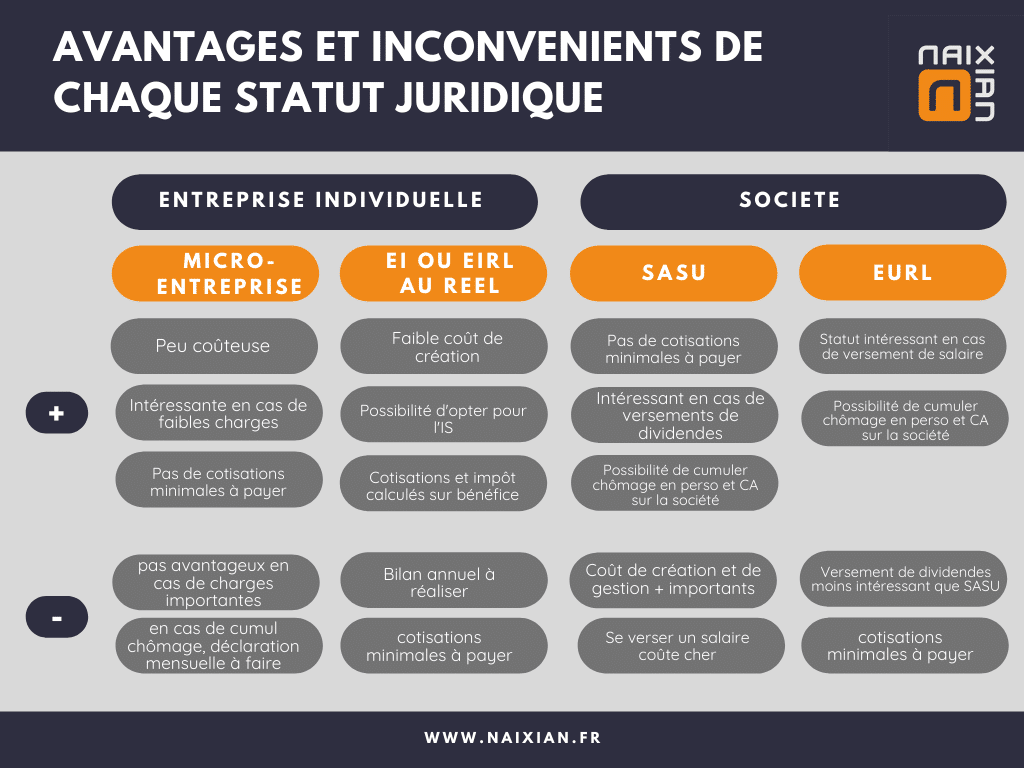

In this article, we'll look at the advantages and disadvantages of the different legal statuses. Whether you're a sole trader, a limited company or a public limited company, each status has positive and negative aspects. Find out which status best suits your needs and plans entrepreneurship.

How to OPTIMIZE your SASU remuneration? 12 tips to know 💰

[arve url="https://www.youtube.com/embed/67sPjObO48E "/]

Which is the most advantageous status?

The most advantageous status for a news site depends on a number of factors, such as company size, financial objectives and liability requirements.

Sole proprietorship status can be the simplest and least expensive choice for a content creator just starting out. However, it also has disadvantages in terms of personal liability, since you are personally responsible for debts and disputes.

Setting up a limited liability company (SARL) can offer greater personal protection while retaining a certain administrative simplicity. However, it involves higher costs and a more formal structure, with requirements to keep commercial accounts and file documents annually with the commercial register.

Setting up a simplified joint stock company (SAS) can be a good compromise for content creators who wish to have several associates or partners. This status offers great flexibility in the distribution of share capital and voting rights. However, it is important to note that the SAS requires a minimum share capital and more complex formalities for its creation and management.

The choice of status will therefore depend on the specific needs of your news site. It is advisable to consult a legal or financial professional for advice tailored to your particular situation.

What are the advantages and disadvantages of choosing sole proprietorship as your legal status?

Benefits :

1. Simplicity : Sole proprietorship status is easy to set up and doesn't require a lot of red tape. This means you can get up and running quickly.

2. Flexibility : As a sole trader, you have the freedom to make all the decisions concerning your business. So you can adapt your news site to suit your needs and desires.

3. Total control : As the sole owner of your company, you have total control over your news site. You can make quick decisions and act on your own vision.

4. Reduced taxation : Sole proprietorships generally benefit from lower taxation, as profits are taxed directly on the owner's income.

