Usufruct is a legal concept enabling a person to enjoy real estate or movable property without owning it. This offers considerable financial and tax advantages, but also the disadvantages associated with the obligations and responsibilities they entail. In this article, we'll explore the pros and cons of usufruct to help you make an informed decision before committing to such an arrangement.

Ususfruit: benefits and limits to be aware of

Usufruct is a legal term that refers to the right to use and enjoy real estate or certain other assets, without owning full ownership. In the context of a news site, usufruct can have benefits and limitations that are important to be aware of.

The benefits of usufruct can include the possibility of using an asset without having to pay the full cost, which can be particularly interesting in the case of real estate. For example, a media company can use a building for its offices without having to purchase full ownership. What's more, as usufructuary, you can generally collect the income generated by the property, such as rents in the case of a rental property.

However, it there are limits to usufruct that are important to consider. As usufructuary, you do not have the right to sell or modify the property, nor to rent it out for a period longer than the usufruct period. What's more, usufruct can be temporary and therefore of limited duration, which may limit its usefulness in the long term.

In conclusion, usufruct can be an interesting solution for using a property without having full ownership, but it's important to understand its limits before deciding to use it.

Dismemberment: what is it? - Wealth management ⚙😀💡

[arve url="https://www.youtube.com/embed/w_jvNFb57FA "/]

Passing on a house to your children: by inheritance or gift?

[arve url="https://www.youtube.com/embed/2XlQHyThom8″/]

What are the benefits of usufruct?

Usufruct is a real right that enables a person to benefit from a property belonging to a third party, without being the owner. In the context of real estate investment, usufruct can offer several financial advantages for the investor.

First and foremost, the usufructuary can take advantage of the property and benefit from its rental or resale. This generates additional income for the investor.

In addition, investors can benefit from advantageous tax treatment with usufruct. This is because the usufructuary is responsible for paying local taxes, property tax and property-related charges. As a result, the investor does not have to assume these costs, which can be a significant saving.

Finally, usufruct can be used for wealth management. For example, parents can give the usufruct of a house to their children while retaining bare ownership. This allows the parents to continue living in the house while gradually transferring ownership to their children.

In short, usufruct offers a number of financial and tax advantages for real estate investors, and can be used in wealth management.

Is the usufructuary required to pay inheritance tax?

Yes, the usufructuary is required to pay inheritance tax. When a person dies and leaves a property in usufruct, the bare owner and the usufructuary are considered as two separate persons for the purposes of calculating inheritance tax. The bare owner must pay inheritance tax on the value of the bare ownership, while the usufructuary must pay inheritance tax on the value of the usufruct. The amount of inheritance tax payable will depend on the value of the property and the relationship between the deceased and the heirs.

How does an estate with usufruct work?

Inheritance with usufruct is a common situation when inheriting, as it allows for an equitable distribution between the heirs and the surviving spouse.

In general, usufruct is awarded to the surviving spouse, who can then continue to enjoy ownership of the property in question, whether real estate or an investment portfolio. However, in this case, children, grandchildren and other heirs receive only bare ownership of the property.

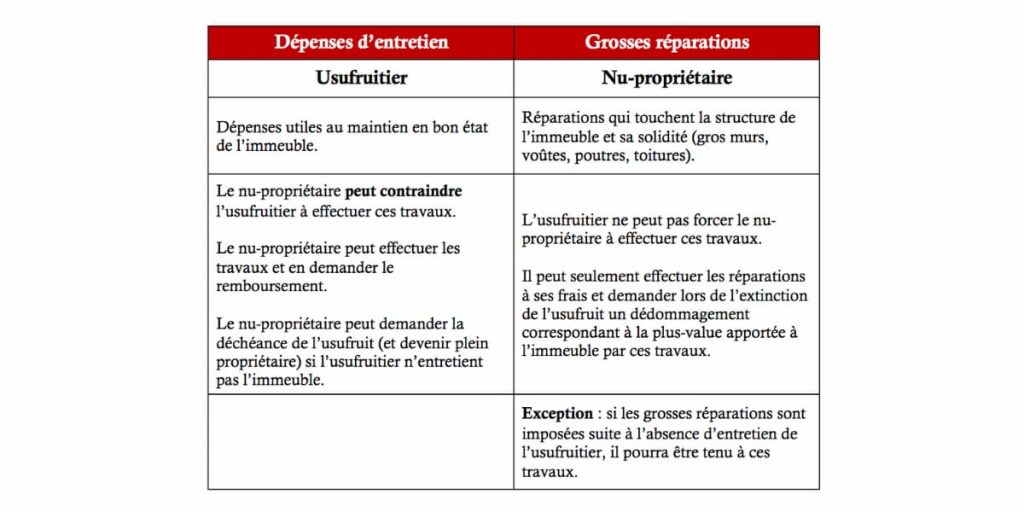

The surviving spouse therefore has the right to use the property and receive income from it, but must also assume any expenses and repairs. In principle, usufruct ceases on the death of the spouse, unless otherwise agreed in the deed of succession.

