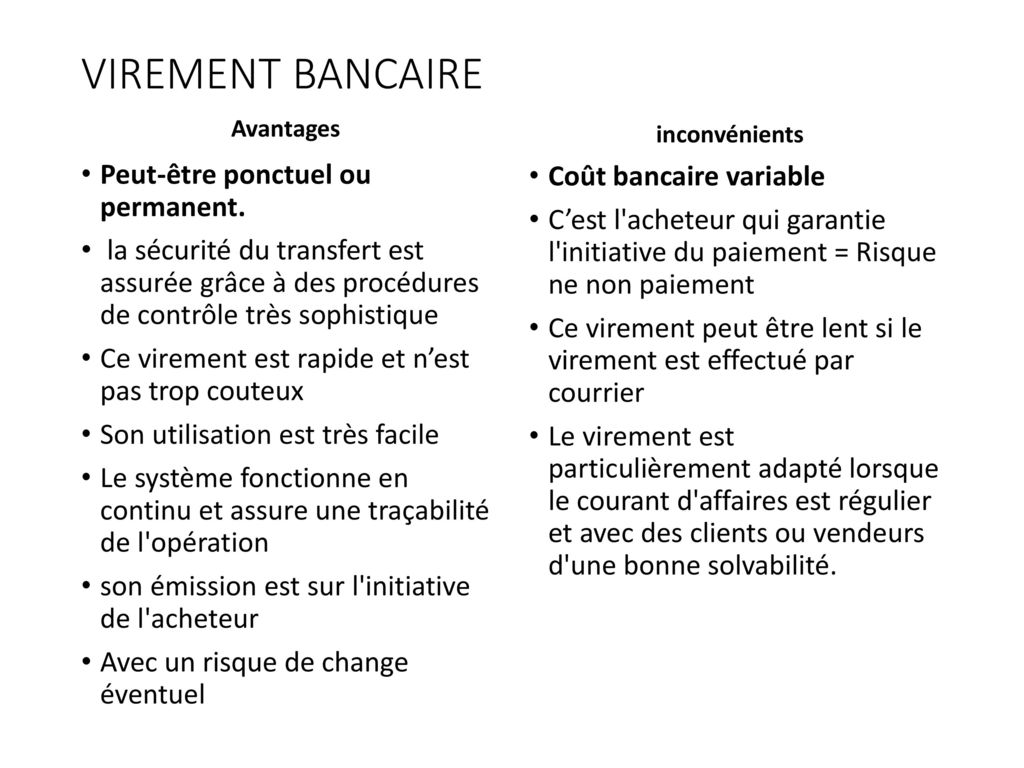

Bank transfers : a widely used method of financial transaction, offering undeniable advantages such as fast, secure transfers. However, they also have certain disadvantages, such as high fees and the need to have a bank account. Find out more about the advantages and disadvantages of bank transfers in this article.

REVOLUT: My opinion as a customer! a good bank?

[arve url="https://www.youtube.com/embed/Nn9jhhaj_eU "/]

What are the disadvantages of bank transfers?

The disadvantages of bank transfers are as follows:

1. Processing times : Bank transfers can take a long time to process, especially when they are made to foreign countries. This can lead to delays in receiving funds.

2. Expenses : Some banks charge fees for bank transfers, especially if they are made to accounts located abroad. These fees can vary considerably from one bank to another.

3. Contact details : To carry out a transfer, it is often necessary to provide the beneficiary's full bank details, including account number and bank SWIFT/BIC code. This can be tedious and risky if the information is transmitted incorrectly.

4. Safety : Although bank transfers are generally considered safe, there is always a risk of fraud. Fraudsters can hack into sensitive data or falsify information to divert funds to fraudulent accounts.

5. Non-reversibility : Once a bank transfer has been made, it is difficult, if not impossible, to reverse it. If an error occurs when entering the information, or if the payment has to be cancelled, it can be complicated to recover the funds.

In conclusion, although bank transfers are a common and convenient way of transferring money, it's important to be aware of these potential drawbacks. It is advisable to take the necessary precautions when making bank transfers to avoid any problems.

Why make a bank transfer?

Making a transfer is a financial operation that involves transferring money from one bank account to another. This may be necessary in a number of situations, including :

1. Payment : When you need to pay a bill or make a payment to a merchant, you can choose to make a transfer to send the funds directly from your bank account.

2. Reimbursement : If you're waiting for a refund from a person or company, they can choose to send you the money by bank transfer.

3. Transfer between accounts : If you have several bank accounts, you can use a transfer to move funds from one account to another. For example, you can transfer money from your current account to your savings account.

4. Send money to friends and family: Money transfers can also be used to send money to family members, friends or anyone else who needs it.

It's important to note that to make a transfer, you'll need to provide certain information, such as the beneficiary's account number and the name of the bank. What's more, some banks may charge fees for transfers, so it's advisable to check your bank's terms and conditions before making such an operation.

In conclusion, a credit transfer is a practical and secure solution for transferring money from one bank account to another, whether to make a payment, reimburse someone, transfer funds between accounts or send money to loved ones.

What's the best way to pay?

The most advantageous payment method for a news site depends primarily on the type of service offered and the company's preferences. However, there are a few common options that can be considered.

1. Credit card payments : This payment method offers users great flexibility, as they can make online payments quickly and easily. What's more, it allows the news site to receive payments instantly.

2. Bank transfers : This method may be more economical for larger transactions. However, it may take longer for the payment system to be verified and payments to be processed.

3. Electronic wallets : These services, such as PayPal, Payoneer and Skrill, enable users to link their bank accounts or credit cards to make online payments. They often offer additional protection in the event of a dispute.

4. Mobile payments : With the advent of smartphones, mobile payments have become increasingly popular. Applications such as Apple Pay, Google Pay or Samsung Pay enable users to make payments using their cell phone.

It's important to note that each payment method has its own advantages and disadvantages in terms of transaction costs, security and ease of use. It may make sense to offer several payment options to meet the needs and preferences of news site users.

What is the maximum amount for a bank transfer?

The maximum amount of a bank transfer generally depends on the bank's policy and current regulations. It's important to check with your bank what specific limits apply to your account. As a general rule, banks set transfer limits to prevent fraud and other suspicious activity. These limits may vary depending on the type of account, the customer's status and the country in which the bank is located. Some banks allow transfers of thousands or millions of euros, while others set lower limits. It is also possible to request an increase in transfer limits by providing the bank with additional supporting documents.

In conclusion, bank transfers have both advantages and disadvantages. On the one hand, they offer enhanced security thanks to their traceability and reliability. What's more, they enable fast, convenient transactions, without the need to handle cash. They are also widely accepted and used throughout the world.

HoweverHowever, there are a number of disadvantages to bear in mind. Transfer fees can be high, especially for international transfers. In addition, processing times can vary depending on the banks involved, which can lead to delays in transfers.

On the whole, bank transfers remain a safe and convenient way of transferring money. However, it's important to compare costs and timescales before choosing this option. Alternatives such as mobile payment apps or online money transfer services can also be considered, depending on individual needs and preferences.