raising larger amounts of capital. However, they can also present disadvantages, such as stricter regulation and higher start-up and management costs. Find out more about this business model, rich in both opportunities and challenges.

CRYPTO: HERE ARE 5 ALTCOINS WITH A MAGNIFICENT CHART 🚨 Analysis & Trading

[arve url="https://www.youtube.com/embed/ACqfqlaDQb8″/]

Why choose a limited liability company?

The corporation, also known as a joint-stock company, is a legal form widely used in the business world. It offers many advantages for entrepreneurs and investors.

First and foremost, the joint-stock company offers limited liability. This means that shareholders are only liable for the company's debts up to the amount of their capital contribution. This legal protection is highly appreciated, as it preserves shareholders' personal assets in the event of financial difficulties.

Next, the joint-stock company makes it easier to raise funds. By issuing shares, companies can attract investors who wish to take a stake in the company's capital. This provides an additional source of financing for expansion, investment in new projects or acquisitions.

What's more, the joint-stock company offers great flexibility when it comes to transferring shares. Shares can be bought, sold, assigned or transferred to third parties without affecting the continuity of the company. This facilitates the management of ownership and enables shareholders to exit the share capital when necessary.

Finally, the capital company enjoys an image of credibility and professionalism. It is often perceived as a solid and serious structure, which can facilitate relations with business partners, suppliers and customers.

However, it should be noted that setting up and managing a limited liability company can be more complex and costly than other legal forms. Strict legal requirements must be met, particularly in terms of governance, accounting and financial reporting.

In conclusion, the joint-stock company offers many advantages for entrepreneurs looking to expand and attract investors. However, it is important to carefully assess your company's needs and consult experts before choosing this legal form.

What is a joint-stock company?

A joint-stock company is a company whose share capital is held by shareholders who own shares in the company. actions. These shares represent ownership in the company, and shareholders have the right to participate in important company decisions. Share capital enables the company to finance its activities and investments by issuing shares on the financial markets. Companies with share capital are often listed on the stock exchange, which facilitates their access to capital and enables them to grow rapidly. However, they must also be accountable to their shareholders and comply with financial regulations.

What is the tax regime for limited companies?

The tax regime applicable to limited liability companies is a crucial element in understanding corporate taxation in France. Corporations, such as sociétés anonymes (SA) and sociétés par actions simplifiées (SAS), are subject to a specific tax regime.

Corporation tax (IS): Corporations are taxed on their net profits through corporate income tax (IS). The standard corporate income tax rate is currently 28% for companies with sales of less than 250 million euros, and 31% above this threshold. However, it should be noted that certain small businesses can benefit from a reduced rate of corporation tax on part of their profits.

Tax credits: Corporations can also benefit from tax credits for specific activities. For example, they may be eligible for the research tax credit (crédit d'impôt recherche - CIR) if they carry out research and development work. This credit reduces the tax due according to the amount of R&D expenditure incurred.

Loss carryforwards: In the event of losses, capital companies can carry these losses forward to future years. This provision enables them to reduce their corporate income tax by deducting losses from future profits.

Other taxes: In addition to corporate income tax, joint-stock companies may also be subject to other taxes, such as the contribution sociale sur les bénéfices (CSB) or the contribution économique territoriale (CET).

It's important to note that the tax regime for limited companies can vary according to the legislation in force and the measures taken by the government. It is therefore essential for entrepreneurs to keep abreast of any changes in corporate taxation.