In conclusion, succession with usufruct preserves the rights of the surviving spouse while guaranteeing equality between heirs. This is a solution that can be advantageous in many cases, but it requires a certain amount of vigilance to avoid any confusion or misunderstanding between the parties concerned.

Who is responsible for paying taxes in the event of usufruct?

In the case of usufruct, it is the usufructuary who is responsible for paying taxes on the property in question. This is because the usufructuary has the right to use and harvest the fruits of the property, which also includes the tax liability associated with it. However, it is important to note that the bare owner retains joint and several liability with the usufructuary for the payment of taxes, even though he or she is not directly liable. This means that if the usufructuary has not paid the taxes due, the bare owner may be held responsible for paying them in full or in part.

What are the advantages and disadvantages of usufruct when it comes to passing on assets?

Usufruct is a very common legal mechanism for transferring assets. It allows one person to enjoy real estate or movable property, while being owned by another. This can have both advantages and disadvantages for the parties involved.

Advantages of usufruct :

- The bare owner can transfer ownership of the property without compromising the rights of the usufructuary. If the bare owner sells the property, the usufruct remains and the new buyer must respect the rights of the usufructuary.

- The usufructuary benefits from the use and enjoyment of the property (e.g. a home), without having to pay any charges (property taxes, works, etc.).

- The usufructuary may also receive income generated by the property (e.g. rental income from rented accommodation).

Disadvantages of usufruct :

- The usufructuary cannot sell the property or dispose of it freely, as he or she does not have full ownership. He must therefore obtain the agreement of the bare owner for any important decision concerning the property.

- Relations between the usufructuary and the bare owner can sometimes be conflictual, particularly if there is disagreement over the use or upkeep of the property.

- At the end of the usufruct period, the property reverts to the bare owner without any further compensation, unless an agreement has been reached between the parties.

In conclusion, usufruct can be an interesting way of passing on wealth, but it's important to weigh up the advantages and disadvantages before embarking on this path.

How do you weigh up the advantages and disadvantages of usufruct for the donee and the donor?

Usufruct is a temporary cessation of ownership of a property. It allows a person, thebeneficial ownerthe right to benefit from the property in question (usually real estate) for a given period of time, while entrusting ownership of it to another person, the bare owner.

For the doneeIf you need a roof over your head right away, usufruct can be an advantage. Usufruct can also offer a source of income during the usufruct period. However, thebeneficial owner must assume the costs of maintaining and repairing the property, which can be very costly.

For the donorusufruct can be a means of transfer the ownership of a property without losing complete enjoyment of it. However, the donor must be aware that the usufruct entails a partial loss of the property's value, as he or she can no longer sell it or use it as collateral for a mortgage while the usufruct is in effect.

Ultimately, usufruct can be a wise choice in certain situations, but it is important for all parties involved to fully understand advantages and disadvantages before making a decision.

What are the main advantages and disadvantages of temporary usufruct for property owners?

Temporary usufruct is a legal contract that allows one person, the usufructuary, to enjoy a property that belongs to another person, the bare owner, for a limited period of time. This type of contract has both advantages and disadvantages for the property owner.

The advantages of temporary usufruct for property owners are multiple. Firstly, it enables the owner to receive regular rental income during the usufruct period. In fact, the usufructuary is required to pay a fee corresponding to the use value of the property.

Secondly, temporary usufruct offers an interesting solution for owners who wish to pass on their estate while retaining a degree of control over their property. The usufructuary cannot do anything without the agreement of the bare owner, who retains the majority of rights to the property. What's more, at the end of the usufruct period, the property automatically reverts to the bare owner, who can then dispose of it as he or she sees fit.

Finally, temporary usufruct can be a way of reducing the tax burden on property owners. As the value of the usufruct is determined according to the duration of the usufruct, it is possible to reduce the taxable base for real estate wealth tax.

However, temporary usufruct also has disadvantages for the property owner. First of all, it can be difficult to find a reliable and solvent usufructuary. Indeed, most people interested in temporary usufruct are institutional investors or real estate companies, which can be difficult to identify and evaluate.

In addition, temporary usufruct can lead to tensions between the bare owner and the usufructuary. The two parties may have diverging interests, which can make it difficult to manage and maintain the property.

Finally, temporary usufruct is not a suitable solution for all types of property. Owners wishing to pass on their principal residence, for example, may be reluctant to entrust their home to a usufructuary for several years.

In short, temporary usufruct offers both advantages and disadvantages for property owners. Before embarking on this type of contract, it's important to assess the risks and opportunities involved.

In conclusion, usufruct can be an interesting legal tool for certain owners who wish to temporarily cede the use of their property. However, it also presents disadvantagesThese include loss of control over the property and the complexity of managing the usufruct. It is therefore essential to think carefully about the consequences of this measure before making a decision. It is also highly advisable to call on a professional to draw up the usufruct contract and avoid unpleasant surprises. In short, usufruct can be a wise choice, but it's worth weighing up the pros and cons before taking the plunge.