Forwards are financial tools commonly used to protect against exchange rate fluctuations. They enable companies to fix an exchange rate in advance, offering greater predictability and risk management. However, they also have disadvantages, such as the loss of profit opportunities in the event of favorable exchange rate movements. Forwards offer financial stability, but can limit potential profits.

Should you trade CFDs or FUTURES? (Advice from a former broker)

[arve url="https://www.youtube.com/embed/JosdljbNAOE "/]

What's the difference between futures and forwards?

Futures and forwards are both financial instruments used in the derivatives markets to trade the future delivery of a financial asset at a pre-agreed price. However, there are some key differences between the two products.

Futures is a standardized contract traded on an exchange. The terms of the contract, such as size, delivery date and settlement terms, are predefined and non-negotiable. Futures transactions are generally centralized on a trading platform and cleared by a clearing house. This guarantees greater liquidity and minimizes counterparty risk.

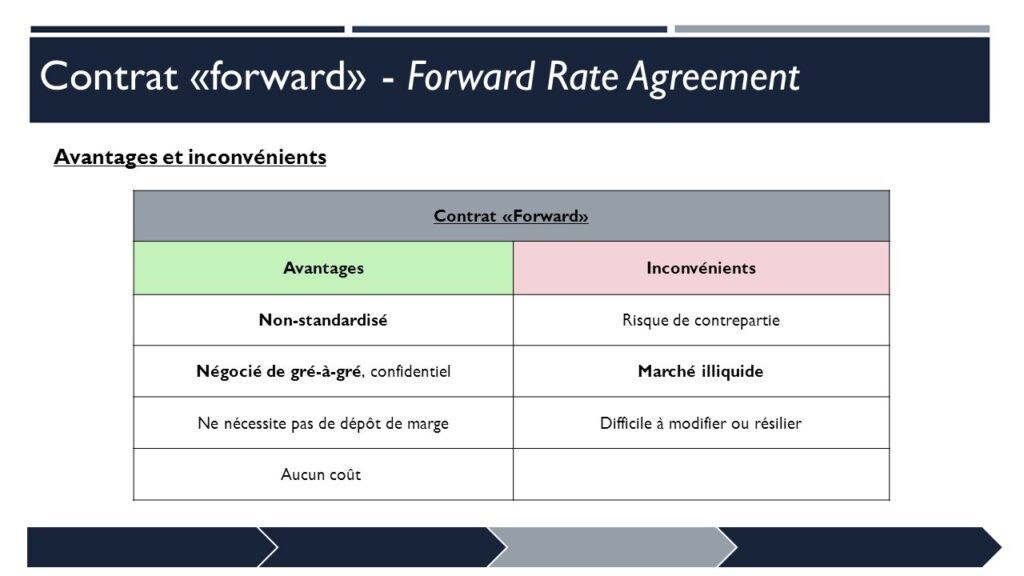

On the other hand, a forward is a customized contract negotiated directly between two parties (without going through an exchange). The terms of the contract can be tailored to the specific needs of the parties involved. This means that forward contracts offer greater flexibility in terms of size, delivery date and settlement terms. However, this customization also implies an increased counterparty risk.

In a nutshellThe main difference lies in the standardization and centralization of futures transactions, while forwards offer greater flexibility but carry a higher counterparty risk.

What is the price of a forward?

The price of a forward contract is the agreed cost of buying or selling a currency, commodity or financial product at a predetermined future date. It is fixed when the forward contract is entered into, and represents the price at which the parties agree to exchange the underlying asset at a future date. This price is influenced by various factors, such as interest rates, economic conditions and market expectations.

The price of a forward is determined by taking into account the interest rate parity between the two currencies concerned in the case of a currency forward. If interest rates in one country are higher than in another, the forward price will generally be higher. In effect, this reflects the opportunity cost to the buyer of not investing in a currency offering higher yields.

In the context of a news siteIt is important to inform readers about forward price fluctuations, as these can have important implications for companies and investors. Price fluctuations can reflect market expectations regarding interest rate trends, economic confidence or geopolitical risks.

It is essential to understand that forwards are customized futures contracts traded on the over-the-counter market, which means that there is no public quotation of prices. Consequently, financial market participants must have a good knowledge and understanding of the market in order to negotiate fair and equitable prices.

In short, the forward price is the price agreed to exchange a financial asset at a predetermined future date. It is influenced by interest rates, economic conditions and market expectations. Fluctuations in forward prices can have significant implications for companies and investors, making it a relevant topic to follow on a news site.

How does a forward work?

A forward, in the context of a news site, refers to the action of sharing an article or piece of information with others. This can be done using various methods, such as sharing on social networks, sending by e-mail or sharing direct links.

When you forward an article, you choose to disseminate information that you feel is relevant or interesting to a wider audience. This makes the article or information known to a larger number of people and helps it to spread.

Forward is an efficient way to share news and arouse public interest in the subjects covered. It can contribute to the virality of content and its widespread distribution.

Social networks are often used to forwardsbecause they make sharing quick and easy. Users can share articles or information on their profiles or in specific groups, allowing others to see and consult them.

E-mailing is also a common way of forwarding a message.. Users can send a link to the article or copy and paste its content into an e-mail to share with contacts or newsletter subscribers.

Using these different forwarding methods, news sites can increase their visibility and reach. The more an article is shared, the more likely it is to be read by a wider audience.

It's important to note that when forwarding, it's best to respect copyright and properly cite the source of the information being shared. This helps to credit the original author and promote responsible, ethical journalism.

In conclusion, forwarding is an effective way of sharing news and promoting its widespread distribution. Social networks and e-mailing are two commonly used methods of forwarding. It's important to respect copyright and properly cite the source when sharing information.

What's the difference between forwards and options?

In the context of a news site, forwards and options are two terms used in the financial world to designate different financial instruments.

Forwards are contracts to buy or sell an underlying asset (such as a currency, commodity or stock) at a pre-agreed price, for future delivery. Forwards are negotiated over-the-counter between two parties and are not standardized. They are often used to hedge currency or price risk in the future.

OptionsOptions, on the other hand, are contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a pre-agreed price, before a predefined expiry date. Unlike forwards, options are standardized and often traded on organized markets. Options can also be used to hedge the risk of price fluctuations, but offer greater flexibility than forwards by allowing the buyer to choose whether or not to exercise his right.

In short, forwards are contracts to buy or sell an asset at a pre-agreed price for future delivery, while options give the right to buy or sell an asset at an agreed price before an expiry date.

In conclusion, forwards have both advantages and disadvantages. On the one hand, they enable you to share information quickly, establish connections between different users and amplify the reach of a message. HoweverBut they can also contribute to the spread of false information and rumors, which can lead to a loss of credibility for news sources. It is therefore crucial to check the authenticity of messages before sharing them, and to give preference to reliable sources. What's more, forwards can also be intrusive and invade our privacy, especially when our personal data is shared without our consent. It's important to keep in mind the importance of respecting confidentiality and not sharing unsolicited content. In conclusion, while enjoying the benefits of forwards, it's essential to be aware of their limitations and to use them responsibly.