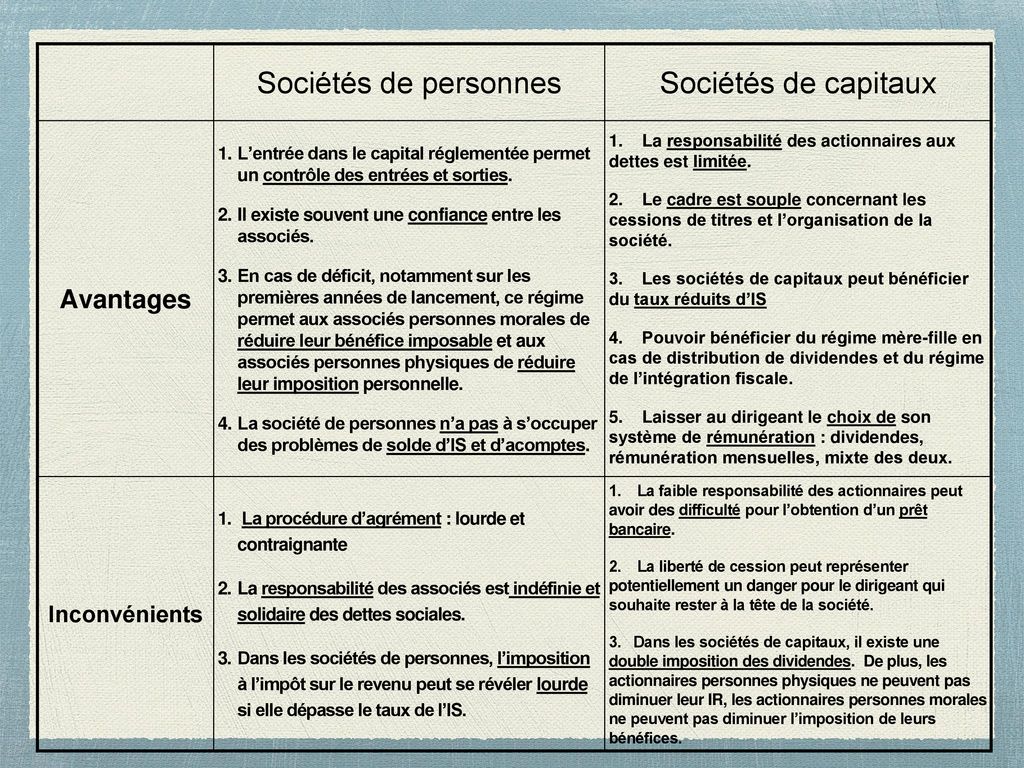

What are the advantages and disadvantages of a public limited company?

The advantages of a public limited company are numerous. First of all, a Société Anonyme (limited liability company) offers considerable financing capacity, as it can issue shares and thus attract investors. This gives the company the resources it needs to grow and innovate. What's more, an SA has a legal personality distinct from that of its shareholders, which means that the latter are not liable for the company's debts beyond their capital contribution. This offers shareholders financial protection.

Another advantage of an SA is the ease with which ownership can be transferred. Shares can be bought and sold on the stock market, providing liquidity for shareholders. In addition, a public limited company can be perpetual, i.e. its existence is not limited to the lifetime of its shareholders, which ensures a certain stability.

However, there are also disadvantages associated with a public limited company. Firstly, its creation and management can be more complex and costly than other legal forms of enterprise. A public limited company is required to publish its accounts and undergo regular audits, which can lead to additional costs.

What's more, in a public limited company, important decisions are often taken by shareholders at general meetings, which can mean longer decision-making times and slower adaptation to market changes.

In a nutshellA public limited company (SA) offers advantages such as high financing capacity, financial protection for shareholders and ease of transfer of ownership. However, it can also be more complex to set up and manage, and can lead to longer decision-making times and additional costs associated with reporting obligations.

In conclusion, it's important to consider both the advantages and disadvantages of a joint-stock company. On the one hand, this type of structure offers shareholders limited liabilityThis means that their personal assets are protected in the event of bankruptcy or litigation. In addition, a joint-stock company makes it easier to raise funds by issuing shares or borrowing from investors. This can help the company grow and expand.

On the other hand, setting up and managing a limited company involves complex administrative and legal formalities. Compliance with current laws and regulations is necessary, and can be costly and time-consuming for contractors. In addition, a joint-stock company is generally subject to higher taxes compared with other legal forms.

It is also important to bear in mind that decision-making can be slower and more complex in a joint-stock companyThis can slow down the company's responsiveness to market changes. This can slow down the company's responsiveness to market changes.

In short, a limited liability company has both advantages and disadvantages. It is important for entrepreneurs to carefully analyze their situation and objectives before choosing this legal form.