Disadvantages :

1. Unlimited liability : As the owner of a sole proprietorship, you are personally liable for the debts and obligations of your business. Your personal assets can be seized to pay business debts.

2. Difficulty raising funds : In general, sole proprietorships have more difficulty obtaining financing or convincing investors, as they are perceived as riskier.

3. Difficulty parting with the company : The transfer or sale of a sole proprietorship can be complex, as there is no legal distinction between the entrepreneur and the business. This can complicate succession or transfer processes.

4. Restrictions on hiring : As a sole proprietorship, it can be difficult to hire staff, as this involves additional administrative formalities and obligations towards employees.

It's important to note that these advantages and disadvantages may vary depending on your personal situation and the specifics of your news site. We recommend that you consult a legal or financial professional before making a final decision on the legal status of your company.

What are the advantages and disadvantages of an SAS?

The Société par Actions Simplifiée (SAS) is a popular legal form for businesses in France, including news websites. It has specific advantages and disadvantages:

Advantages :

1. Flexibility : The SAS offers considerable freedom in its articles of association, enabling shareholders to define the company's operating rules according to their specific needs.

2. Limitation of liability : SAS shareholders are not personally liable for the company's debts, as their liability is limited to their capital contribution.

3. Tax system : The SAS can choose between a corporate income tax regime and an income tax regime, offering a degree of tax flexibility.

4. Easy transfer of shares : SAS shares can be easily transferred, making it easy to sell off shares when necessary.

Disadvantages :

1. Formalities : Setting up an SAS requires more complex administrative formalities than for other legal forms, which can mean higher costs and longer lead times.

2. Cost of social security contributions : SAS directors are affiliated to the general social security system, which can lead to higher social security contributions than in other legal forms.

3. Financial transparency : SASs must publish their annual accounts, which may reveal sensitive financial information to competitors or the general public.

In conclusion, the SAS offers great flexibility and limited liability for news sites, but also requires more complex administrative formalities and can entail higher costs. It's important to consider these advantages and disadvantages when choosing the legal form best suited to your specific needs.

What are the advantages and disadvantages of the company?

Company benefits :

1. Wide range : As a news site, the company is able to reach a wide audience thanks to the availability of online information.

2. News : The company can provide up-to-date information on current events, keeping users informed in real time.

3. Diversity of subjects : A news site can cover a wide range of topics, from politics and economics to entertainment and sports, reaching a broad spectrum of interests.

4. Interaction with readers : News sites often offer readers the chance to comment, which facilitates exchanges and creates a sense of community between readers and content creators.

Company disadvantages:

1. Competition : In today's digital world, there is fierce competition between news sites, making it difficult for a company to stand out and attract a sufficient number of visitors.

2. Fake news: With the proliferation of fake news online, news sites can face challenges in guaranteeing the veracity and reliability of their information, which can damage their reputation.

3. Difficult monetization : Generating revenue from a news site can be difficult, as online advertising can be expensive and users are increasingly reluctant to pay for access to information.

4. Dependence on traffic : The company is often dependent on online traffic to generate advertising revenue, which means that any drop in visitor numbers can have a negative impact on its finances.

In conclusion, it is clear that each legal status presents both advantages and disadvantages. advantages and disadvantages.

One of the advantages of choosing a specific legal form is the protection from personal liability offered by certain structures, such as the société à responsabilité limitée (SARL) or the société par actions simplifiée (SAS). This means that business owners are not personally liable for the company's debts.

What's more, certain legal statuses, such as sole proprietorship or micro-business, offer greater flexibility. administrative simplicity and less complex start-up procedures. This can be advantageous for entrepreneurs who want to get their business off the ground quickly, without having to worry about complicated administrative formalities.

However, it's important to note that there are also disadvantages associated with each legal status. For example, a sole proprietorship exposes the owner to aunlimited personal risk. In the event of financial difficulties, creditors can seize the owner's personal assets to repay the company's debts.

In addition, some structures, such as the joint-stock company (SA), may be subject to strict governance rules, which can result in a loss of flexibility for owners.

It is therefore essential for every entrepreneur tocarefully evaluate the advantages and disadvantages of each legal status before making a decision. It is also advisable to consult a legal professional for advice tailored to the company's specific situation.

In conclusion, the choice of legal status is a crucial step in setting up a business. It's important to weigh up the advantages and disadvantages carefully, so as to make the best possible decision for the long-term success of your business.